Question

In: Economics

a. Suppose that government would like to maximize tax revenue. Explain why it may not be...

a. Suppose that government would like to maximize tax revenue. Explain why it may not be a good idea for the government to lower tax rates for the goods that have very low price elasticities of demand (less than one).

b. Suppose that the government wants to maximize tax revenue. Explain why it may be not a good idea for the government to raise tax rates for a good with a price elasticity of demand more than one.

c. Use a demand/supply diagram to discuss why producers for luxury goods may benefit from a technological improvement in producing the goods.

Solutions

Expert Solution

When goods have price elasticity of less than 1 the increase in price by one unit causes a one unit decrease in demand and thus lowering taxes will cause the overall recenues to fall due to already high prices paid causing low consumption and hence low government tax revenues.

Similarly when price elasticity of good is more than 1, the increase in prices by one unit causes the demand to rise by one unit. Hence when government raises taxes the overall net effective prices will rise causing consumptions to fall and hence the government tax revenues will decline again.

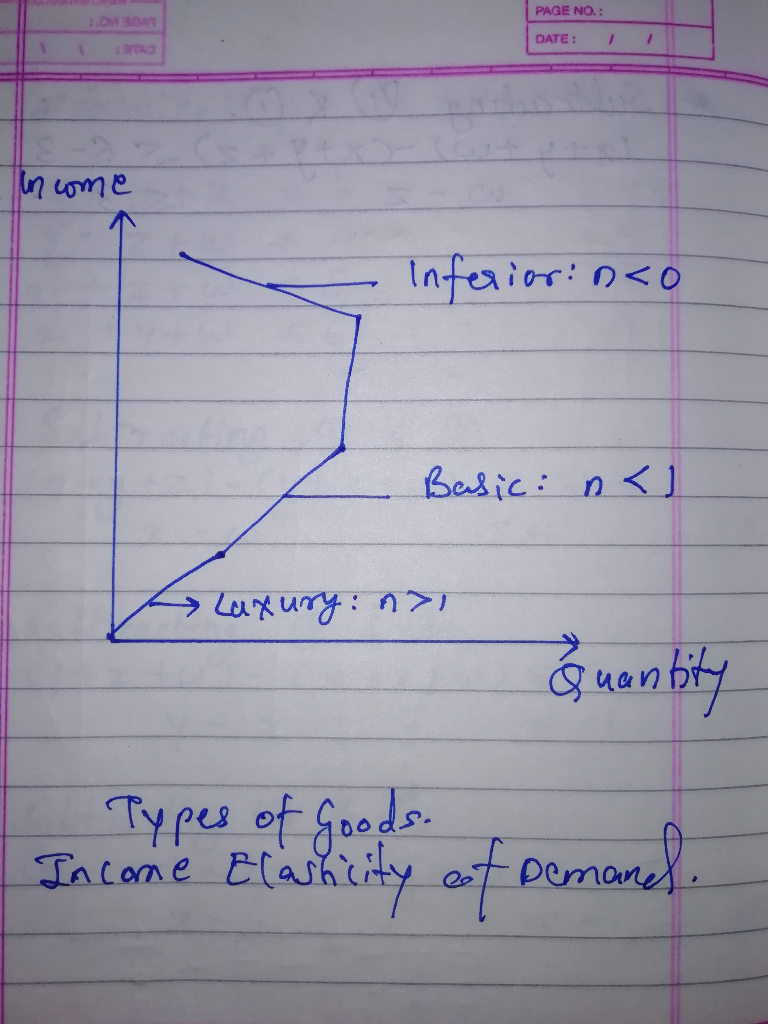

Producers from luxury goods benefit from technology improvements as their overall costs come down due to newer technologies and the excitement to purchase increases. For example, with advent of AI based processors the cost of making luxurious smartphone has halved and the consumption has doubled as it has high elasticity of demand. This makes consumers well off with dounle win situation of low cost and high demand ultimately giving higher revenues in topline and bottomline.

PLEASE UPVOTE INCASE YOU LIKED THE ANSWER WILL BE ENCOURAGING FOR US THANKYOU VERY MUCH.

Related Solutions

a. Define the price elasticity of demand. b.Suppose that government would like to maximize tax revenue....

Suppose the government imposes a tax on gasoline. Would the revenue collected from this tax likely...

Read and explain a graph showing how government tax revenue is spent

Suppose the U.S. government has to raise a given amount of tax revenue by taxing two...

Suppose the government raises its revenue by a net tax of 20 percent on income, t...

One of the major sources of revenue for the government is Tax. The government spends the...

Assume the government would like to incentivize saving by increasing the tax advantage on registered savings...

Suppose a government department would like to investigate the relationship between the cost of heating a...

Suppose a government department would like to investigate the relationship between the cost of heating a...

Suppose a government department would like to investigate the relationship between the cost of heating a...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

Rahul Sunny answered 3 months ago

Rahul Sunny answered 3 months ago