Question

In: Accounting

The following is the balance sheet of Korver Supply Company at December 31, 2020 (prior year)....

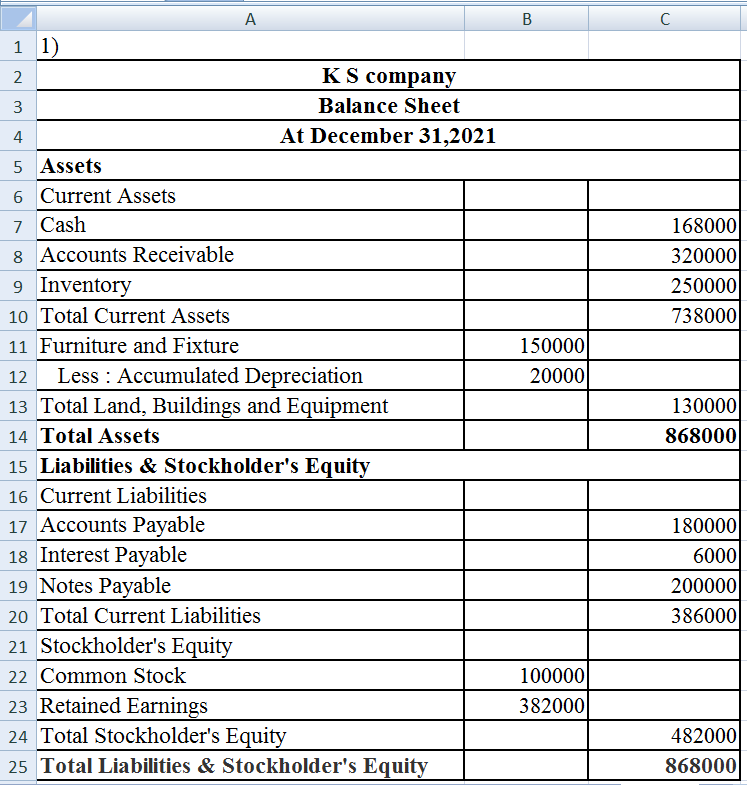

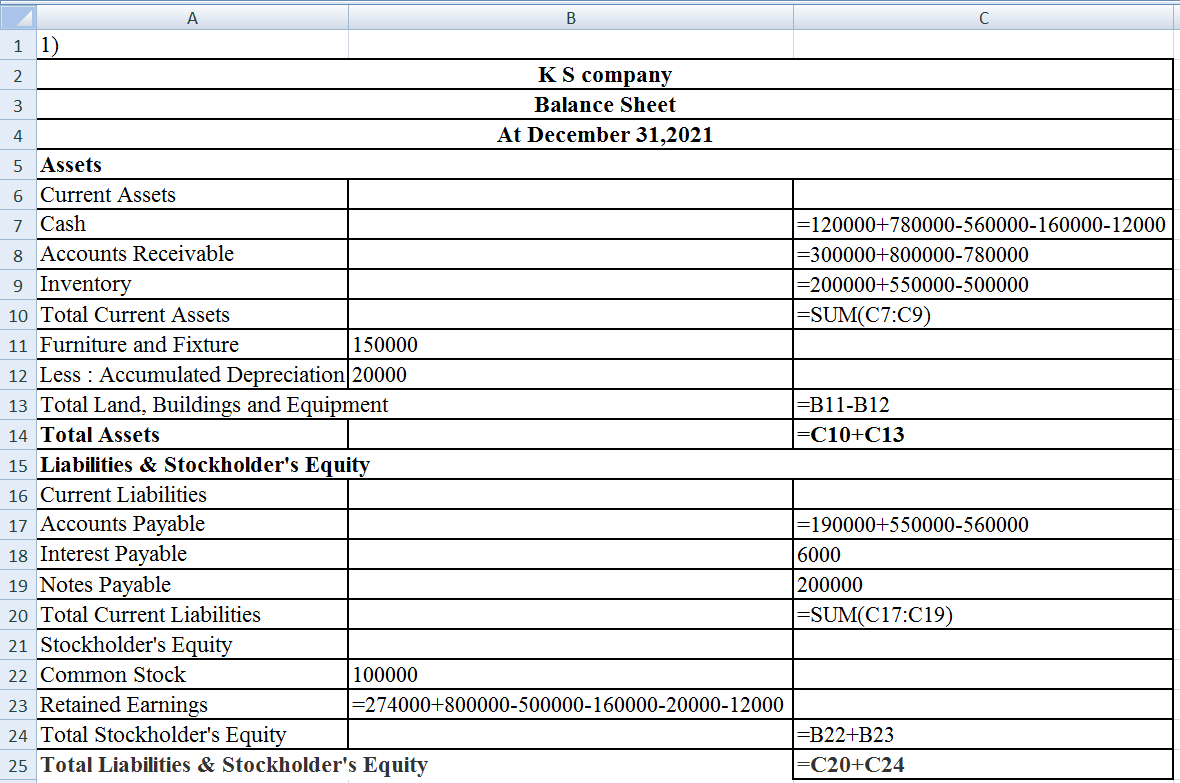

The following is the balance sheet of Korver Supply Company at December 31, 2020 (prior year). KORVER SUPPLY COMPANY Balance Sheet At December 31, 2020 Assets Cash $120,000 Accounts receivable 300,000 Inventory 200,000 Furniture and fixtures (net) 150,000 Total assets $770,000 Liabilities and Shareholders’ Equity Accounts payable (for merchandise) $190,000 Notes payable 200,000 Interest payable 6,000 Common stock 100,000 Retained earnings 274,000 Total liabilities and shareholders’ equity $770,000 Transactions during 2021 (current year) were as follows: 1. Sales to customers on account $800,000 2. Cash collected from customers 780,000 3. Purchase of merchandise on account 550,000 4. Cash payment to suppliers 560,000 5. Cost of merchandise sold 500,000 6. Cash paid for operating expenses 160,000 7. Cash paid for interest on notes 12,000 Additional Information: The notes payable are dated June 30, 2020, and are due on June 30, 2022. Interest at 6% is payable annually on June 30. Depreciation on the furniture and fixtures for 2021 is $20,000. The furniture and fixtures originally cost $300,000.

Required: Prepare a classified balance sheet at December 31, 2021, by updating ending balances from 2020 for transactions during 2021 and the additional information. The cost of furniture and fixtures and their accumulated depreciation are shown separately.

Solutions

Related Solutions

The following is the balance sheet of Korver Supply Company at December 31, 2020 (prior year)....

The following is the balance sheet of Korver Supply Company at December 31, 2017. KORVER SUPPLY...

Consider the following financial statements for Industrial Supply Company. (Actual) December 31, Balance sheet Year 1...

Example Company Balance Sheet December 31, 2019 and 2020 Example Company Income Statment For Year Ended...

at December 31, the company's fiscal year-end. The 2020 balance sheet disclosed the following: Current assets:...

Partial information from the comparative balance sheet of Jackson Company as of December 31, 2020 and...

Following is a partially completed balance sheet for Hoeman Inc. at December 31, 2020, together with...

Below is the partial balance sheet for Gabi Gold Limited: December 31, 2021 December 31, 2020...

Dog, inc., reported the following receivable in its December 31, 2020, year-end balance sheet: Current assets:...

The following balance sheet was prepared by the bookkeeper for Jacuzi Company as of December 31,...

- C PROGRAMMIMG I want to check if my 2 input is a number or not all...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

ekkarill92 answered 3 months ago

ekkarill92 answered 3 months ago