Question

In: Math

Hart Manufacturing makes three products. Each product requires manufacturing operations in three departments: A, B, and...

Hart Manufacturing makes three products. Each product requires manufacturing operations in three departments: A, B, and C. The labor-hour requirements, by department, are as follows:

| Department | Product 1 | Product 2 | Product 3 |

| A | 1.70 | 3.20 | 2.20 |

| B | 2.40 | 1.40 | 2.90 |

| C | 0.45 | 0.45 | 0.45 |

During the next production period, the labor-hours available are 490 in department A, 390 in department B, and 90 in department C. The profit contributions per unit are $29 for product 1, $32 for product 2, and $34 for product 3. Use a software package LINGO.

- Formulate a linear programming model for maximizing total

profit contribution. For those boxes in which you must enter

subtractive or negative numbers use a minus sign. (Example: -300)

If constant is “1”, it must be entered in the box.

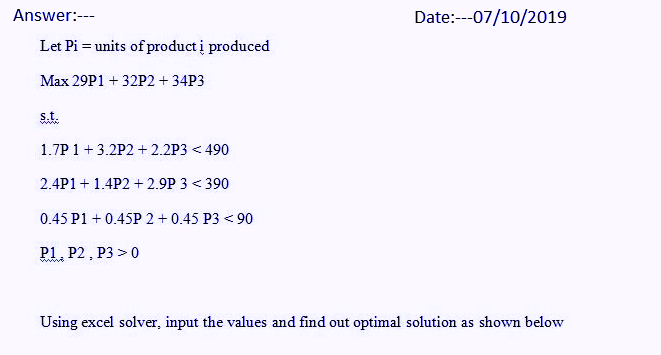

Let Pi = units of product i produced

Max ______P1 + ______P2 + ______P3 s.t. ______P1 + ______P2 + ______P3 ≤ ______ ______P1 + ______P2 + ______P3 ≤ ______ ______P1 + ______P2 + ______P3 ≤ ______ P1, P2, P3 ≥ 0 - Solve the linear program formulated in part (a). How much of

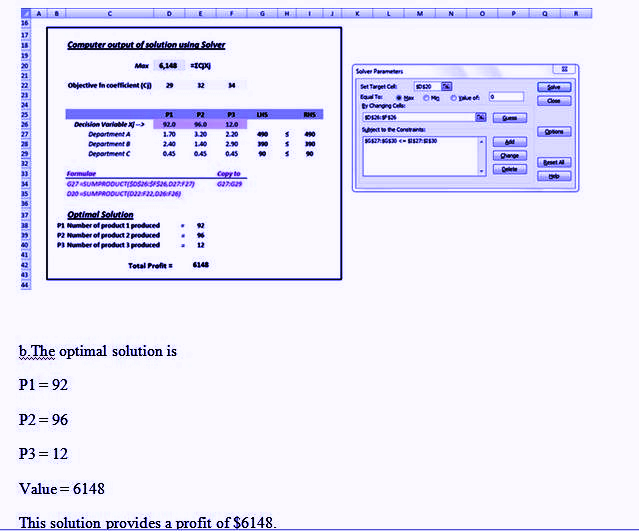

each product should be produced, and what is the projected total

profit contribution?

P1 = ______

P2 = ______

P3 = ______

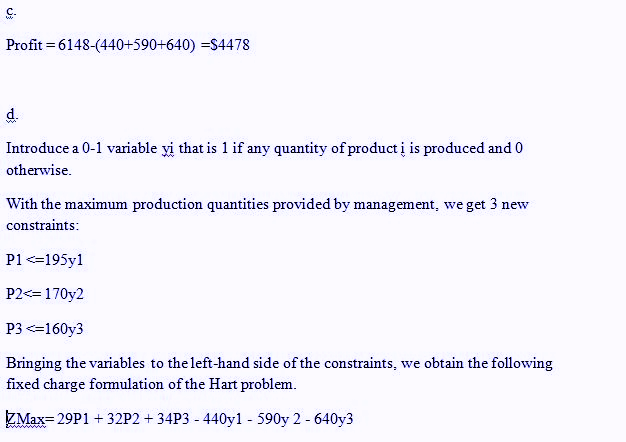

Profit = $ ______ - After evaluating the solution obtained in part (b), one of the

production supervisors noted that production setup costs had not

been taken into account. She noted that setup costs are $440 for

product 1, $590 for product 2, and $640 for product 3. If the

solution developed in part (b) is to be used, what is the total

profit contribution after taking into account the setup

costs?

Profit = $ ______ - Management realized that the optimal product mix, taking setup

costs into account, might be different from the one recommended in

part (b). Formulate a mixed-integer linear program that takes setup

costs into account. Management also stated that we should not

consider making more than 195 units of product 1, 170 units of

product 2, or 160 units of product 3. For those boxes in which you

must enter subtractive or negative numbers use a minus sign.

(Example: -300) If constant is “1”, it must be entered in the box.

Enter “0” if your answer is zero.

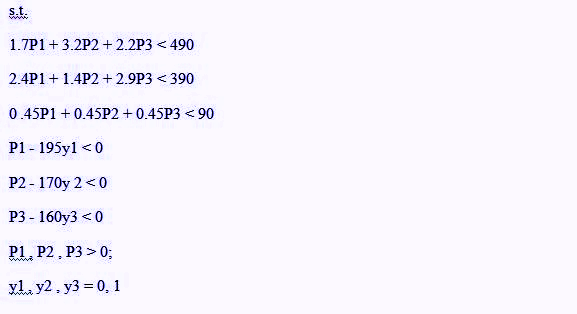

Here introduce a 0-1 variable yi that is one if any quantity of product i is produced and zero otherwise.

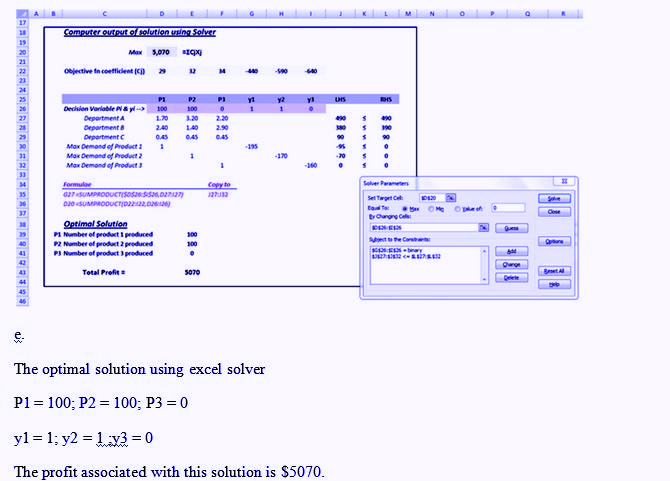

Max ______P1 + ______P2 + ______P3 + ______y1 + ______y2 + ______y3 s.t. ______P1 + ______P2 + ______P3 ≤ ______ ______P1 + ______P2 + ______P3 ≤ ______ ______P1 + ______P2 + ______P3 ≤ ______ ______P1 + ______y1 ≤ ______ ______P2 + ______y2 ≤ ______ ______P3 + ______y3 ≤ ______ P1, P2, P3 ≥ 0; y1, y2, y3 = 0, 1 - Solve the mixed-integer linear program formulated in part (d).

How much of each product should be produced, and what is the

projected total profit contribution? Compare this profit

contribution to that obtained in part (c). Enter “0” if your answer

is zero.

P1 = ______

P2 = ______

P3 = ______

Profit = $ ______

The profit is increased by $ ______.

Please fill out all the blanks! Thank you!!

Solutions

Related Solutions

Hart Manufacturing makes three products. Each product requires manufacturing operations in three departments: A, B, and...

Hart Manufacturing makes three products. Each product requires

manufacturing operations in three departments: A, B, and C. The

labor-hour requirements, by department, are as follows:

Department

Product 1

Product 2

Product 3

A

1.50

3.00

2.00

B

2.00

1.00

2.50

C

0.25

0.25

0.25

During the next production period the labor-hours available are

450 in department A, 350 in department B, and 50 in department C.

The profit contributions per unit are $25 for product 1, $28 for

product 2,...

Hart Manufacturing makes three products. Each product requires manufacturing operations in three departments: A, B, and...

Hart Manufacturing makes three products. Each product requires

manufacturing operations in three departments: A, B, and C. The

labor-hour requirements, by department, are as follows:

Department

Product 1

Product 2

Product 3

A

3.00

2.00

1.50

B

1.00

2.50

2.00

C

0.25

0.25

0.25

During the next production period the labor-hours available are

450 in department A, 350 in department B, and 50 in department C.

The profit contributions per unit are $28 for product 1, $30 for

product 2,...

Hart Manufacturing makes three products. Each product requires manufacturing operations in three departments: A, B, and...

Hart Manufacturing

makes three products. Each product requires manufacturing

operations in three departments: A, B, and C. The labor-hour

requirements, by department, are as follows:

Department

Product 1

Product 2

Product 3

A

3.00

2.00

1.50

B

1.00

2.50

2.00

C

0.25

0.25

0.25

During the next

production period the labor-hours available are 450 in department

A, 350 in department B, and 50 in department C. The profit

contributions per unit are $28 for product 1, $30 for product 2,...

Hart Manufacturing makes three products. Each product requires manufacturing operations in three departments: A, B, and...

Hart Manufacturing makes three products. Each product requires

manufacturing operations in three departments: A, B, and C. The

labor-hour requirements, by department, are as follows:

Department

Product 1

Product 2

Product 3

A

2.00

1.50

3.00

B

2.50

2.00

1.00

C

0.25

0.25

0.25

During the next production period the labor-hours available are

450 in department A, 350 in department B, and 50 in department C.

The profit contributions per unit are $30 for product 1, $25 for

product 2,...

A company manufactures Products A, B, and C. Each product is processed in three departments: I,...

A company manufactures Products A, B, and

C. Each product is processed in three departments: I, II,

and III. The total available labor-hours per week for Departments

I, II, and III are 900, 1080, and 840, respectively. The time

requirements (in hours per unit) and profit per unit for each

product are as follows. (For example, to make 1 unit of product

A requires 2 hours of work from Dept. I, 3 hours of work

from Dept. II, and 2...

A company manufactures Products A, B, and C. Each product is processed in three departments: I,...

A company manufactures Products A, B, and

C. Each product is processed in three departments: I, II,

and III. The total available labor-hours per week for Departments

I, II, and III are 900, 1080, and 840, respectively. The time

requirements (in hours per unit) and profit per unit for each

product are as follows. (For example, to make 1 unit of product

A requires 2 hours of work from Dept. I, 3 hours of work

from Dept. II, and 2...

A company manufactures Products A, B, and C. Each product is processed in three departments: I,...

A company manufactures Products A, B, and

C. Each product is processed in three departments: I, II,

and III. The total available labor-hours per week for Departments

I, II, and III are 900, 1080, and 840, respectively. The time

requirements (in hours per unit) and profit per unit for each

product are as follows. (For example, to make 1 unit of product

A requires 2 hours of work from Dept. I, 3 hours of work

from Dept. II, and 2...

ABC products makes parts for car engines. three departments (A, B and C) are involved in...

ABC products makes parts for car engines. three departments (A,

B and C) are involved in the manufacturing process. The budgets for

departmental overhead costs are $25,000, $45,000 and $30,000

respectively, which are allocated to products based on direct labor

hours. Estimates of direct labor hours for each department are

5,000 7,000 and 10,000 hours respectively. The business-wide

overhead absorption rate is:

a. $3.00

b. $4.55

c. $4.81

d. 5.00

A manufacturing company makes three products, A, B, and C. The fixed FO is $60,000, consisting...

A manufacturing company makes three products, A, B, and

C. The fixed FO is $60,000, consisting of $10,000 for material

handling, material waste, and procurement; $30,000 for rent and

utilities; and $20,000 for safety and canteen costs. Other costs

are shown in Table 6.16

Product A

Product B

Product C

Number of Units Produced Per Month

(-)

250

400

900

Total Material Costs Per Month ($)

5000

8000

4000

Labor Hours Per Unit (hr)

4

3.5

1.5

Labor Rate Per...

Sonata Corporation makes three types of products—Model Z, Model EF, and Model DS. The manufacturing operations...

Sonata Corporation makes three types of products—Model Z, Model

EF, and Model DS. The manufacturing operations are mechanized and

there is no direct labor. Manufacturing overhead costs are

significant, and Destiny has adopted an activity-based costing

system. Direct materials costs per unit for each model are as

follows:

Model

Z

$93

Model

EF $88

Model

DS $127

Sonata Corporation has 5

activities—assembly, materials management, testing, inspecting and

milling. The cost driver for assembly is machine hours. Total costs

and production...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

ADVERTISEMENT

milcah answered 4 months ago

milcah answered 4 months ago