Question

In: Accounting

Required information [The following information applies to the questions displayed below.] Comparative financial statements for Weaver...

Required information

[The following information applies to the questions displayed below.]

Comparative financial statements for Weaver Company follow:

| Weaver Company Comparative Balance Sheet at December 31 |

||||||||

| This Year | Last Year | |||||||

| Assets | ||||||||

| Cash | $ | 5 | $ | 13 | ||||

| Accounts receivable | 308 | 230 | ||||||

| Inventory | 156 | 196 | ||||||

| Prepaid expenses | 9 | 6 | ||||||

| Total current assets | 478 | 445 | ||||||

| Property, plant, and equipment | 505 | 426 | ||||||

| Less accumulated depreciation | (85) | (72) | ||||||

| Net property, plant, and equipment | 420 | 354 | ||||||

| Long-term investments | 26 | 32 | ||||||

| Total assets | $ | 924 | $ | 831 | ||||

| Liabilities and Stockholders' Equity | ||||||||

| Accounts payable | $ | 304 | $ | 224 | ||||

| Accrued liabilities | 70 | 77 | ||||||

| Income taxes payable | 74 | 64 | ||||||

| Total current liabilities | 448 | 365 | ||||||

| Bonds payable | 196 | 171 | ||||||

| Total liabilities | 644 | 536 | ||||||

| Common stock | 160 | 200 | ||||||

| Retained earnings | 120 | 95 | ||||||

| Total stockholders’ equity | 280 | 295 | ||||||

| Total liabilities and stockholders' equity | $ | 924 | $ | 831 | ||||

| Weaver Company Income Statement For This Year Ended December 31 |

||||||

| Sales | $ | 753 | ||||

| Cost of goods sold | 450 | |||||

| Gross margin | 303 | |||||

| Selling and administrative expenses | 219 | |||||

| Net operating income | 84 | |||||

| Nonoperating items: | ||||||

| Gain on sale of investments | $ | 6 | ||||

| Loss on sale of equipment | (2) | 4 | ||||

| Income before taxes | 88 | |||||

| Income taxes | 23 | |||||

| Net income | $ | 65 | ||||

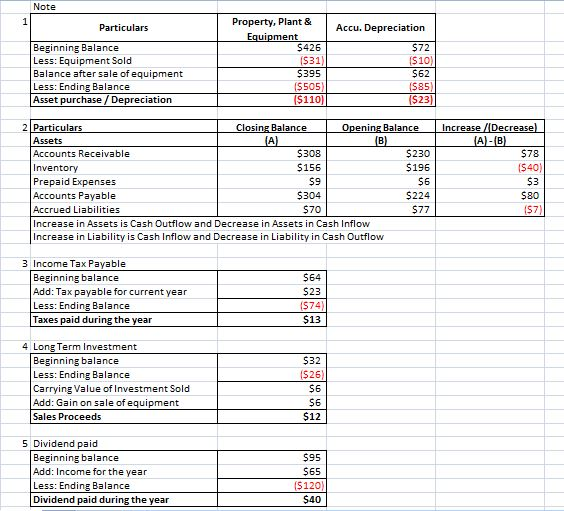

During this year, Weaver sold some equipment for $19 that had cost $31 and on which there was accumulated depreciation of $10. In addition, the company sold long-term investments for $12 that had cost $6 when purchased several years ago. Weaver paid a cash dividend this year and the company repurchased $40 of its own stock. This year Weaver did not retire any bonds.

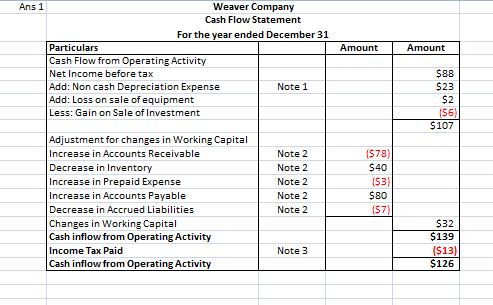

1. Using the indirect method, determine the net cash provided by/used in operating activities for this year. (List any deduction in cash and cash outflows as negative amounts.)

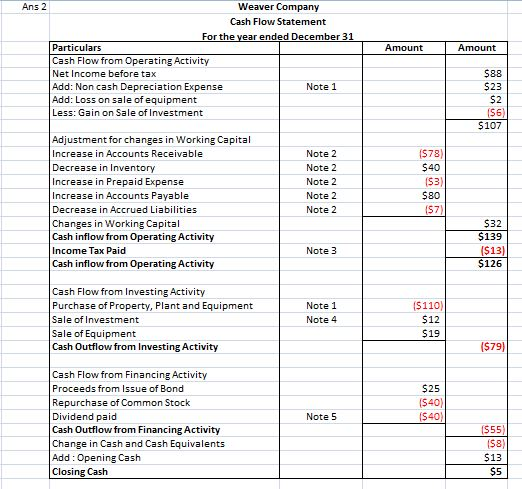

2. Using the information in (1) above, along with an analysis of the remaining balance sheet accounts, prepare a statement of cash flows for this year. (List any deduction in cash and cash outflows as negative amounts.)

Solutions

Related Solutions

Required information [The following information applies to the questions displayed below.] Comparative financial statements for Weaver...

Required information [The following information applies to the questions displayed below.] Comparative financial statements for Weaver...

[The following information applies to the questions displayed below.] Comparative financial statements for Weaver Company follow:...

Required information [The following information applies to the questions displayed below.] The comparative financial statements for...

Required information [The following information applies to the questions displayed below.] The following financial statements and...

Required information [The following information applies to the questions displayed below.] The following financial statements and...

Required information [The following information applies to the questions displayed below.] The following financial statements and...

Required information [The following information applies to the questions displayed below.] The following financial statements and...

Required information [The following information applies to the questions displayed below.] The following financial statements and...

Required information [The following information applies to the questions displayed below.] The following financial statements and...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

ekkarill92 answered 3 months ago

ekkarill92 answered 3 months ago