Question

In: Finance

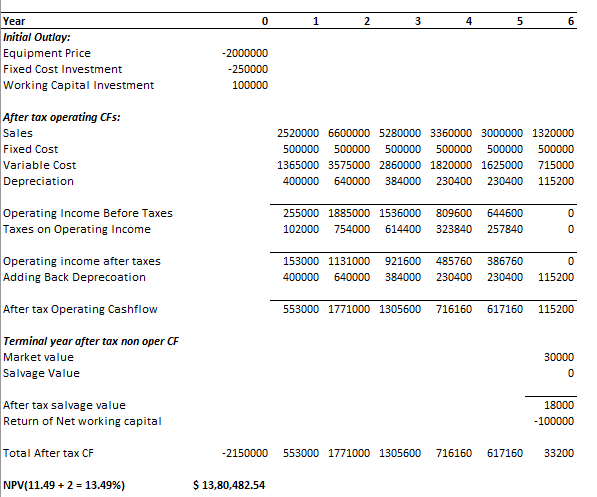

I need the NPV of this project. Tax Rate is 40% and the WACC is 11.49%...

I need the NPV of this project. Tax Rate is 40% and the WACC is 11.49%

This project requires an initial investment of $2,000,000 in

equipment which will cost an additional $250,000 to install. The

firm will use the attached MACRS depreciation schedule to expense

this equipment. Once the equipment is installed, the company will

need to increase net working capital by $100,000. The project will

last 6 years at which time the market value for the equipment will

be $30,000.

The project will project a product with a sales price of $120.00

per unit and the variable cost per unit will be $65.00. The fixed

costs would be $500,000 per year. Because this project is very

different to current products sold by the business, management has

imposed a 2 percentage point premium above its current WACC as the

valuation hurdle it must meet or surpass.

Years 2014 2015 2016 2017 2018 2019 Forecasted Units Sold 21,000

55,000 44,000 28,000 25,000 11,000

Solutions

Related Solutions

If you earn the WACC on a project, (IRR = WACC) or NPV = 0, what...

18. Coleman Technologies Inc. is estimating its WACC Tax rate = 40%. Debt value: $15,000. Par...

what is the NPV of the Project if Dominant Retailer’s WACC is 16.75%? Your company, Dominant...

If the tax rate is 40 percent, compute the before-tax real interest rate and the after-tax...

I need 450 words. Explain why the NPV of a relatively long-term project, defined as one...

WACC and NPV calculation SHOW ALL WORK !!!! Calculate the Components of WACC and the WACC...

Assume a corporate tax rate is 40% and an individual tax rate of 25%. Perryton Corp....

Suppose the corporate tax rate is 40%, investors pay a tax rate of 20% on income...

Suppose the corporate tax rate is 40%, investors pay a tax rate of 20% on income...

Suppose the corporate tax rate is 40%, investors pay a tax rate of 20% on income...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

jeff jeffy answered 2 months ago

jeff jeffy answered 2 months ago