Question

In: Accounting

Haley Company produces one product and has the capacity to make 150,000 units per month. The...

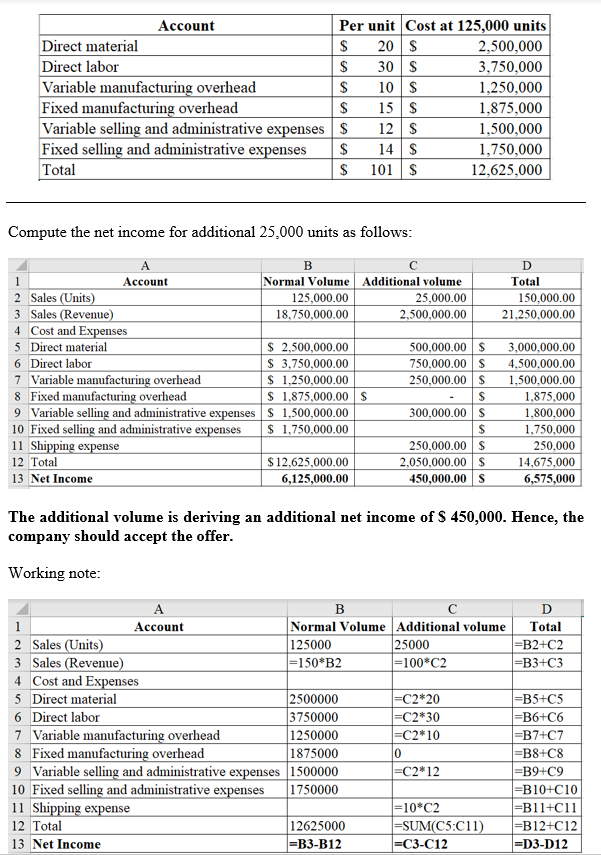

Haley Company produces one product and has the capacity to make 150,000 units per month. The cost that is associated with producing 125,000 units is shown below:

|

Account |

Per Unit |

Cost at 125,000 units |

| Direct Materials | $ 20.00 | $2,500,000.00 |

| Direct Labor | $ 30.00 | $3,750,000.00 |

| Variable Manufacturing overhead | $ 10.00 | $1,250,000.00 |

| Fixed Manufacturing overhead | $ 15.00 | $1,875,000.00 |

| Variable selling and administrative expenses | $ 12.00 | $1,500,000.00 |

| Fixed selling and administrative expenses | $ 14.00 | $1,750,000.00 |

| Totals | $ 101.00 | $12,625,000.00 |

The selling price per unit is $150. The Haley company was contacted by a prospective customer interested in purchasing 25,000 units for $100. The management team is considering this offer and in the meeting about this new prospect, you (the management accountant), stated that the fixed cost will remain the same, but the variable cost will increase along with $10 shipping expense due to the customer’s international location. Management has asked you to determine if they should accept or reject the new customer proposal and what nonmonetary factors should be considered.

| Account | Per Unit | Cost at 125,000 units | |

| Direct Materials | $ 20.00 | $2,500,000.00 | |

| Direct Labor | $ 30.00 | $3,750,000.00 | |

| Variable Manufacturing overhead | $ 10.00 | $1,250,000.00 | |

| Fixed Manufacturingoverhead | $ 15.00 | $1,875,000.00 | |

| Variable selling and adminidtrative expenses | $ 12.00 | $1,500,000.00 | |

| Fixed selling and administrative expenses | $ 14.00 | $1,750,000.00 | |

| Totals | $101.00 | $12,625,000.00 | |

| Accounts | Normal Volume | Additional volume | Combined Total |

| Sales | |||

| Cost and Expenses: | |||

| Direct Materials | |||

| Direct Labor | |||

| Variable Overhead | |||

| Fixed Overhead | |||

| Variable Selling and Admin exp. | |||

| Fixed selling and Admin exp. | |||

| Total costs and expenses: | |||

| Net Income | $ - | $ - | $ - |

Solutions

Related Solutions

Goshford Company produces a single product and has capacity to produce 140,000 units per month. Costs...

Millstone Company produces only one product. Normal capacity is 20,000 units per year, and the unit...

Zephram Corporation has a plant capacity of 200,000 units per month. Unit costs at capacity are:...

The capacity for regular time production is 200 units per month. Overtime capacity is 100 per...

World Company expects to operate at 80% of its productive capacity of 50,000 units per month....

World Company expects to operate at 80% of its productive capacity of 56,250 units per month....

A manufacturing company produces 32,000 units per month, 78% are free of defects. The percentage of...

23. Thanos company's total production capacity is 4,500 units per month. Currently, the company plans to...

Your shoe factory has a production capacity of 10,000 units per month. Your fixed costs are...

Calla Company produces skateboards that sell for $68 per unit. The company currently has the capacity...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

ekkarill92 answered 3 months ago

ekkarill92 answered 3 months ago