Question

In: Accounting

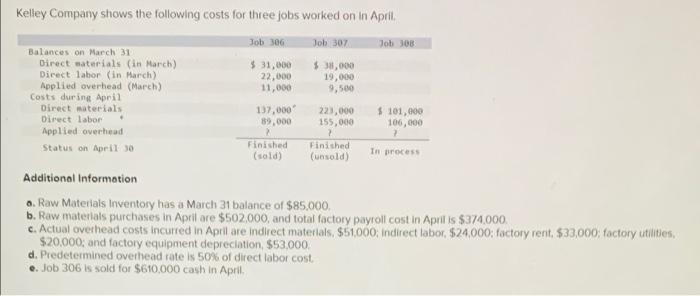

Journal entries for jobs work.

(1) Post relevant journal entries for Job 306, Job 307 and Job 308 for the month of April.

(2) Calculate cost of goods sold for Job 306.

(3) Calculate overapplied or underapplied overhead.

Solutions

Expert Solution

(1) Journal Entries -

Workings -

(1) Finished goods= Job 306+Job 307

Job 306= Direct materials+Direct labor+Manufacturing overhead

= $31000+137000+22000+89000+11000+(89000*50%)= $334,500

Job 307= $38000+223000+19000+155000+9500+(155000*50%)= $522,000

Finished goods= $334,500+522,000= $856,500

----------

(2) Cost of goods sold for Job 306= Direct materials+Direct labor+Manufacturing overhead=

= $31000+137000+22000+89000+11000+(89000*50%)

= $334,500

-----------

(3) Calculation of overapplied or underapplied -

Actual overhead = Indirect materials+Indirect labor+Factory rent+Factory utilities+Factory equipment depreciation = $51000+24000+33000+20000+53000 = $181,000

Applied overhead = Direct labor paid * 50% = ($89000+155000+106000) * 50% = $175,000

Overapplied or underapplied = Actual overhead - Applied overhead

= $181,000 -175,000 = $6,000 underapplied

------------------

(1) Jounal entries in explanation.

(2) Cost of goods sold for Job 306 = $334,500

(3) Overapplied or underapplied = $6,000 underapplied

Related Solutions

Entries and schedules for unfinished jobs and completed jobs Instructions Chart of Accounts Amount Descriptions Journal...

Unit Cost, Ending Work-in-Process Inventory, Journal Entries During August, Skyler Company worked on three jobs. Data...

Journal entries:

Journal Entries

Journal entries

Journal Entries, T-Accounts Ehrling Brothers Company makes jobs to customer order. During the month of July,...

Journal entries; assigning costs to jobs; cost accumulation Ialani Corp. uses a job order costing system...

Journal Entries, T-Accounts Ehrling Brothers Company makes jobs to customer order. During the month of July,...

PART B – Journal Entries: Prepare journal entries for the month of March to record the...

I need Journal Entries for each of these, Adjusted Journal Entries for each of these, T-...

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

Nikita Chaplot answered 4 years ago

Nikita Chaplot answered 4 years ago