Question

In: Accounting

Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of...

Absorption and Variable Costing Income Statements for Two Months and Analysis

During the first month of operations ended July 31, Head Gear Inc. manufactured 28,200 hats, of which 26,200 were sold. Operating data for the month are summarized as follows:

| Sales | $251,520 | |||

| Manufacturing costs: | ||||

| Direct materials | $155,100 | |||

| Direct labor | 39,480 | |||

| Variable manufacturing cost | 19,740 | |||

| Fixed manufacturing cost | 16,920 | 231,240 | ||

| Selling and administrative expenses: | ||||

| Variable | $13,100 | |||

| Fixed | 9,560 | 22,660 | ||

During August, Head Gear Inc. manufactured 24,200 hats and sold 26,200 hats. Operating data for August are summarized as follows:

| Sales | $251,520 | |||

| Manufacturing costs: | ||||

| Direct materials | $133,100 | |||

| Direct labor | 33,880 | |||

| Variable manufacturing cost | 16,940 | |||

| Fixed manufacturing cost | 16,920 | 200,840 | ||

| Selling and administrative expenses: | ||||

| Variable | $13,100 | |||

| Fixed | 9,560 | 22,660 | ||

Required:

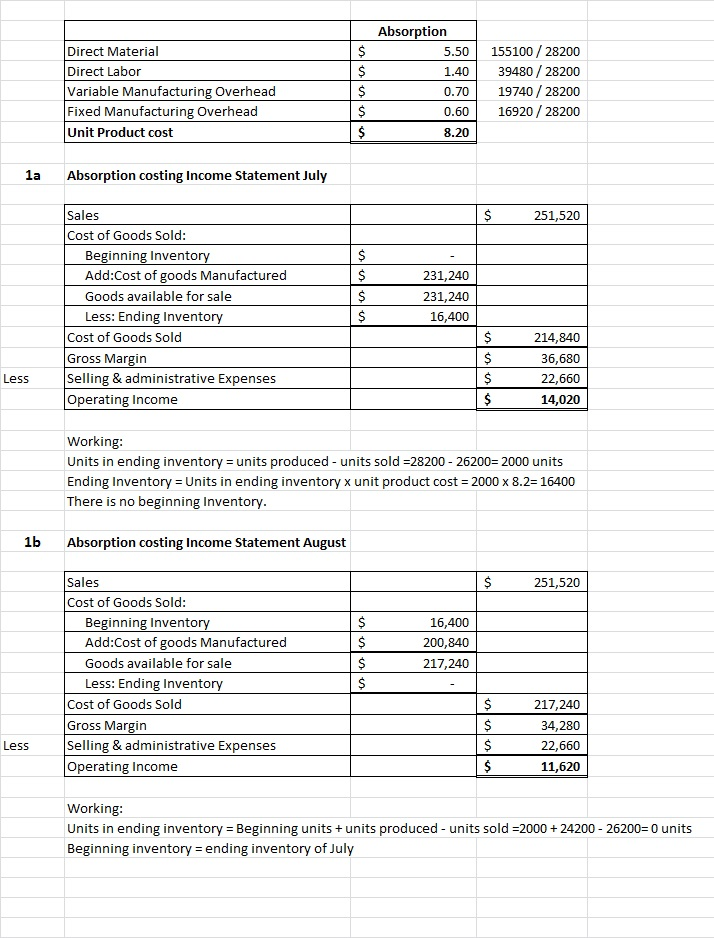

1a. Prepare income statement for July using the absorption costing concept.

| Head Gear Inc. | ||

| Absorption Costing Income Statement | ||

| For the Month Ended July 31 | ||

| Sales | $ | |

| Cost of goods sold: | ||

| Cost of goods manufactured | $ | |

| Inventory, July 31 | ||

| Total cost of goods sold | ||

| Gross profit | $ | |

| Selling and administrative expenses | ||

| Operating income | $ | |

1b. Prepare income statement for August using the absorption costing concept.

| Head Gear Inc. | ||

| Absorption Costing Income Statement | ||

| For the Month Ended August 31 | ||

| $ | ||

| Cost of goods sold: | ||

| $ | ||

| $ | ||

| $ | ||

Solutions

Related Solutions

Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of...

Absorption and Variable Costing Income Statements for Two Months

and Analysis

During the first month of operations ended July 31, Head Gear

Inc. manufactured 32,600 hats, of which 30,600 were sold. Operating

data for the month are summarized as follows:

Sales

$201,960

Manufacturing costs:

Direct materials

$123,880

Direct labor

32,600

Variable manufacturing

cost

16,300

Fixed manufacturing

cost

13,040

185,820

Selling and administrative expenses:

Variable

$9,180

Fixed

6,700

15,880

During August, Head Gear Inc. manufactured 28,600 designer hats

and sold 30,600...

Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of...

Absorption and Variable Costing Income Statements for Two Months

and Analysis

During the first month of operations ended July 31, Head Gear

Inc. manufactured 21,800 hats, of which 20,700 were sold. Operating

data for the month are summarized as follows:

Sales

$198,720

Manufacturing costs:

Direct materials

$119,900

Direct labor

30,520

Variable manufacturing cost

15,260

Fixed manufacturing cost

13,080

178,760

Selling and administrative expenses:

Variable

$10,350

Fixed

7,560

17,910

During August, Head Gear Inc. manufactured 19,600 hats and sold

20,700 hats....

Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of...

Absorption and Variable Costing Income Statements for Two Months

and Analysis

During the first month of operations ended July 31, Head Gear

Inc. manufactured 21,800 hats, of which 20,700 were sold. Operating

data for the month are summarized as follows:

Sales

$198,720

Manufacturing costs:

Direct materials

$119,900

Direct labor

30,520

Variable manufacturing cost

15,260

Fixed manufacturing cost

13,080

178,760

Selling and administrative expenses:

Variable

$10,350

Fixed

7,560

17,910

During August, Head Gear Inc. manufactured 19,600 hats and sold

20,700 hats....

Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of...

Absorption and Variable Costing Income Statements for Two Months

and Analysis

During the first month of operations ended July 31, Head Gear

Inc. manufactured 6,400 hats, of which 5,200 were sold. Operating

data for the month are summarized as follows:

Sales

$104,000

Manufacturing costs:

Direct materials

$47,360

Direct labor

22,400

Variable manufacturing cost

12,160

Fixed manufacturing cost

15,360

97,280

Selling and administrative expenses:

Variable

$10,920

Fixed

5,200

16,120

During August, Head Gear Inc. manufactured 4,000 hats and sold

5,200 hats....

Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of...

Absorption and Variable Costing Income Statements for Two Months

and Analysis

During the first month of operations ended July 31, Head Gear

Inc. manufactured 29,300 hats, of which 27,200 were sold. Operating

data for the month are summarized as follows:

Sales

$174,080

Manufacturing costs:

Direct materials

$105,480

Direct labor

29,300

Variable manufacturing

cost

11,720

Fixed manufacturing

cost

11,720

158,220

Selling and administrative expenses:

Variable

$8,160

Fixed

5,960

14,120

During August, Head Gear Inc. manufactured 25,100 designer hats

and sold 27,200...

Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of...

Absorption and Variable Costing Income Statements for Two Months

and Analysis

During the first month of operations ended July 31, Head Gear

Inc. manufactured 23,000 hats, of which 21,400 were sold. Operating

data for the month are summarized as follows:

Sales

$179,760

Manufacturing costs:

Direct materials

$110,400

Direct labor

29,900

Variable manufacturing cost

13,800

Fixed manufacturing cost

11,500

165,600

Selling and administrative expenses:

Variable

$8,560

Fixed

6,250

14,810

During August, Head Gear Inc. manufactured 19,800 hats and sold

21,400 hats....

Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of...

Absorption and Variable Costing Income Statements for Two Months

and Analysis

During the first month of operations ended July 31, Head Gear

Inc. manufactured 34,800 hats, of which 32,700 were sold. Operating

data for the month are summarized as follows:

Sales

$261,600

Manufacturing costs:

Direct materials

$160,080

Direct labor

41,760

Variable manufacturing cost

20,880

Fixed manufacturing cost

17,400

240,120

Selling and administrative expenses:

Variable

$13,080

Fixed

9,550

22,630

During August, Head Gear Inc. manufactured 30,600 hats and sold

32,700 hats....

Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of...

Absorption and Variable Costing Income Statements for Two Months

and Analysis

During the first month of operations ended July 31, Head Gear

Inc. manufactured 26,800 hats, of which 25,500 were sold. Operating

data for the month are summarized as follows:

Sales

$183,600

Manufacturing costs:

Direct materials

$109,880

Direct labor

29,480

Variable manufacturing cost

13,400

Fixed manufacturing cost

10,720

163,480

Selling and administrative expenses:

Variable

$10,200

Fixed

7,450

17,650

During August, Head Gear Inc. manufactured 24,200 designer hats

and sold 25,500...

Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of...

Absorption and Variable Costing Income Statements for Two Months

and Analysis

During the first month of operations ended July 31, Head Gear

Inc. manufactured 31,600 hats, of which 29,700 were sold. Operating

data for the month are summarized as follows:

Sales

$243,540

Manufacturing costs:

Direct materials

$148,520

Direct labor

37,920

Variable manufacturing

cost

18,960

Fixed manufacturing

cost

15,800

221,200

Selling and administrative expenses:

Variable

$11,880

Fixed

8,670

20,550

During August, Head Gear Inc. manufactured 27,800 designer hats

and sold 29,700...

Absorption and Variable Costing Income Statements During the first month of operations ended July 31, YoSan...

Absorption and Variable Costing Income Statements

During the first month of operations ended July 31, YoSan Inc.

manufactured 9,800 flat panel televisions, of which 9,100 were

sold. Operating data for the month are summarized as follows:

Sales

$1,456,000

Manufacturing costs:

Direct materials

$735,000

Direct labor

215,600

Variable manufacturing cost

186,200

Fixed manufacturing cost

98,000

1,234,800

Selling and administrative expenses:

Variable

$118,300

Fixed

54,400

172,700

Required:

1. Prepare an income statement based on the

absorption...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

ADVERTISEMENT

ekkarill92 answered 3 months ago

ekkarill92 answered 3 months ago