Question

In: Accounting

or the current year, Custom Craft Services Inc. (CCS), a C corporation, reports taxable income of...

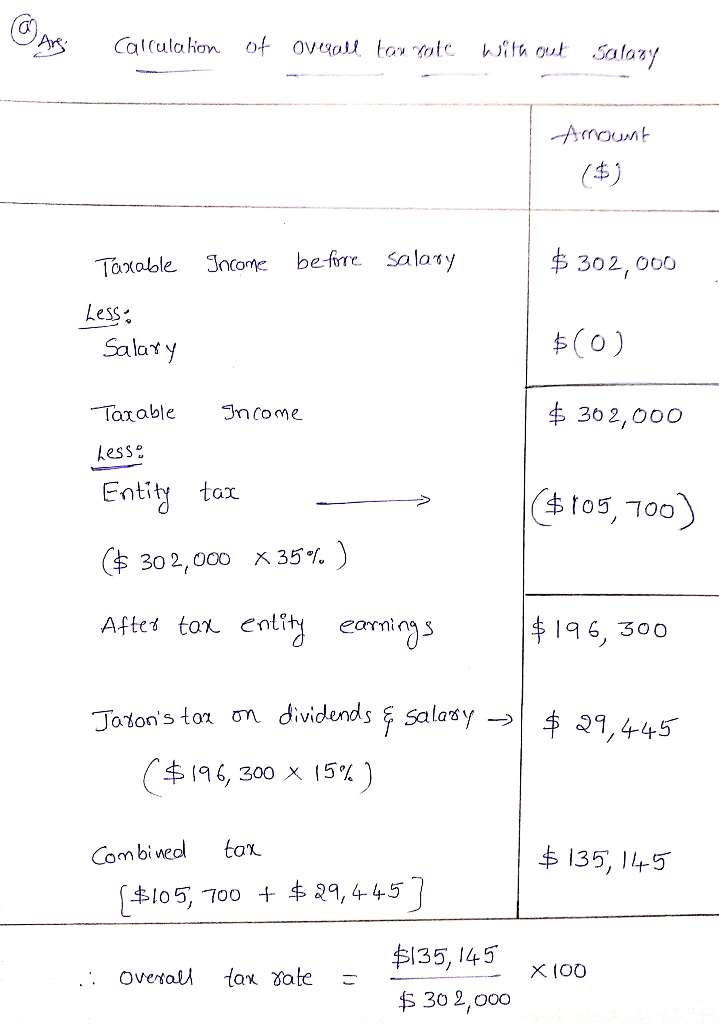

or the current year, Custom Craft Services Inc. (CCS), a C corporation, reports taxable income of $302,000 before paying salary to Jaron the sole shareholder. Jaron’s marginal tax rate on ordinary income is 35 percent and 15 percent on dividend income. Assume CCS’s tax rate is 35 percent. a. How much total income tax will Custom Craft Services and Jaron pay (combining both corporate and shareholder level taxes) on the $302,000 taxable income for the year if CCS doesn’t pay any salary to Jaron and instead distributes all of its after-tax income to Jaron as a dividend (assume Jaron is not subject to the net investment income tax or the additional Medicare tax)?

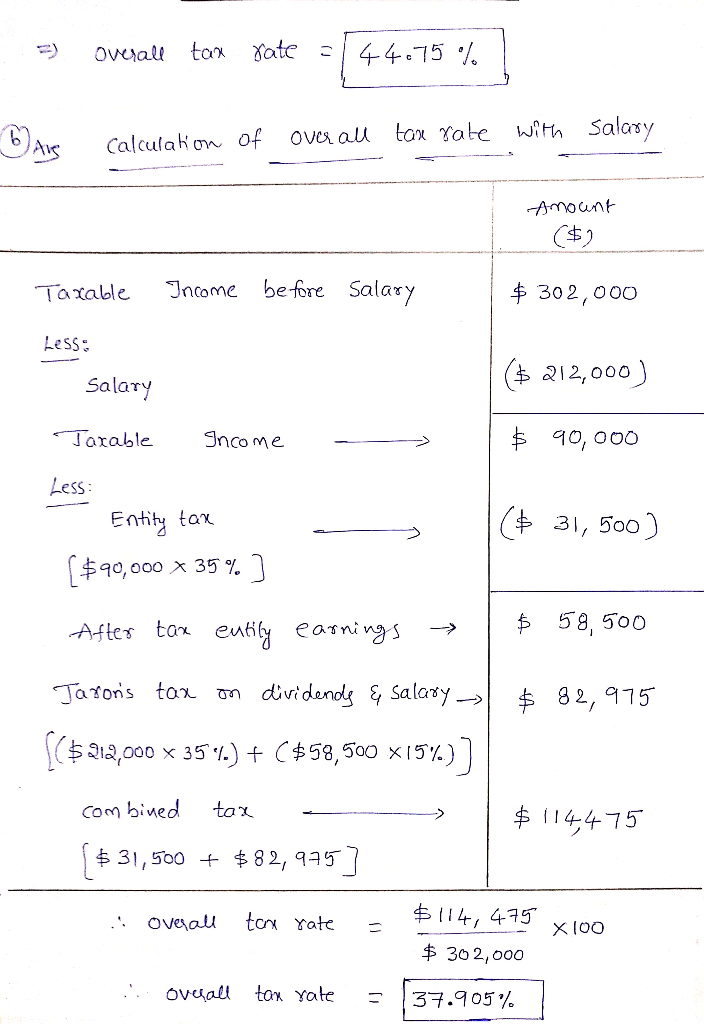

b. How much total income tax will Custom Craft Services and Jaron pay (combining both corporate and shareholder level taxes) on the $302,000 of income if CCS pays Jaron a salary of $212,000 and distributes its remaining after-tax earnings to Jaron as a dividend (assume Jaron is not subject to the net investment income tax or the additional Medicare tax)?

Solutions

Related Solutions

Marathon Inc. (a C corporation) reported $1,350,000 of taxable income in the current year. During the...

Marathon Inc. (a C corporation) reported $1,750,000 of taxable income in the current year. During the...

1.In the current year, Apricot Corporation had taxable income of $120,000. Included in taxable income was...

Cranberry Corporation has $3,240,000 of current year taxable income. If the current year is a calendar...

For the current year, LNS corporation reported the following taxable income at the end of its...

Bullwinkle Corporation, an S corporation, reports the following results for the current year: Ordinary income =...

Crocker and Company (CC) is a C corporation. For the year, CC reported taxable income of...

1. In 2019, Nighthawk Corporation, a calendar year C corporation, has $5,620,000 of adjusted taxable income...

[LO 8.2 & 8.3] Juno Corporation had ordinary taxable income of $167,000 in the current year...

Juno Corporation had ordinary taxable income of $167,000 in the current year before consideration of any...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

ekkarill92 answered 1 month ago

ekkarill92 answered 1 month ago