Question

In: Economics

Suppose a global recession is underway. Answer the following questions using the money market. (a) What...

Suppose a global recession is underway. Answer the following questions using the money market.

(a) What action will the Fed likely take? How will their interest rate target change? What action will they take to achieve their target?

(b) Using a graph of the money market, what happens on impact in response to that change in policy?

(c) How does the money market transition to the new equilibrium?

Solutions

Expert Solution

(a)

During recession, Fed will increase aggregate demand by increasing money supply. This is done by open market purchase of securities and/or by decreasing discount rate and/or by decreasing reserve ratio.

Increase in money supply will decrease interest rate.

(b)

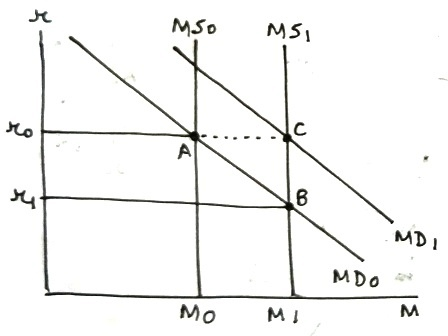

In following graph, MD0 and MS0 are initial money demand and supply curves, intersecting at point A with initial interest rate r0 and quantity of money M0. When money supply rises, MS0 shifts right to MS1, intersecting MD0 at point B with lower interest rate r1 and higher quantity of money M1.

(c)

In long run, higher interest rate will increase the demand for bonds and decrease the demand for money, shifting money demand curve to left until it intersects new money supply curve at original interest rate.

In above graph, MD0 will shift left to MD1, intersecting MS0 at point C with initial interest rate r0 and quantity of money M1.

Related Solutions

Use the money market and FX diagrams to answer the following questions.

Use the money market equilibrium and Foreign Exchange (Forex) market equilibrium to answer the following questions....

Use the money market equilibrium and Foreign Exchange (Forex) market equilibrium to answer the following questions....

Use the money market equilibrium and Foreign Exchange (Forex) market equilibrium to answer the following questions....

Use the money market equilibrium and Foreign Exchange (Forex) market equilibrium to answer the following questions....

Use the money market equilibrium and Foreign Exchange (Forex) market equilibrium to answer the following questions....

Use the money market equilibrium and Foreign Exchange (Forex) market equilibrium to answer the following questions....

Use the money market and FX diagrams to answer the following questions. This question considers the...

Use the foreign exchange and money market diagrams to answer the following questions about the relationship...

Use the money market and FX diagrams to answer the following questions about the relationship between...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

- How many grays is this?Part A A dose of 4.7 Sv of γ rays in a...

Rahul Sunny answered 3 months ago

Rahul Sunny answered 3 months ago