Question

In: Finance

There is an investment that returned 7.6% while having a 7.4 PE ratio and a risk...

There is an investment that returned 7.6% while having a 7.4 PE ratio and a risk evaluation of 1. Estimate the return on this investment assuming its 7.4 PE ratio and Risk evaluation of 1. What is the residual compared to the actual 7.6 return? |PE Ratio Risk Return |7.4 1.0 7.6 11.1 1.3 13.0 8.7 1.1 8.9 11.2 1.2 10.9 11.6 1.7 12.1 12.2 1.3 12.8 12.5 1.2 11.3 12.5 1.3 14.1 13.0 1.6 14.8 13.4 1.4 16.7

PLEASE SHOW STEPS AND BASIC FORMULAS USED FOR EQUATIONS AND CALCULATIONS.PREVIOUS CHEGG ANSWER CANNOT BE COMPREHENDED.

Solutions

Expert Solution

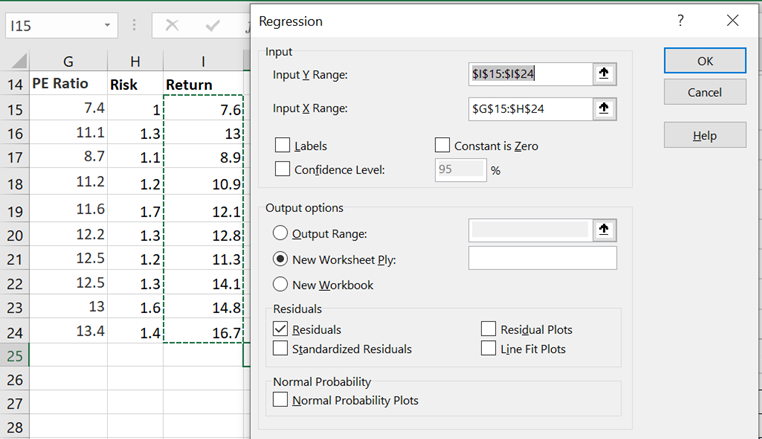

As a first step, we need to run a multi variate regression on the given data to obtain the relation ship between the three variables. Please put the data in an excel file, go to Data tab => Data Analysis => Choose Regression

Return is the Y Range and the other two are X Ranges.

Plese see the screenshot below:

Please

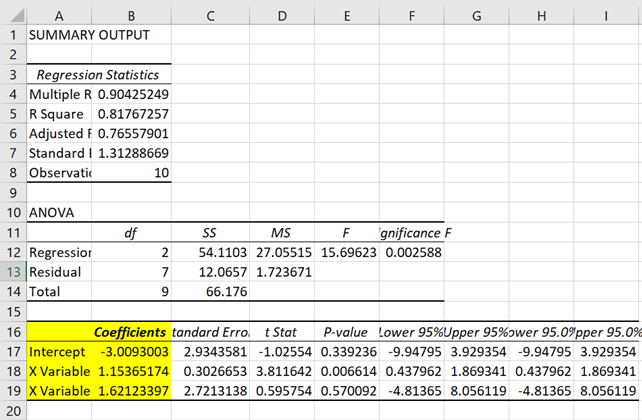

see the solution of the regression below:

Please

see the solution of the regression below:

Hence, the regression equation is:

y = - 3.0093003 + 1.153651742X1 + 1.621233975X2 i.e

Return = - 3.0093003 + 1.153651742 x PE Ratio + 1.621233975 x Risk Factor

Hence, predicted return when PE ratio = 7.4 and risk factor is 1.0 will be

= - 3.0093003 + 1.153651742 x PE Ratio + 1.621233975 x Risk Factor = - 3.0093003 + 1.153651742 x 7.4 + 1.621233975 x 1 = 7.148956571 = 7.148956571%

Hence, residual = Actual - predicted = 7.6% - 7.148956571% = 0.451043429%

Please do round off as per your requirement.

And I sincerely hope that you are able to comprehend the solution this time.

Related Solutions

2) Last year an investment in the Vanguard Total Market Index returned a negative 7.6 percent...

when looking at PE ratios is it considered a better investment if the ratio matches similar...

If a stock is overvalued, but it’s PE ratio is well under the industry average PE...

Discussion : The Price Earnings Ratio or PE ratio is an indicator of how expensive a...

1. Company A has a current ratio of 2, PE ratio of 12, debt ratio of...

what is alibaba target price and how it can be achieved with the PE Ratio

Bree's Tennis Supply's market-to-book ratio is currently 9.4 times and PE ratio is 20 times.

At pH of 7.4, the side chain of glutamic acid exists in a ratio of base:acid...

The coefficient of variation considers how an investment impacts the total risk of the firm, while...

Explain the use of return on assets (ROA) and the price-to-earnings (PE) ratio in evaluating the...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

jeff jeffy answered 4 months ago

jeff jeffy answered 4 months ago