Question

In: Computer Science

We will use El Paso information for our python script to compute property taxes for a...

We will use El Paso information for our python script to compute property taxes for a home. We will default and use the Ysleta Independent School District tax rate for our school (more complete lookups will allow you to compute taxes based on exact address.) The taxing entities, and their respective tax rates per $100 is shown below:

Jurisdiction Total Rate ($) per $100

YSLETA ISD 1.3533

CITY OF EL PASO 0.907301

COUNTY OF EL PASO 0.488997

UNIVERSITY MEDICAL CENTER OF EL PASO 0.267747

EL PASO COMMUNITY COLLEGE 0.141167

Python Script Instructions: Create a loop that will allow the user to input a property value and calculate its related tax payment. Output property information as described below. The user will be asked to continue for another property or quit.

This will be a script broken into functions. It must include (may include more):

• Main function • Calculate property tax function

• Output information function called from Calculate function. Output will include the amount for each jurisdiction, and amount owed per year.

Other important information: We will assume each property value is eligible for a 10% Homestead Exemption of the property’s value. For example, if a property value is $100,000, the person would receive an exemption of $10,000. Their property taxes would be calculated on $90,000.

Don’t forget the rate is applied per $100 (i.e. you have to divide the amount for each jurisdiction you calculated by 100)

Sample calculation: Property value: $175,000 Yearly taxes owed: $4,974.66

Solutions

Expert Solution

Program:

Output:

Enter Property value: $175000

YSLETA ISD $2131.45

CITY OF EL PASO $1429.00

COUNTY OF EL PASO $770.17

UNIVERSITY MEDICAL CENTER OF EL PASO $421.70

EL PASO COMMUNITY COLLEGE $222.34

Yearly taxes owed: $4974.66

continue for another property or quit?quit

N.B. Whether you face any problem or need any modification then share with me in the comment section, I'll happy to help you.

Text version of code:

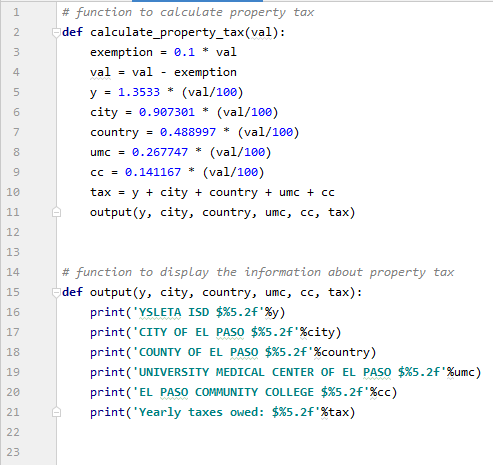

# function to calculate property tax

def calculate_property_tax(val):

exemption = 0.1 * val

val = val - exemption

y = 1.3533 * (val/100)

city = 0.907301 * (val/100)

country = 0.488997 * (val/100)

umc = 0.267747 * (val/100)

cc = 0.141167 * (val/100)

tax = y + city + country + umc + cc

output(y, city, country, umc, cc, tax)

# function to display the information about property tax

def output(y, city, country, umc, cc, tax):

print('YSLETA ISD $%5.2f'%y)

print('CITY OF EL PASO $%5.2f'%city)

print('COUNTY OF EL PASO $%5.2f'%country)

print('UNIVERSITY MEDICAL CENTER OF EL PASO $%5.2f'%umc)

print('EL PASO COMMUNITY COLLEGE $%5.2f'%cc)

print('Yearly taxes owed: $%5.2f'%tax)

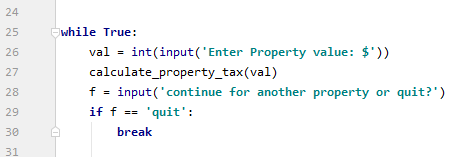

f = ''

while f != 'quit':

val = int(input('Enter Property value: $'))

calculate_property_tax(val)

f = input('continue for another property or quit?')

Related Solutions

(1) a city levies property taxes to use for general operations of the city in the...

please use python to solve this problem. Math and String operations Write a script to perform...

Use the percentage method to compute the federal income taxes to withhold from the wages or...

Use the percentage method to compute the federal income taxes to withhold from the wages or...

Use the percentage method to compute the federal income taxes to withhold from the wages or...

Use the percentage method to compute the federal income taxes to withhold from the wages or...

How do we use our knowledge of edge effects to plan the reserves? What information do...

Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes...

how can we use cryptography libraries in Python

short answers (complete sentences are not required) Is it appropriate to use our methods to compute...

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

venereology answered 4 months ago

venereology answered 4 months ago