Question

In: Finance

A binomial tree with one-month time steps is used to value an index option. The interest...

A binomial tree with one-month time steps is used to value an index option. The interest rate is 3% per annum and the dividend yield is 1% per annum. The volatility of the index is 16%. What is the probability of an up movement?

|

0.4704 |

||

|

0.5065 |

||

|

0.5592 |

||

|

0.5833 |

Solutions

Expert Solution

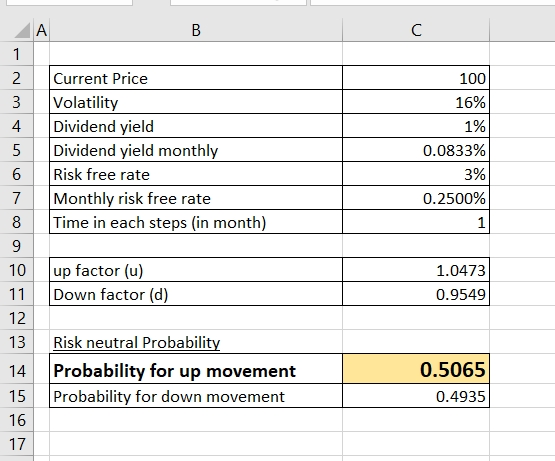

Correct answer: 0.5065

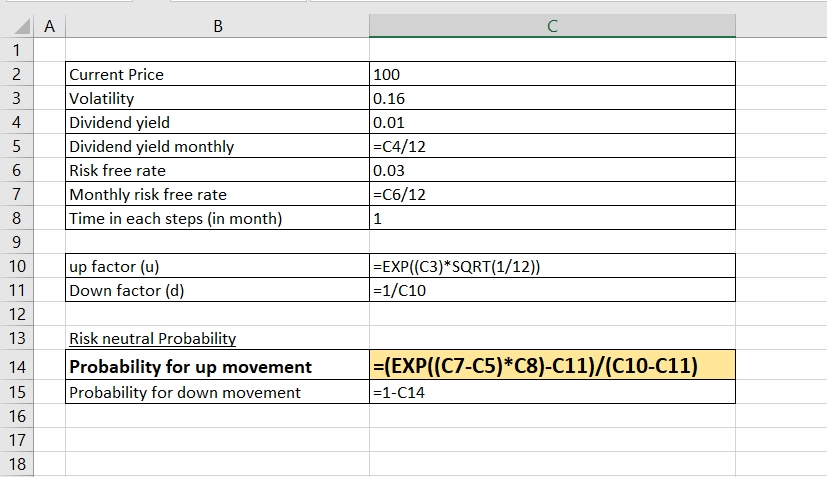

Please refer to below spreadsheet for calculation and answer. Cell reference also provided.

Cell reference -

Please note:

There are three parameters of Option Binomial Pricing Model

· up factor (u)

· down factor (d)

· probability (P)

up factor and down factor used to calculate rise in price and fall in price of underlying assets in one period. Probability is measure probability of rise in price and (1-P) is probability of price fall.

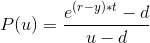

Cox-Rox-Rubinstein has suggested following formula to calculate these factors,

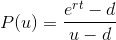

If dividend yield given:

where,

u = Price up factor

d = Price down factor

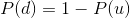

P = Probability

t= time in a period

=

volatility

=

volatility

y = dividend yield for time in one step

Related Solutions

You want to use the binomial tree analysis to value a 6-month call option with a...

A 2-step binomial tree is used to value an American put option with strike 104, given...

Calculate u, d and p when a binomial tree is constructed to value an option on...

(1) Please use binomial option pricing model to derive the value of a one-year put option....

1. Please use binomial option pricing model to derive the value of a one-year put option....

]Using either a Black Scholes or Binomial Tree option calculator on the internet, what is the...

Use a 2 step binomial tree to value a new exotic derivative. Draw the tree and...

Use a 2 step binomial tree to value a new exotic derivative. Draw the tree and...

Use a one step binomial option pricing model to value a 1 year at the money...

Use the binomial option pricing model to find the value of a call option on £10,000...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

jeff jeffy answered 3 months ago

jeff jeffy answered 3 months ago