Question

In: Mechanical Engineering

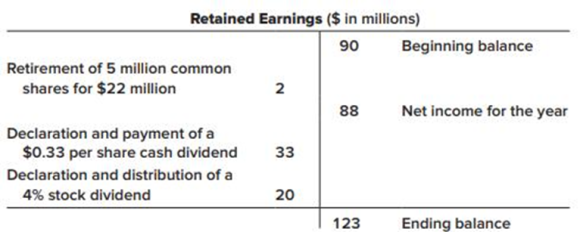

Shown below in T-account format are the changes affecting the retained

Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during 2021. At January 1, 2021, the corporation had outstanding 105 million common shares, $1 par per share.

Required:

1. From the information provided by the account changes you should be able to re-create the transactions that affected Brenner-Jude’s retained earnings during 2021. Reconstruct the journal entries which can be used as spreadsheet entries in the preparation of a statement of cash flows. Also indicate any investing and financing activities you identify from this analysis that should be reported on the statement of cash flows.

2. Prepare a statement of retained earnings for Brenner-Jude for the year ended 2021.

Solutions

Expert Solution

Statement of cash flows

Statement of cash flows is a financial statement, which reports the inflow and outflow of cash of a company over a particular period of time. It shows how the operating, investing, and financing activity affects the flow of cash of a company.

The statement of cash flows reports the cash receipt and cash payment of business for a particular period.

(1)

Journal entry: The record of business transactions in a chronological order in the journal is referred to as journal entry.

Prepare journal entry for BJ Corporation for the year 2018:

Journal entry for retirement of common shares:

|

Date |

Account Title and explanation |

Debit ($) |

Credit ($) |

|

Jan 1 |

Common stock (E-) |

5 |

|

|

2021 |

Paid-in capital-excess of par (E-) |

15 |

|

|

|

Retained earnings (E-) |

2 |

|

|

|

Cash (A-) |

|

22 |

|

|

(To record the common stock.) |

|

|

This transaction identifies a $22 million is a cash outflow from the financing activities.

Working notes:

Calculate the amount of common stock:

Common stock = $5 million shares × $1 per share

= $5 × $1

= $5

Calculate the amount of paid-in capital-excess of par:

Paid-in capital-excess of par = [Common share of $22 million – Amount of common stock – Retained earnings]

= $22 - $5 - $2

= $15

Journal entry for net income closed to retained earnings:

|

Date |

Account Title and Explanation |

Debit ($) |

Credit ($) |

|

Jan 1 |

Income Summary (E-) |

88 |

|

|

2021 |

Retained Earnings (E+) |

|

88 |

|

|

(To close the income summary account) |

|

|

Changes in the components of net income sum up the operating activity. But, this helps partially to understand the change in retained earnings when entered in the spread sheet.

Journal entry for declaration of cash dividend:

|

Date |

Account Title and Explanation |

Debit ($) |

Credit ($) |

|

Jan 1 |

Retained earnings (E-) |

33 |

|

|

2021 |

Cash (A-) |

|

33 |

|

|

(To record the payment of dividends in cash.) |

|

|

This transaction identifies a $33 million is a cash outflow from the financing activities.

Journal entry for declaration of a stock dividend:

|

Date |

Account Title and Explanation |

Debit ($) |

Credit ($) |

|

Jan 1 |

Retained earnings (E-) |

20 |

|

|

2021 |

Common stock (E+) |

|

4 |

|

|

Paid-in capital in excess of par (E+) |

|

16 |

|

|

(To record the payment of dividends in cash.) |

|

|

This transaction does not represent cash flows from investing or financing activities. But, this helps partially to understand the change in retained earnings when entered in the spread sheet.

Working note:

Calculate the amount of common stock:

Common stock = [(Amount of outstanding common shares – Retained of 5 million common shares) × 4% of stock dividend]

= [($105 - $5) × 4%]

= $5

(2)

Statement of retained earnings:

This is an equity statement which shows the changes in the owners’ equity over a period of time. This statement uses the information from income statement and provides the retained earnings’ information over a reporting period to the balance sheet.

Prepare statement of retained earnings BJ Corporation for the year ended December 31, 2018.

|

BJ Corporation |

|

|

Statement of Retained Earnings |

|

|

Year Ended December 31, 2021 |

|

|

Particulars |

Amount ($) |

|

Retained earnings, January 1, 2021 |

90 |

|

Net income for the year |

88 |

|

|

178 |

|

Less: Retirement of common stock |

(2) |

|

Cash dividends of $.33 per share |

(33) |

|

4% of stock dividend |

(20) |

|

Retained earnings, December 31, 2021 |

$123 |

(1)

This transaction identifies a $22 million is a cash outflow from the financing activities.

Common stock = [(Amount of outstanding common shares – Retained of 5 million common shares) × 4% of stock dividend]

= [($105 - $5) × 4%]

= $5

(2)

Statement of retained earnings:

Related Solutions

Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during...

Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during...

Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during...

Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during...

Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during...

Shown below in T-account format are the beginning and ending balances ($ in millions) of both inventory and accounts payable.

A commercial bank’s T-account in 2020 is shown as below: Table 2: T-Account for Bank A...

Analysis of Adjusted Data Selected T-account balances for Parris Company are shown below as of January...

Problem 4-6 Below is the Retained Earnings account for the year 2017 for Pronghorn Corp. Retained...

Analyzing Accounts Using Adjusted Data Selected T-account balances for Fields Company are shown below as of...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

Junaid answered 4 years ago

Junaid answered 4 years ago