Question

In: Accounting

a. The initial cost of the extraction equipment is $2,500,000. In addition to this cost, the...

a. The initial cost of the extraction equipment is $2,500,000. In addition to this cost, the equipment will require a large concrete foundation at a cost of $300,000. The vendor has quoted an additional cost of $200,000 to install and test the equipment. These costs are all considered part of the cost of acquiring the equipment.

b.The useful life of the equipment is 10 years with no salvage value at the end of this period. However, for tax purposes, the equipment will be classified as 7year property and use the following MACRS depreciation allowances (half year convention) for computing tax depreciation deductions:

Percentage Of Original Year Cost

1 . . . . . . . . . . 14.3%

2 . . . . . 24.5

3 . . . . . . . . . . 17.5

4 . . . . . . . . . . 12.5

5 . . . . . . . . . . 8.9

6 . . . . . . . . . .8.9

7 . . . . . . . . . . 8.9

8 . . . . . . . . . .4.5

100.0%

c. Using the new equipment, 250 pounds of platinum can be extracted annually for the next 10 years from the previously inaccessible area of the mine.

d.The cost to extract and separate platinum from the ore is $4,000 per pound of platinum. After separation, the platinum must undergo further processing and testing that costs $1900 per pound of platinum. These are all out of pocket, variable costs.

e.Two skilled technicians will be hired to operate the new equipment. The total salary and fringe benefit expense for these two employees will be $200,000 annually over the 10 years.

f.Periodic maintenance on the equipment is expected to cost $175,000 per year.

g.The project requires an investment in additional working capital of $300,000. This working capital would be released for use elsewhere at the conclusion of the project in 10 years.

h.Environmental and safety regulations require that the mine be extensively restored and toxic substances be safely disposed at the conclusion of the project. The cost of environmental remediation work is expected to be $4,500,000

i.The current market price of platinum is 12,800 per pound

j.The tax rate is 21% and it uses an 18% after tax discount rate (minimum required rate of return)

Question:

| 2. Capital investment evaluation |

| Determine the following for the proposed extractoin equipment investment and specify whether or not the investment is acceptable under each of the following approaches. Assume a minimum payback period of 2 years is required |

| a. Net Present Value (NPV) |

| b. Internal rate of return (IRR) [Under TOOLS select GOAL SEEK and SET CELL for NPV equal to "0" - by changing after-tax discount rate 18% |

| c. Payback (in years) - round to nearest whole year |

2.

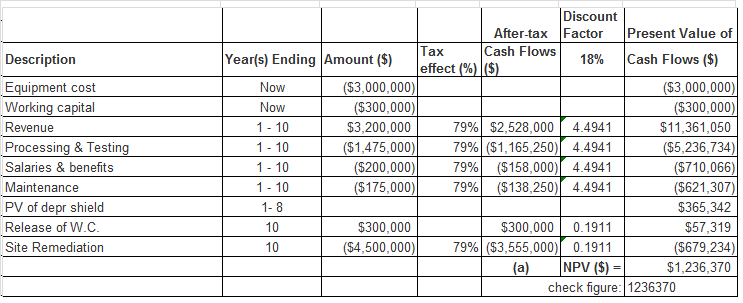

| After-tax | Present Value of | |||||

| Description | Year(s) Ending | Amount ($) | Tax effect (%) | Cash Flows ($) | Discount Factor | Cash Flows ($) |

| Equipment cost | Now | |||||

| Working capital | Now | |||||

| Revenue | 1-10 | 3,200,000 | 79% | 2,528,000 | 4.4941 | |

| Processing & Testing | 1-10 | |||||

| Salaries & benefits | 1-10 | |||||

| Maintenance | 1-10 | |||||

| PV of depr shield | 1-8 | 365,342 | ||||

| Release of W.C. | 10 | - | 0.1911 | |||

| Site Remediation | 10 | |||||

| (a) | NPV ($) = | |||||

| check figure: | 1236370 |

Solutions

Expert Solution

Answer (a)

Equipment cost = 2500000 + 300000 + 200000 = $3,000,000

NPV = $1,236,370

Workings:

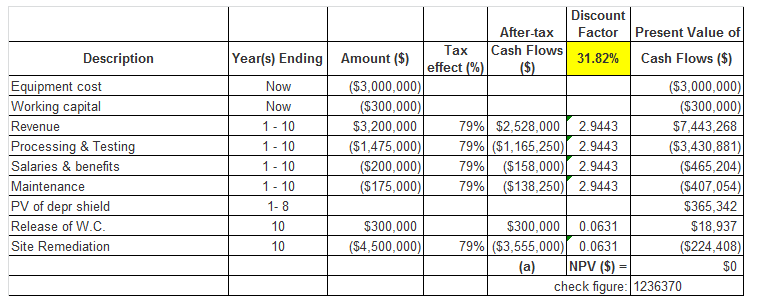

Answer (b):

IRR = 31.82%

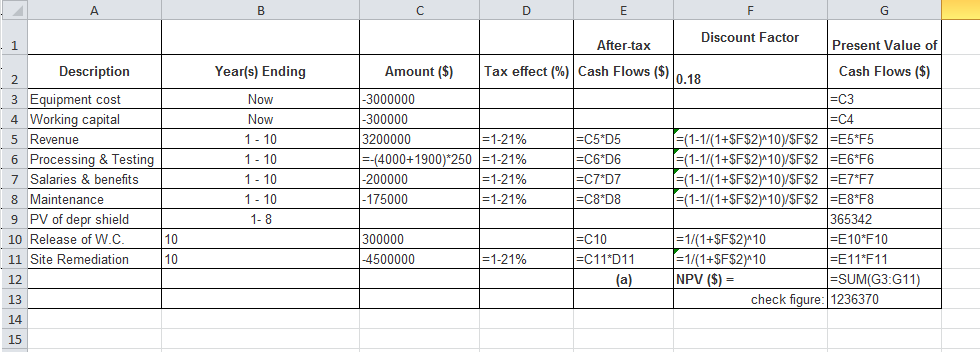

To use goal seek pl see below the above excel with 'show formula':

Discount factor is at cell F2:

On use goal seek (SET CELL G12 for NPV equal to "0" - by changing after-tax discount rate CELL F2) we get IRR = 31.82%

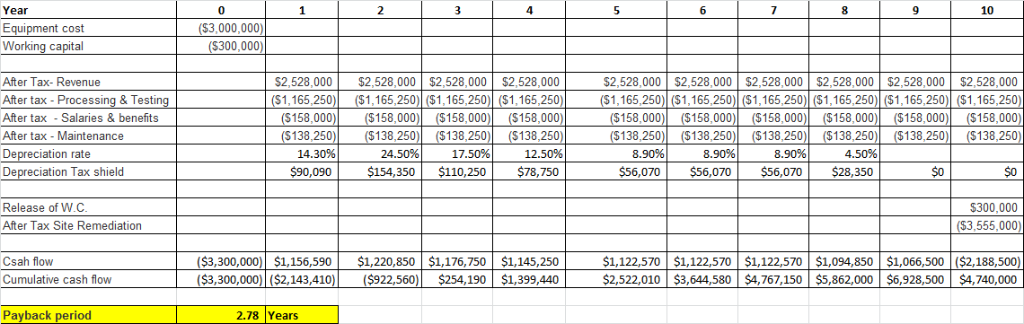

Answer (c):

Payback (in years) = 3 years

Working:

Related Solutions

An investment requires an initial disbursement of € 2,500,000 and the duration of the project is...

automated DNA extraction technique/equipment explain it in detail.

Cordia Corporation is planning a 15 year project with an initial investment of $2,500,000. The project...

A concrete plant is considering a new piece of equipment with an initial cost of $75,000...

Project A: This project requires an initial investment of $20,000,000 in equipment which will cost an...

What costs are included in the initial cost of property, plant, and equipment when they are...

Part A A new project has an initial cost of $142,000. The equipment will be depreciated...

Mountain Frost is considering a new project with an initial cost of $270,000. The equipment will...

The hospital has acquired medical diagnostic equipment that cost $2,000,000 total. In addition, the hospital had...

Question: The hospital has acquired medical diagnostic equipment that cost $3,000,000 total. In addition, the hospital...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

ekkarill92 answered 3 months ago

ekkarill92 answered 3 months ago