Question

In: Economics

Exercise goals: Be able to solve the profit maximization problem of a monopolist with third-degree price...

Exercise goals: Be able to solve the profit maximization problem

of a monopolist with third-degree price discrimination.

Understand the differences between 3DPD and single-pricing. You own

a monopoly that produces cars to be sold in two countries:

Freedonia and Sylvania. Demand for cars in Freedonia is given by PF

= 16,000-20QF, while demand in Sylvania is given by

PS = 20, 000 - 10QS. You own a single plant in Sylvania

that produces cars for both countries. Your cost function is C (Q)

= 8, 000Q, where Q = QF + QS.

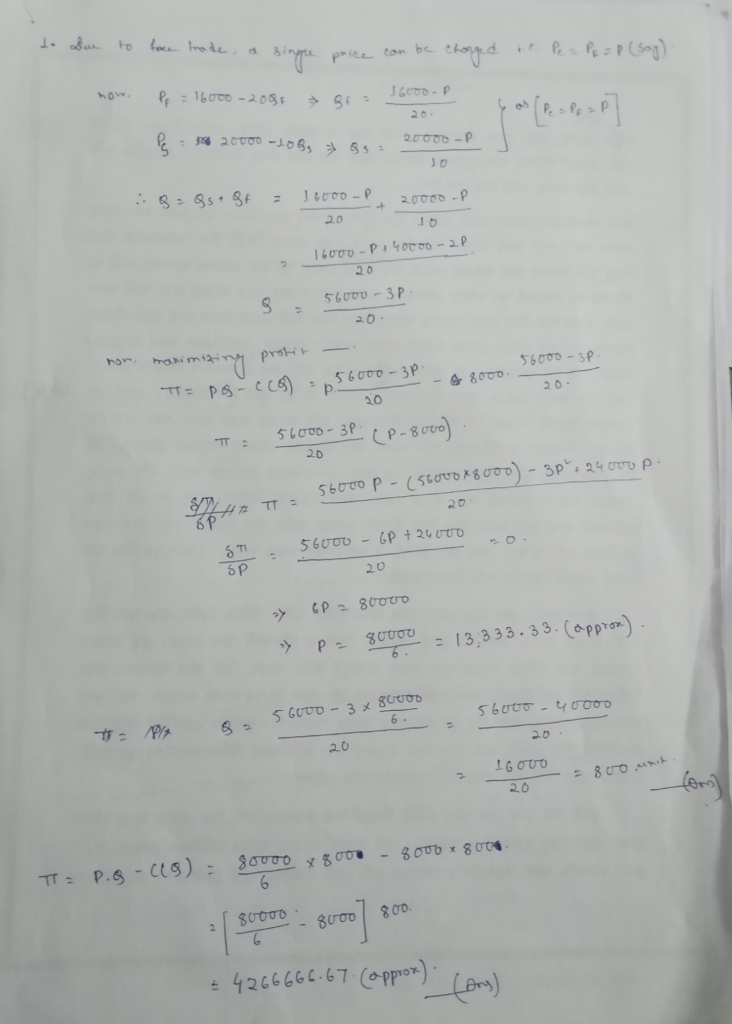

1. (1 point) Initially, these two countries have a peaceful

relationship, and free trade exists between them, therefore you can

only charge a single price between the two countries. What price do

you set? How much profit do you collect? [Hint: it may be easier to

solve this maximization problem in terms of P. To do so, you can

first obtain the demand functions (i.e. Q(P) = . . .), and then

write the cost function in terms of P using the demand

functions]

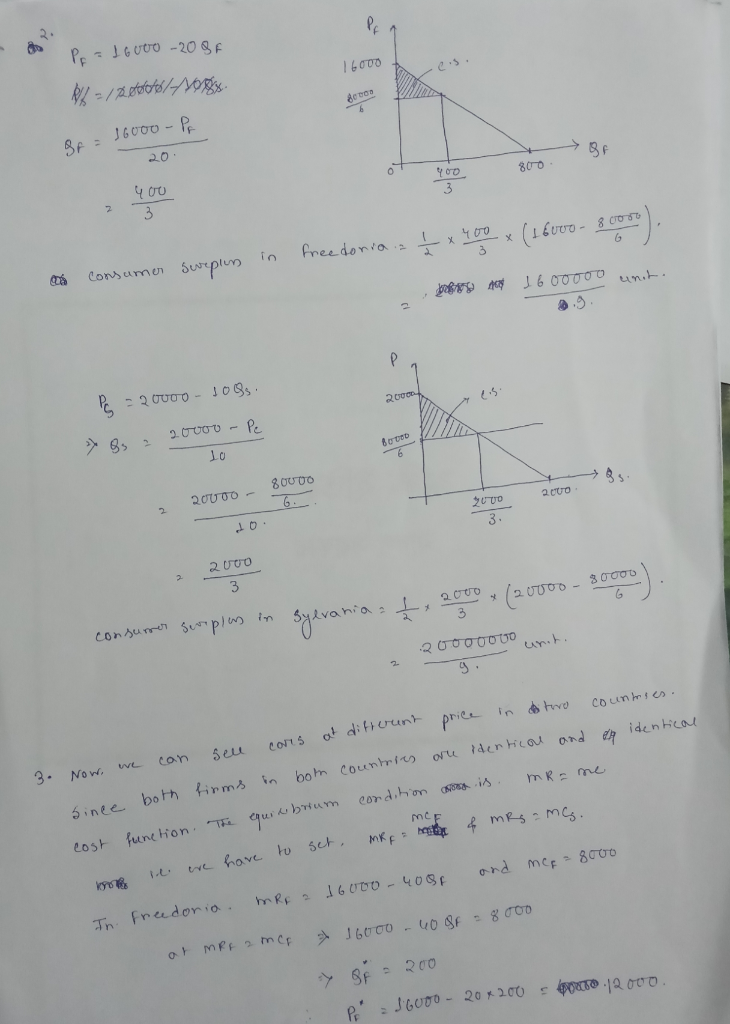

2. (1 point) How much consumer surplus is generated in each country?

3. (1 points) The Freedonian government finds out that Sylvania

is secretly plotting to invade Freedonia. This discovery leads to

an interruption in free trade between the two countries. That’s

good news for you: it means you can now sell cars in Freedonia at a

different price than in Sylvania. However, in order to do so, you

have to build a factory in Freedonia as well. Suppose that you can

build a factory for free (the Freedonian government is giving you a

generous handout because they like your cars). The plants are

identical, so you have the same cost function in both countries (C

(Q) = 8, 000Q). What prices do you set? How much profit do you

collect?

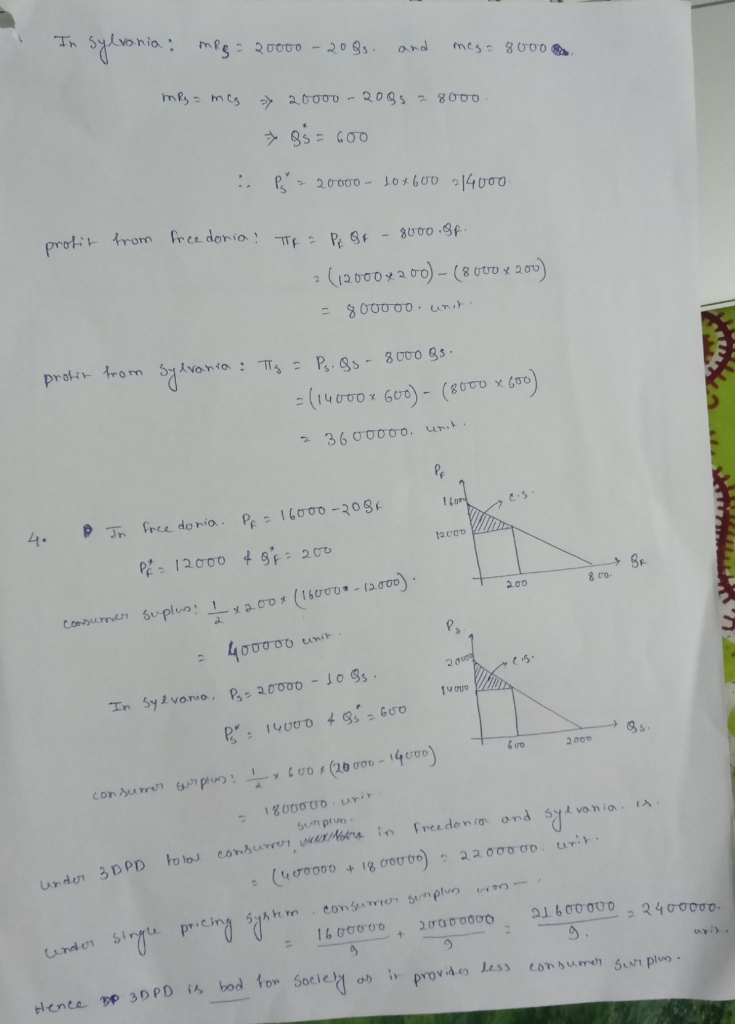

4. (1 point) How much consumer surplus is generated for each

country in this new scenario? Comment on whether you think 3DPD is

good or bad for society as a whole (i.e. Freedonia + Sylvania) in

this case.

5. (1 point) Suppose that the cost of building a factory is

300,000. Does it make sense for the Freedonian government to

subsidize the plant? Why or why not? [When answering this question,

assume that the Freedonian government only cares about the

well-being of its citizens]

Solutions

Related Solutions

A monopolist is considering third degree price discrimination. It estimates that the inverse demand curves of...

A monopolist is considering third degree price discrimination. It estimates that the inverse demand curves of...

A monopolist practicing third degree price discrimination has two types of consumers.

Write out the profit-maximization conditions for a monopolist to mark-up over price. That is, what is...

A monopolist is using third-degree price discrimination. Which of the following statements are true? I. ...

a) Evaluate and explain the following assertion: “Profit maximization on the part of a monopolist means...

7. Show analytically that the necessary condition for the profit maximization of a monopolist that supplies...

Suppose a pure monopolist sells output in two different markets [A&B]. (third-degree price discrimination!). The demand...

Exercise 3. Third Degree Price Discrimination Some air routes are only served by a couple of...

3. Profit maximization and loss minimization BYOB is a monopolist in beer production and distribu...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

Rahul Sunny answered 1 month ago

Rahul Sunny answered 1 month ago