Question

In: Finance

2. Please calculate the following bond values, Yield to Maturity, current yield and capital gains. 1)...

2. Please calculate the following bond values, Yield to Maturity, current yield and capital gains.

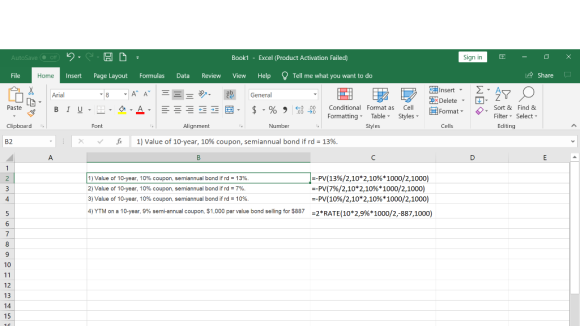

1) Value of 10-year, 10% coupon, semiannual bond if rd = 13%.

2) Value of 10-year, 10% coupon, semiannual bond if rd = 7%.

3) Value of 10-year, 10% coupon, semiannual bond if rd = 10%.

4) YTM on a 10-year, 9% semi-annual coupon, $1,000 par value bond selling for $887

5) Current yield and capital gains for case

6) What is the relation between bond value and years remaining till maturity?

Solutions

Expert Solution

As per rules I am answering the first 4 subparts of the question

| 1) Value of 10-year, 10% coupon, semiannual bond if rd = 13%. | $834.72 |

| 2) Value of 10-year, 10% coupon, semiannual bond if rd = 7%. | $1,213.19 |

| 3) Value of 10-year, 10% coupon, semiannual bond if rd = 10%. | $1,000.00 |

| 4) YTM on a 10-year, 9% semi-annual coupon, $1,000 par value bond selling for $887 | 10.88% |

Workings

Related Solutions

CURRENT YIELD, CAPITAL GAINS YIELD, AND YIELD TO MATURITY Hooper Printing Inc. has bonds outstanding with...

CURRENT YIELD, CAPITAL GAINS YIELD, AND YIELD TO

MATURITY Hooper Printing Inc. has bonds outstanding with 9 years

left to maturity. The bonds have an 8% annual coupon rate and were

issued 1 year ago at their par value of $1,000. However, due to

changes in interest rates, the bond’s market price has fallen to

$901 40. The capital gains yield last year was −9 86%.

A. What is the yield to maturity?

B. For the coming year, what are...

Question 2 - Calculate the yield to maturity of the following bond with a par value...

Question 2 - Calculate the yield to maturity of the following

bond with a par value of $1,000 that pays a 3.9% coupon

semiannually. The bond was settled on Jan 1, 2010 and matures on

Jan 1, 2032. It currently trades at a price of $972.84 (5

points)

Coupon Bond YTM

settlement date: 01/01/2020; maturity date: 01/01/2032; coupon

rate: 3.9%; coupons per year: 2; face value (% of par): 100; Bond

price (% of par): $972.84.

What is the YTM?...

4. A) Explain the total return, the current yield, and the capital gains yield for a...

4.

A) Explain the total return, the current yield, and the capital

gains yield for a bond and how each is determined.

B) What is price risk for a bond? What is reinvestment risk for

a bond? What bonds would have the most price risk? What bonds would

have the least price risk?

C)

How is default risk measured for a bond? What lets you know a

bond is investment grade? What lets you know that a bond is

speculative...

What are the total return, the current yield, and the capital gains yield for the discount...

What are the total return, the current yield, and the capital

gains yield for the discount bond? (Assume the bond is held to

maturity and the company does not default on the bond.)

1. Over the next year, what is the current yield, capital gains yield, and total return...

1. Over the next year, what is the current yield, capital gains

yield, and total return (or total yield) of a 5 year bond with a 4%

YTM and a coupon rate of 5%? Assume the YTM over the next year

remains the same.

2. Same question as above, except the YTM at the end of the year

has risen to 4.5%. (

Bond Problem: Formulas: current yield = Dollar income Capital gains = Ending value – Beg. Value...

Bond Problem:

Formulas: current yield = Dollar income Capital gains = Ending

value – Beg. Value

Beginning value Beginning value

Bond yield = current yield + capital gains yield

Suppose that one year ago Cisco Systems sold a 15-year bond issue

that had a $1,000 par value and a 7 percent coupon rate. Interest

is paid semiannually.

a. If the bond sold at $1,000 initially, what was the market

interest rate when it was sold?

b. If the going rate...

What is the yield to maturity of the following bond? Current year: 2019 Coupon 9% Maturity...

What is the yield to maturity of the following bond?

Current year: 2019

Coupon 9%

Maturity date 2027

Interest paid semiannually

Par Value $1000

Market price $955.00

What is the current yield of bond ?

Values for a bond bought at par with face value $1000, with yield to maturity of...

Values for a bond bought at par with face value $1000, with

yield to maturity of 5% initially, and 2% after 1

year.

Values for a bond bought at par with face value $1000, with

yield to maturity of 2% initially, and 5% after 1

year.

Aug 28, 2018 10:49 AM

Instructions

The goal is to create a table for the rates or return on bonds

of varying maturities like the one in the notes for Chapter 4. The

bond...

Yield to maturity on a bond is:

Yield to maturity on a bond is:I. Above the coupon rate when the bond sells at a discount and

below the coupon rate when the bond sells at a premiumII. The discount rate that will set the present value of the

payments equal to the bond priceIII. Equal to the true compound return on investment only if all

interest payments received are reinvested at the yield to

maturityGroup of answer choicesI, II, and IIII and II onlyII onlyI only

For a zero coupon bond, use the following information to calculate its yield to maturity. Years...

For a zero coupon bond, use the following information to

calculate its yield to maturity.

Years left to maturity = 10 years.

Price = $250.

14.87%

14.35%

12.25%

11.51%

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

- How many grays is this?Part A A dose of 4.7 Sv of γ rays in a...

ADVERTISEMENT

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago