Question

In: Accounting

What is the Residual Income?

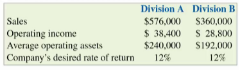

Jarren Cough drops operates two divisions. The following information pertains to each division for year 1.

Required

-

Compute each division’s residual income.

-

Which division increased the company’s profitability more?

Solutions

Expert Solution

a. residual Income equals Operating Income - the product of Operating Assets and Desired return on investment

RI= OI -( OA x Desired ROI)

Division A:

RI= $38,400 - (28,000 x 0.12)

RI= $9,600

Division B:

RI= $28,800 - (192,000 x 0.12)

RI= $5,760

b. The division that increased the company's profitability more is Division A.

a. The residual Income for division A is $9,600.

The residual Income for division A is $$5,760.

b. The division that increased the company's profitability more is Division A.

Related Solutions

What is the residual Income?

Return on Investments and Residual income

What are the strengths and weaknesses of using Residual Income (RI), Return on Investment (ROI), or...

what is criticisms of ROI and why the residual income may be a better indicator than...

You Explain it: What is a residual? What does it mean when a residual is positive?...

Explain residual risk as it relates to common stock ownership. Do fixed income instruments have residual...

How is residual income being used in corporations today?

In your own words, discuss what a residual is. What does it mean when a residual...

When we use the Residual Income model to value Starbucks, what are some reasons why the...

Explain and contrast return on investment and residual income. Provide examples.

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

Christopher Mann answered 4 years ago

Christopher Mann answered 4 years ago