Question

In: Finance

A forklift will last for only 4 more years. It costs $6,100 a year to maintain....

A forklift will last for only 4 more years. It costs $6,100 a year to maintain. For $16,000 you can buy a new lift that can last for 9 years and should require maintenance costs of only $3,100 a year. a-1. Calculate the equivalent cost of owning and operating the forklift if the discount rate is 6% per year. (Do not round intermediate calculations. Round your answer to 2 decimal places.) a-2. Should you replace the forklift? b-1. Calculate the equivalent cost of owning and operating the forklift if the discount rate is 14% per year. (Do not round intermediate calculations. Round your answer to 2 decimal places.) b-2. Should you replace the forklift?

Solutions

Expert Solution

For the existing forklift, asset price is treated as nil since there is no additional cost involved.

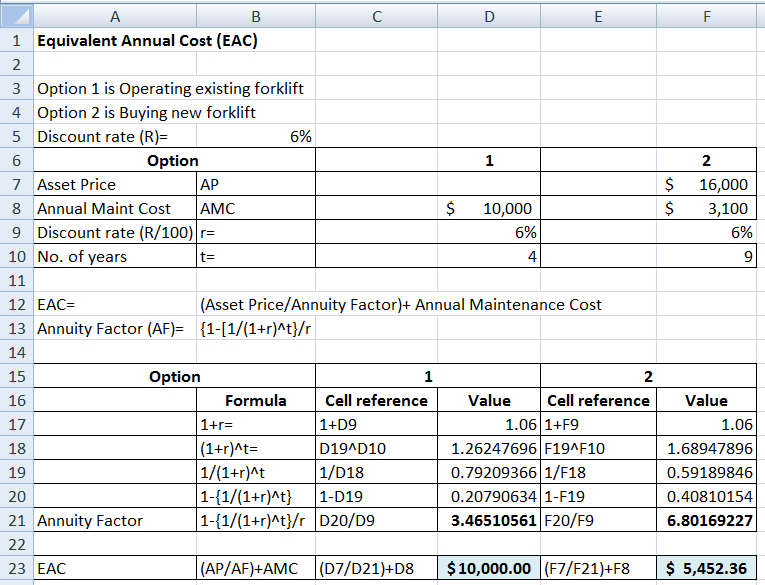

Part a-1: At the discount rate of 6% per year:

Equivalent Annual Cost of operating the existing forklift= $10,000

Equivalent Annual Cost of buying and operating new forklift= $5,452.36

Details of computation as follows:

Part a-2: Since the equivalent annual cost of replacing the forklift is less, the same is opted.

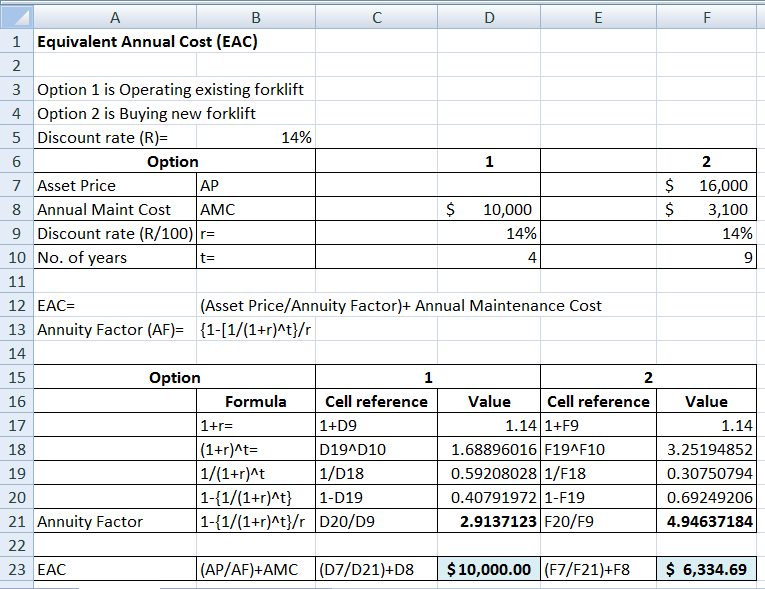

Part b-1: At the discount rate of 14% per year:

Equivalent Annual Cost of operating the existing forklift= $10,000

Equivalent Annual Cost of buying and operating new forklift= $6334.69

Details of computation as follows:

Part b-2: Since the equivalent annual cost of replacing the forklift is less, the same is opted.

Related Solutions

A forklift will last for only 3 more years. It costs $6,000 a year to maintain....

A new forklift truck would cost $22,000, have operating costs of $1200 in the first year,...

A stock costs $80 and pays a $4 dividend each year for three years. a) If...

Pacific Packaging's ROE last year was only 4%, but its management has developed a new operating...

RETURN ON EQUITY Pacific Packaging's ROE last year was only 4%; but its management has developed...

A machine costs $35,000 to buy and $5,000 per year to operate and maintain. It will...

A machine costs $35,000 to buy and $5,000 per year to operate and maintain. It will...

A precision lathe costs $13,500 and will cost $22,000 a year to operate and maintain. If...

Investment X offers to pay you $6,100 per year for nine years, whereas Investment Y offers...

What is the EAC of two projects: project A, which costs $150 and is expected to last two years, and project B, which costs $190 and is expected to last three years?

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

jeff jeffy answered 3 months ago

jeff jeffy answered 3 months ago