Question

In: Accounting

income statement and retained earnings statement

Misclassifcations Roz Corporation's Multiple-Step income statement and retained earnings statement for the year ended December 31, 2019 as developed by its bookkeeper are shown here:

| Revenue Statement December 31, 2019 |

|||

| Sales (net) | $179,000 | ||

| Plus: Income from operations of discontinued Division P (net of $960 income taxes) | 2,240 | ||

| Less: Dividends declared ($1.50 per common share) | (7,500) | ||

| Net revenues | $173,740 | ||

| Less: Selling expenses | (19,000) | ||

| Gross profit | $154,740 | ||

| Less Operating expenses: | |||

| Interest expense | $4,100 | ||

| Loss on sale of Division P (net of $1,200 income tax credit) | 2,800 | ||

| Cost of goods sold | 110,700 | ||

| Income tax expense on income from continuing operations | 5,370 | (122,970) | |

| Total operating expenses | $31,770 | ||

| Operating income | |||

| Miscellaneous items: | |||

| Dividend revenue | $1,800 | ||

| General and administrative expenses | (24,300) | (22,500) | |

| Income before unusual items | $9,270 | ||

| Unusual items: | |||

| Loss on sale of land | $(4,800) | ||

| Correction of error in last year's income (net of $1,500 income taxes) | 3,500 | (1,300) | |

| Net income | $7,970 | ||

| Retained Earnings Statement December 31, 2019 |

|

| Beginning retained earnings | $62,850 |

| Add: Net income | 7,970 |

| Adjusted retained earnings | $70,820 |

| Less: Loss from theft (net of $2,760 income tax credit) | (6,440) |

| Ending retained earnings | $64,380 |

You determine that the account balances listed on the statements are correct but are incorrectly classified in certain cases. The company laces a 30% tax rate. No shares of common stock were issued or retired during 2019

Required:

1. Review both statements and indicate where each incorrectly classified item should be classified.

2 Prepare a correct multiple-step income statement for 2019

3. Determine the correct beginning balance in retained earnings and then prepare a correct 2019 retained earnings statement.

Solutions

Expert Solution

Financial statements can be defined as accounting records that tell us about the business firm's financial performance and financial position. Different types of financial statements that a company must publish are the income statement, statement of retained earnings, balance sheet, and cash flow statement. An income statement is a statement that determines the net income or net loss (financial performance) of the business during an accounting period.

Part (1)

- Income from discontinued operations does not get adjusted before gross profit. It is treated in a separate section.

- The dividend declared does not come under the income statement. Payment of compensation is adjusted under the idea of retained earnings.

- Selling expenses are a part of operating expenses. It does not get adjusted before computing gross profit.

- Interest expenses are not a part of operating expenses.

- Loss on sale of division is not a part of operating expenses. It will be adjusted under the result of discontinued operations.

- The cost of goods sold should be adjusted from net revenues before computing gross profit.

- Income tax expense is not a part of operating expenses.

- General and administrative expenses are a part of operating expenses.

- Loss on sale of land should come under other items rather than unusual items

- Correction of error will be adjusted under the statement of retained earnings

- Loss from theft will be reported under the extraordinary (unique) items in the income statement.

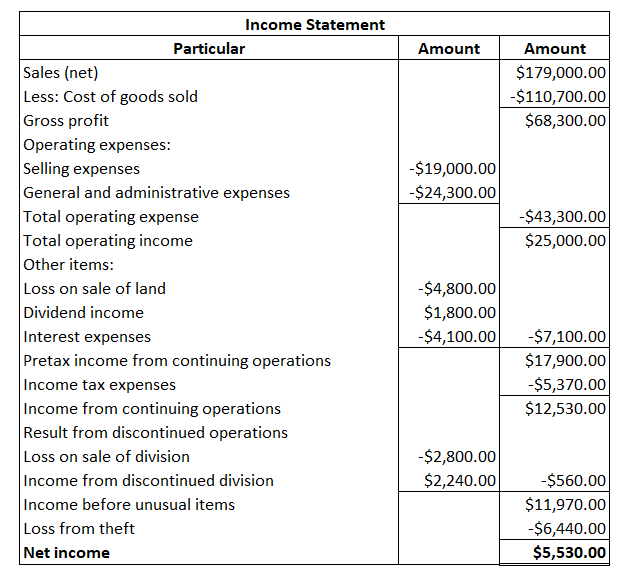

Part (2)

Multi-step income statement:

Part (3)

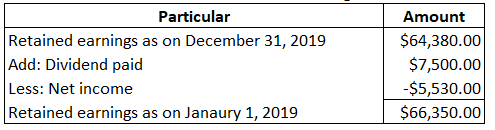

Beginning balance of retained earnings:

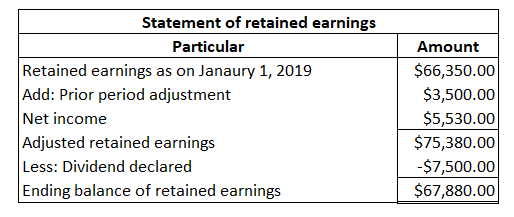

Retained earnings statement of 2019:

Answers can be found in the Explanation section.

Related Solutions

Preparing Income Statement, Retained Earnings, and Balance Sheet

Prepare an income statement and a statement of retained earnings for the month of May (note...

Statement of retained earnings :

Statement of retained earnings

A portion of the combined statement of income and retained earnings of Culver Inc. for the...

Please create a retained earnings statement, income statement, and a balance sheet for the month of...

Explain the connection between the income statement, the retained earnings statement and the balance sheet.

I need to create a multi step income statement and statement of retained earnings with the...

Prepare an income statement, a retained earnings statement, and a balance sheet for the dental practice...

Use the information presented in this worksheet to prepare an income statement, retained earnings statement, and...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

- How many grays is this?Part A A dose of 4.7 Sv of γ rays in a...

- how to operate a business?

DogeShow answered 4 years ago

DogeShow answered 4 years ago