Question

In: Finance

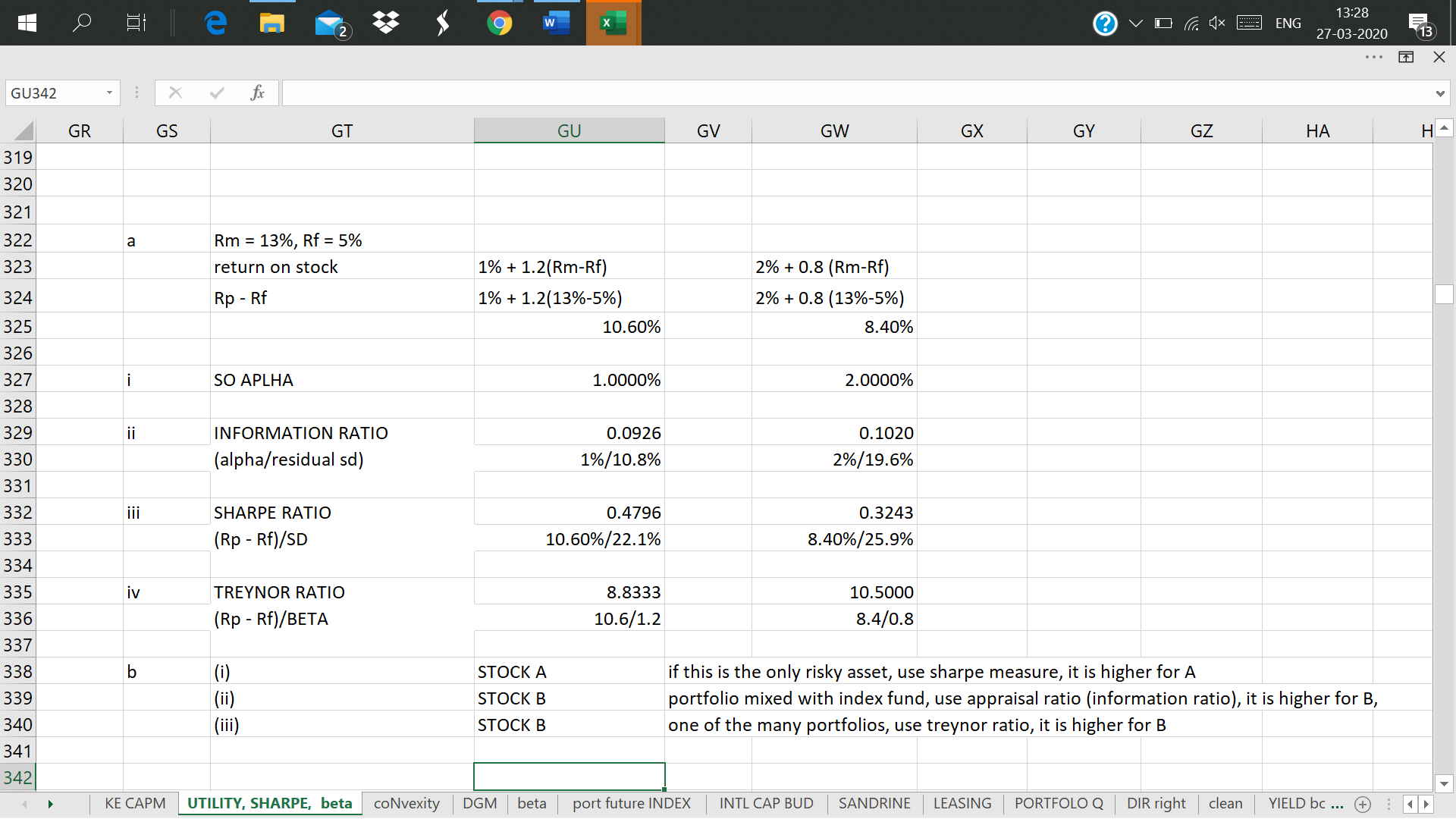

Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate...

Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate over the period was 5%, and the market’s average return was 13%. Performance is measured using an index model regression on excess returns. Stock A Stock B Index model regression estimates 1% + 1.2(rM − rf) 2% + 0.8(rM − rf) R-square 0.605 0.451 Residual standard deviation, σ(e) 10.8% 19.6% Standard deviation of excess returns 22.1% 25.9% a. Calculate the following statistics for each stock: (Round your answers to 4 decimal places.) b. Which stock is the best choice under the following circumstances?

Solutions

Related Solutions

Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate...

Consider the two (excess return) index-model regression results

for stocks A and B. The risk-free rate over the

period was 8%, and the market’s average return was 14%. Performance

is measured using an index model regression on excess returns.

Stock A

Stock B

Index model regression estimates

1% + 1.2(rM − rf)

2% + 0.8(rM − rf)

R-square

0.665

0.481

Residual standard deviation, σ(e)

11.8%

20.6%

Standard deviation of excess returns

23.1%

27.9%

a. Calculate the following statistics for each...

Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate...

Consider the two (excess return) index-model regression results

for stocks A and B. The risk-free rate over the

period was 7%, and the market’s average return was 14%. Performance

is measured using an index model regression on excess returns.

Stock

A

Stock

B

Index model

regression estimates

1% +

1.2(rM − rf)

2% +

0.8(rM − rf)

R-square

0.635

0.466

Residual

standard deviation, σ(e)

11.3%

20.1%

Standard

deviation of excess returns

22.6%

26.9%

a. Calculate the following statistics for each...

Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate...

Consider the two (excess return) index-model regression results

for stocks A and B. The risk-free rate over the

period was 7%, and the market’s average return was 15%. Performance

is measured using an index model regression on excess returns.

Stock A

Stock B

Index model regression estimates

1% + 1.2(rM − rf)

2% + 0.8(rM − rf)

R-square

0.641

0.469

Residual standard deviation, σ(e)

11.4%

20.2%

Standard deviation of excess returns

22.7%

27.1%

a. Calculate the following statistics for each...

Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate...

Consider the two (excess return) index-model regression results

for stocks A and B. The risk-free rate over the

period was 6%, and the market’s average return was 15%. Performance

is measured using an index model regression on excess returns.

Stock A

Stock B

Index model regression estimates

1% + 1.2(rM − rf)

2% + 0.8(rM − rf)

R-square

0.594

0.445

Residual standard deviation, σ(e)

10.6%

19.4%

Standard deviation of excess returns

21.9%

25.5%

a. Calculate the following statistics for each...

Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate...

Consider the two (excess return) index-model regression results

for stocks A and B. The risk-free rate over the

period was 5%, and the market’s average return was 14%. Performance

is measured using an index model regression on excess returns.

Stock A

Stock B

Index model regression estimates

1% + 1.2(rM − rf)

2% + 0.8(rM − rf)

R-square

0.611

0.454

Residual standard deviation, σ(e)

10.9%

19.7%

Standard deviation of excess returns

22.2%

26.1%

a. Calculate the following statistics for each...

Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate...

Consider the two (excess return) index-model regression results

for stocks A and B. The risk-free rate over the

period was 4%, and the market’s average return was 12%. Performance

is measured using an index model regression on excess returns.

Stock

A

Stock

B

Index model

regression estimates

1% +

1.2(rM − rf)

2% +

0.8(rM − rf)

R-square

0.689

0.493

Residual

standard deviation, σ(e)

12.2%

21%

Standard

deviation of excess returns

23.5%

28.7%

a. Calculate the following statistics for each...

Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate...

Consider the two (excess return) index-model regression results

for stocks A and B. The risk-free rate over the

period was 8%, and the market’s average return was 12%. Performance

is measured using an index model regression on excess returns.

Stock A

Stock B

Index model regression estimates

1% + 1.2(rM − rf)

2% + 0.8(rM − rf)

R-square

0.653

0.475

Residual standard deviation, σ(e)

11.6%

20.4%

Standard deviation of excess returns

22.9%

27.5%

a. Calculate the following statistics for each...

Problem 24-9 Consider the two (excess return) index-model regression results for stocks A and B. The...

Problem 24-9

Consider the two (excess return) index-model regression results

for stocks A and B. The risk-free rate over the

period was 5%, and the market’s average return was 15%. Performance

is measured using an index model regression on excess returns.

Stock

A

Stock

B

Index model regression

estimates

1% +

1.2(rM ? rf)

2% +

0.8(rM ? rf)

R-square

0.617

0.457

Residual standard deviation,

?(e)

11%

19.8%

Standard deviation of excess

returns

22.3%

26.3%

a. Calculate the following statistics...

Consider the two (excess return) index model regression results for A and B: RA = –1.8%...

Consider the two (excess return) index model regression results

for A and B:

RA = –1.8% + 2RM

R-square = 0.640

Residual standard deviation = 12.6%

RB = 1.4% + 1RM

R-square = 0.590

Residual standard deviation = 11.4%

If rf were constant at 6% and the regression

had been run using total rather than excess returns, what would

have been the regression intercept for stock A?

(Negative value should be indicated by a minus sign. Round

your answer to...

Consider the two (excess return) index model regression results for stock A and B RA =...

Consider the two (excess return) index model regression results

for stock A and B RA = 0.01 + 1.2RM R2 of 0.576; Std deviation of

error term of 10.3% RB = -0.02 + 0.8RM R2 of 0.436; Std deviation

of error term of 9.1%

a) Which stock has more firm-specific risk? Explain [4

points]

b) Which has greater market risk? Explain [4 points]

c) For which stock does market movement explain a grater

fraction of return variability? Explain [4 points]...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

ADVERTISEMENT

jeff jeffy answered 4 months ago

jeff jeffy answered 4 months ago