Question

In: Finance

Madsen Motors's bonds have 16 years remaining to maturity. Interest is paid annually, they have a...

Madsen Motors's bonds have 16 years remaining to maturity. Interest is paid annually, they have a $1,000 par value, the coupon interest rate is 12%, and the yield to maturity is 13%. What is the bond's current market price? Round your answer to the nearest cent.

$

Solutions

Expert Solution

Face value of the bond = FV = $1,000

Interest is paid annually

Annual coupon rate = 12%

Annual coupon payment = Coupon rate x Face Value = 12%*1000 = 120

Time to maturity = 16 years

Yield to maturity = YTM = 13%

Method 1: Uisng ba ii plus calculator

N = 16, I/Y = 13, PMT = 120, FV = 1000

CPT -> PV (Press CPT and then press PV)

We get, PV = -933.9612494

So, the current market price of the bond is $933.96 (rounded to nearest cent)

Answer -> current market price of the bond = 933.96

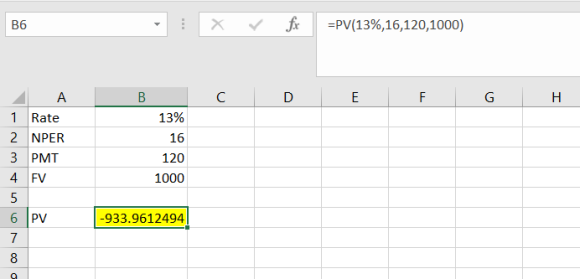

Method 2: Using Excel

We can use the PV function in Excel to calculate the present value of the bond, as shown below:

=PV(13%,16,120,1000) = -933.9612494

Current market price of the bond = 933.96

Answer -> Bond's current market price = 933.96

Method 3 - Using Formula

Price of the bond is the sum of the present value of all the future cash flows

Since the bond pays annual interest payments the cash flows of the bond are:

C1 = C2 =.......=C15 = 120, C16 = 1120

The present value of these cashflows can be calculated using the formula

PV = C/(1+r)n

Below table shows the cash flows and the present value of the cash flows

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 |

| Cash flow | 120 | 120 | 120 | 120 | 120 | 120 | 120 | 120 | 120 | 120 | 120 | 120 | 120 | 120 | 120 | 1120 |

| Present value of Cashflows | 106.1947 | 93.9776 | 83.16602 | 73.59825 | 65.13119 | 57.63822 | 51.00728 | 45.13918 | 39.94618 | 35.3506 | 31.28372 | 27.68471 | 24.49974 | 21.68119 | 19.18689 | 158.4758 |

Price of the bond = 106.1947+93.9776+83.16602+73.59825+65.13119+57.63822+51.00728+45.13918+39.94618+35.3506+31.28372+27.68471+24.49974+21.68119+19.18689+158.4758 = 933.96127

Answer -> Price of the bond = 933.96

Related Solutions

Madsen Motors's bonds have 13 years remaining to maturity. Interest is paid annually; they have a...

Madsen Motors's bonds have 25 years remaining to maturity. Interest is paid annually, they have a...

Madsen Motors's bonds have 20 years remaining to maturity. Interest is paid annually; they have a...

Madsen Motors's bonds have 23 years remaining to maturity. Interest is paid annually; they have a...

Madsen Motors's bonds have 21 years remaining to maturity. Interest is paid annually, they have a...

Madsen Motors's bonds have 20 years remaining to maturity. Interest is paid annually, they have a...

Madsen Motors's bonds have 20 years remaining to maturity. Interest is paid annually, they have a...

Madsen Motors's bonds have 23 years remaining to maturity. Interest is paid annually, they have a...

Madsen Motors's bonds have 22 years remaining to maturity. Interest is paid annually; they have a...

Madsen Motors's bonds have 19 years remaining to maturity. Interest is paid annually; they have a...

- MINIMUM MAIN.CPP CODE /******************************** * Week 4 lesson: * * finding the smallest number * *********************************/...

- Do you think President Eisenhower had a successful presidency?

- Barbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known...

- C PROGRAMMIMG I want to check if my 2 input is a number or not all...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago