Question

In: Finance

3. You would like to retire at the end of 40 years with an annual pension...

3. You would like to retire at the end of 40 years with an annual pension of $1 million per year for 30 years.

a) How much would you have to deposit every year for the next 40 years to meet your goal? Assume you invest in the stock market at an average return of 12 percent per year (for the entire 70 years).

b) Suppose your annual deposits calculated in part (a) actually earned only 6 percent per year for 40 years, how much would you be able to withdraw every year for 30 years following retirement? Assume the 6 percent return is earned over the entire 70 years.

Solutions

Expert Solution

Future value at the end of 40 years = Present value of stream of annual pension for 30 years

Annual pension (PMT) = $ 1 Million

Number of years (nper) = 30

Rate per year (rate) = 12%

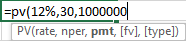

Present value of stream of annual pension for 30 years(PV) =

= $

8,055,183.97

= $

8,055,183.97

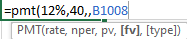

a)

Future value of deposit = $ 8,055,183.97

Number of years(nper) = 40

Rate = 12%

Annual Deposit (PMT) =  = $

10,500.94

= $

10,500.94

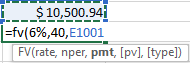

b)

Annual Deposit (PMT) = $ 10,500.94

Rate = 6%

Number of years(nper) = 40

Future value at the end of 40 years(FV) =  = $ 1,625,146.72

= $ 1,625,146.72

This is the Present value for the stream of payments every year for 30 years

PV = $ 1,625,146.72

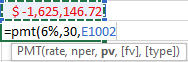

rate = 6%

Nper = 30

Withdrawal every year for 30 years following retirement

(PMT) =  = $ 118,065.14

= $ 118,065.14

Related Solutions

Given the following information: You are 40 years old and you would like to retire at...

You would like to retire in 40 years with $1,000,000. Assume you could earn 6% on...

You would like to have $650,000 when you retire in 40 years. How much should you...

You will retire in 40 years. At that time you will begin making annual withdrawals and...

You are planning for a very early retirement. You would like to retire at age 40...

You are planning for a very early retirement. You would like to retire at age 40...

Suppose you plan to retire in 40 years. If you make 10 annual investments of $...

Suppose you plan to retire in 40 years. If you make 10 annual investments of $...

You’d like to buy a small ranch when you retire in 40 years. You estimate that...

you would like to retire 20 years from now and have an investment worth $3 million...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

jeff jeffy answered 3 months ago

jeff jeffy answered 3 months ago