Question

In: Math

A small entrepreneurial company is trying to decide between developing two different products that they believe...

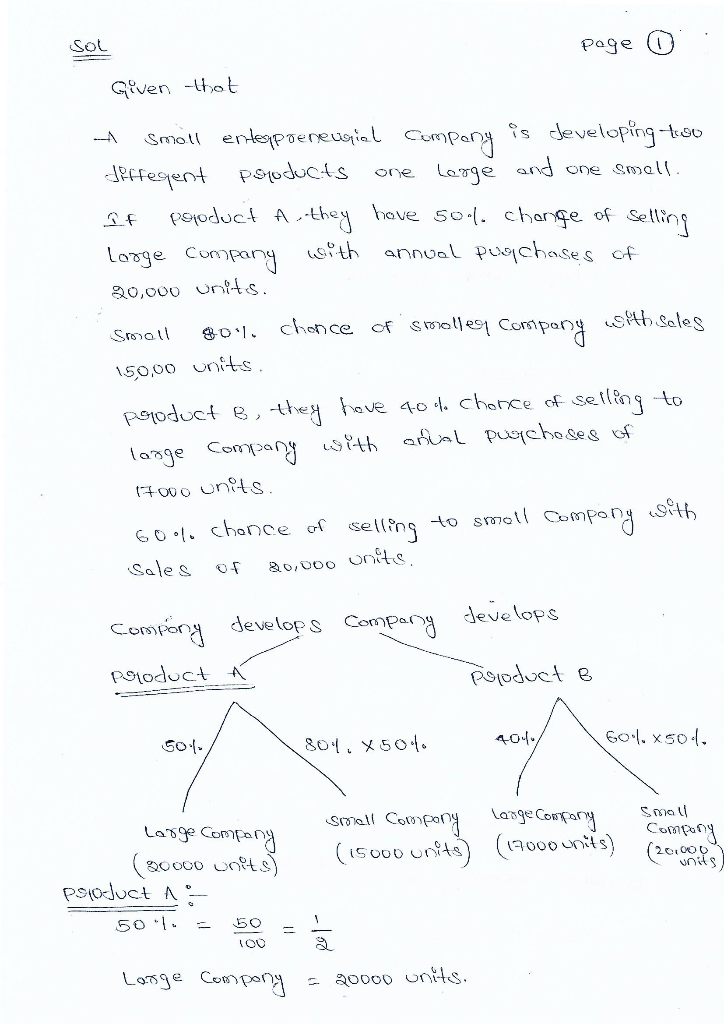

A small entrepreneurial company is trying to decide between developing two different products that they believe they can sell to two potential companies, one large and one small. If they develop Product A, they have a 50% chance of selling it to the large company with annual purchases of about 20,000 units. If the large company won't purchase it, then they think they have an 80% chance of placing it with a smaller company, with sales of 15,000 units. On the other hand if they develop Product B, they feel they have a 40% chance of selling it to the large company, resulting in annual sales of about 17,000 units. If the large company doesn't buy it, they have a 60% chance of selling it to the small company with sales of 20,000 units.

*Need excell formula for each cell*

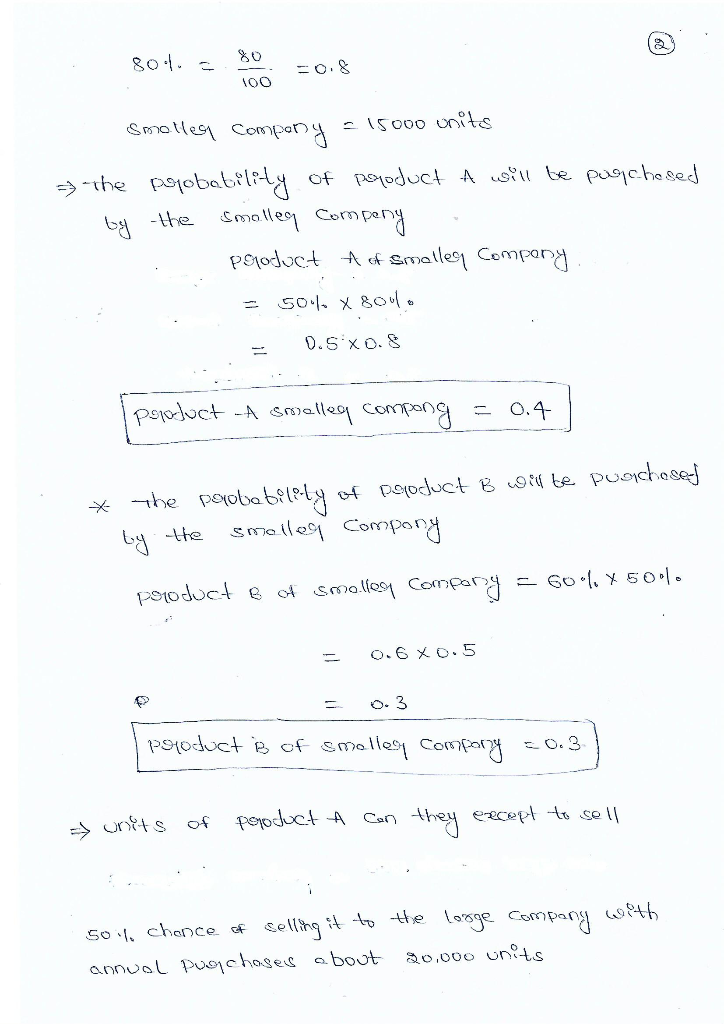

| What is the probability that Product A will be purchased by the smaller company? | ||||||||

| What is the probability that Product B will be purchased by the smaller company? | ||||||||

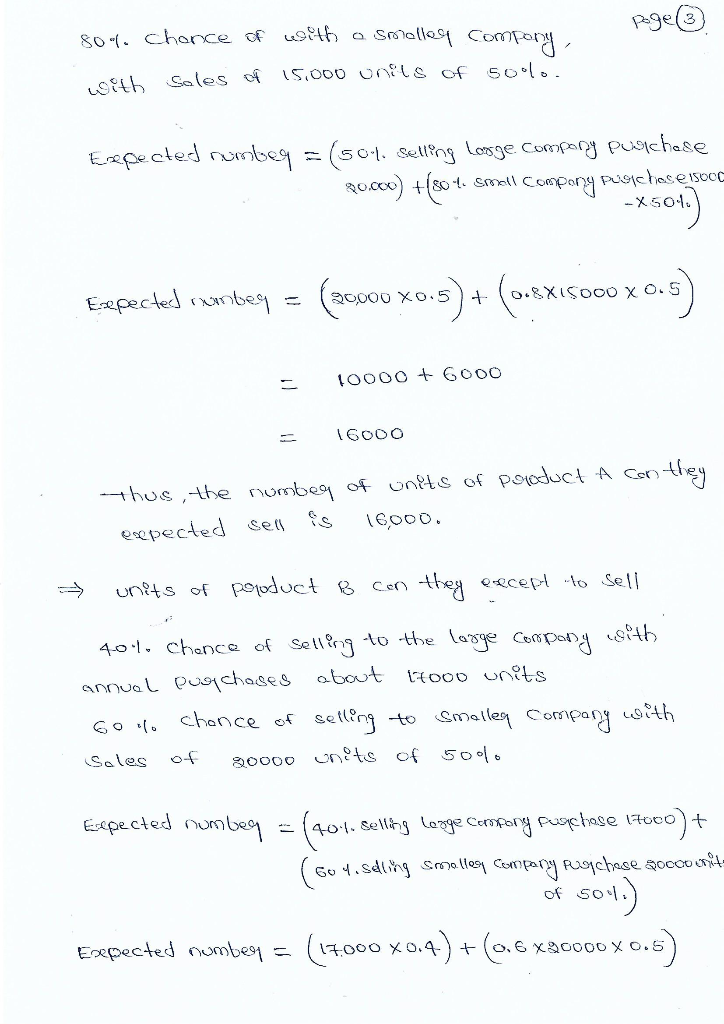

| How many units of Product A can they expect to sell? | ||||||||

| How many units of Product B can they expect to sell? | ||||||||

Solutions

Related Solutions

Brazen, Ltd. has $75,000 to invest. The company is trying to decide between two different projects. The...

Pags Industrial Systems Company (PISC) is trying to decide between two different conveyor belt systems. System...

Letang Industrial Systems Company (LISC) is trying to decide between two different conveyor belt systems. System...

Lang Industrial Systems Company (LISC) is trying to decide between two different conveyor belt systems. System...

Lang Industrial Systems Company (LISC) is trying to decide between two different conveyor belt systems. Systems...

Lang Industrial Systems Company (LISC) is trying to decide between two different conveyor belt systems. System...

Letang Industrial Systems Company (LISC) is trying to decide between two different conveyor belt systems. System...

Lang Industrial Systems Company (LISC) is trying to decide between two different conveyor belt systems. System...

Hagar Industrial Systems Company (HISC) is trying to decide between two different conveyor belt systems. System...

Hagar Industrial Systems Company (HISC) is trying to decide between two different conveyor belt systems. System...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

milcah answered 2 months ago

milcah answered 2 months ago