Question

In: Economics

Suppose an inflationary economy can be described by the following equations representing the goods and money...

Suppose an inflationary economy can be described by the following equations representing the goods and money markets:

C = 20 + 0.7Yd

M = 0.4Yd

I = 70 – 0.1r

T = 0.1Y

G = 100 X = 20

Ld = 389 + 0.7Y – 0.6r

Ls = 145

where G represents government expenditure, M is imports, X is exports, Y is national income, Yd is disposable income, T is government taxes (net of transfer payments), I is investment, r is the rate of interest, C is consumption, Ld is money demand, and Ls is money supply.

i) Use the inverse matrix method to solve for the equilibrium level of national income and the equilibrium rate of interest in this economy. (Note: ½ of the marks in this part are given for the correct set up of the equations. Explain what you are doing, including how equilibrium is established in each market.)

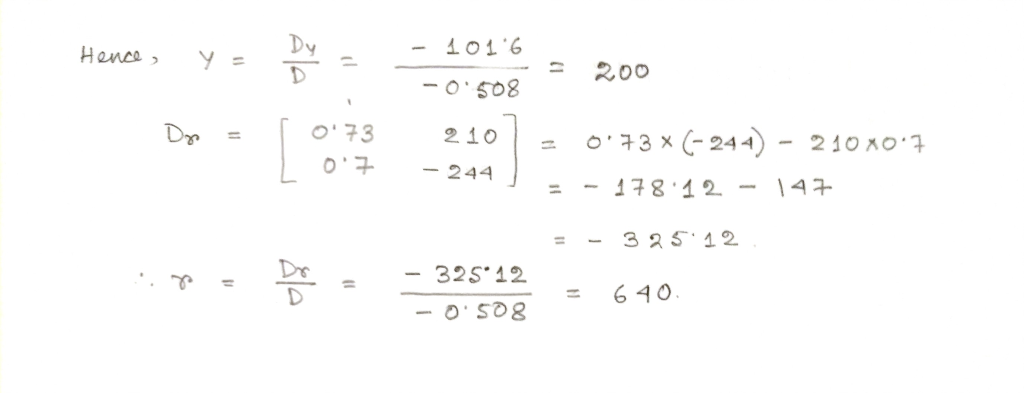

ii) Now use Cramer’s rule to find your answer.

Solutions

Expert Solution

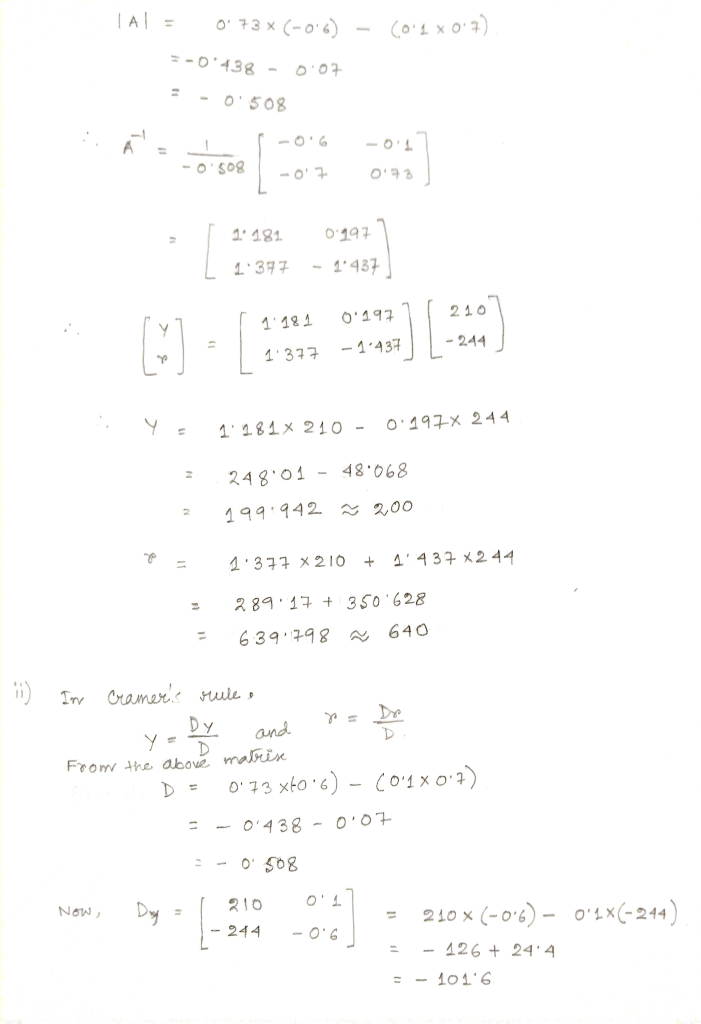

From the above equation, we form the equation for IS and LM curve. Then we would form a 2x2 matrix to solve the value of Y and r.

For IS curve, we establish that goods market is in equilibrium and in LM curve, we establish that the money market is in equilibrium.

Now, if we consider the matrix form as, AX = C

then multiplying both side by A-1, we can get the solution for X.

i.e., A-1. AX = A-1. C

or, X = A-1. C

this is how we can solve the equations with the help of inverse matrix.

Related Solutions

Suppose an inflationary economy can be described by the following equations representing the goods and money...

Suppose the goods-market of the economy of Macronium is described by the following equations Consumption: C...

These are the equations for the goods, and money market in a hypothetical economy: C =...

Suppose that the closed economy of an island H is described by the following equations: GDP...

Consider an economy described by the following equations:

3. Suppose that a closed economy could be described by the following set of equations: Production...

Suppose the goods market in an economy is represented by the following equations. C = 500...

A classical economy is described by the following equations: ?? = 150 + 0.8(? − ?)...

Assume the money sector can be described by the following two equations: md = (1/4)Y...

) Consider an economy described by the following equations: Real Sector &n

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

Rahul Sunny answered 3 months ago

Rahul Sunny answered 3 months ago