Question

In: Accounting

If overhead is applied on the basis of machine hours, what will be the overhead rate per hour?

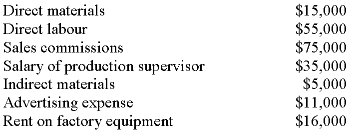

Simplex Company has the following estimated costs for next year:

Simplex estimates that 10,000 direct labour and 16,000 machine hours will be worked during the year. If overhead is applied on the basis of machine hours, what will be the overhead rate per hour?

Solutions

Expert Solution

Calculation of Estimated Manufacturing overhead

Estimated Manufacturing overhead = Salary of production supervisor + Indirect materials + Rent on factory equipment

=$35,000 + $5,000 + $16,000

=$56,000

Calculation of Predetermined overhead rate

Predetermined overhead rate = Estimated manufacturing overhead / Estimated machine hours

=$56,000 / $16,000

=$3.50 machine per hour

Predetermined overhead rate = $3.50 machine per hour

Related Solutions

MAnufacturing overhead is applied on the basis of direct labor hours. The direct labor hours for...

MAnufacturing overhead is applied on the basis of direct labor

hours. The direct labor hours for the period are 500 and the

estimated manufacturing overhead is 2000. actual direct labor hours

were 160 and actual overhead was 1000.

Compute the manufacturing overhead applied during this

period.

Estimated variable manufacturing overhead $25 per machine hour Estimated fixed manufacturing overhead $67,100 Estimated machine-hours 6,100...

Estimated variable manufacturing overhead $25 per machine hour

Estimated fixed manufacturing overhead $67,100 Estimated

machine-hours 6,100 Actual manufacturing overhead $231,500 Actual

machine-hours 6,250 The estimates of the manufacturing overhead and

of machine-hours were made at the beginning of the year for the

purpose of computing the company's predetermined overhead rate for

the year. The applied manufacturing overhead for the year is:

Overhead is applied on the basis of direct labor hours. Three direct labor hours are required...

Overhead is applied on the basis of

direct labor hours. Three direct labor hours are required for each

product unit. Planned production for the period was set at 8,000

units. Manufacturing overhead for the period is budgeted at

$204,000, of which 30 percent is fixed. The 26,200 hours worked

during the period resulted in production of 8,500 units.

Manufacturing overhead cost incurred was $220,500.

Required:

a. Calculate the overhead spending

variance:

b. Calculate the overhead efficiency variance:

c. Calculate the...

Barnes Company applies overhead on the basis of machine hours. Given the...

Question 14 Barnes Company applies overhead on the basis of machine hours. Given the following data, compute overhead applied and the under- or overapplication of overhead for the period: Estimated annual overhead cost $3,000,000 Actual annual overhead cost $2,970,000 Estimated machine hours 300,000Actual machine hours 295,000 1) $2,950,000 applied and $20,000 overapplied 2) $3,000,000 applied and $20,000 overapplied 3) $2,950,000 applied and $20,000 underapplied 4) $2.970,000 applied and neither under- nor overappliedQuestion 21 Activity-based costing uses 1) one plantwide pool and a single cost driver. 2)...

Happy Clicks Inc. uses a predetermined overhead allocation rate of $4.75 per machine hour. Actual overhead...

Happy Clicks Inc. uses a predetermined overhead

allocation rate of $4.75 per machine hour. Actual overhead costs

incurred during the year are as follows:

Indirect materials

$5,200

Indirect labor

$3,750

Plant depreciation

$4,800

Plant utilities and insurance

$9,530

Other plant overhead costs

$12,700

Total machine hours used during the year

7,520 hours

What is the amount of manufacturing overhead cost

allocated to Work-in-Process Inventory during the

year?

Is the manufacturing overhead account under or over

allocated and if so by...

1. The predetermined manufacturing overhead rate is $18 per machine hour based on an estimated manufacturing...

1. The predetermined manufacturing overhead rate is $18 per

machine hour based on an estimated manufacturing overhead of

180,000 and 10,000 machine hours. For the year the actual overhead

was 200,000 and machine hours were 11,000. How much manufacturing

overhead was applied during the year?

a. 198,000

b. 200,000

c. none of the above

2. Overapplied manufacturing overhead that is not material is

adjusted by which entry?

a. debit manufacturing overhead and credit misc exp

b. debit cash and credit...

A business absorbs overheads on a machine hour basis, which were budgeted at 12,250 machine hours...

A business absorbs overheads on a machine hour basis, which

were budgeted at 12,250 machine hours with overheads of £147,000.

Actual results were 9,870 hours with actual overheads of £154,645.

Calculate the over or under recovery.

Over recovery of £36,205

Over recovery of £7,645

Under recovery of £7,645

Under recovery of £36,205

A highly automated process is used to make tins of paint. It

has a budgeted overhead of £40,000, taking 1,250 machine hours and

500 direct labour hours. Each...

The manufacturing overhead costs are applied to products on the basis of machine time. Unfortunately, due...

The manufacturing overhead costs are applied to products on the

basis of machine time. Unfortunately, due to system glitch, several

numbers and labels have been omitted from the analysis of fixed

overhead below. Supply the missing numbers and labels to help

out:

1) Assume 6 minutes of machine time is standard per unit of

production. How many units were actually produced in this

situation?

Actual Fixed Overhead Cost

Flexible Budget Overhead Cost

Fixed Overhead Cost Applied to Work in Progress...

Ikerd Company applies manufacturing overhead to jobs on the basis of machine hours used. Overhead costs...

Ikerd Company applies manufacturing overhead to jobs on the

basis of machine hours used. Overhead costs are expected to total

$300,000 for the year, and machine usage is estimated at 125,000

hours. For the year, $322,000 of overhead costs are incurred and

130,000 hours are used. Collapse question part (a) Compute the

manufacturing overhead rate for the year. (Round answer to 2

decimal places, e.g. 1.25.) Manufacturing overhead rate $ per

machine hour

Ikea Company applies manufacturing overhead to jobs on the basis of machine hours used. Overhead costs...

Ikea Company applies manufacturing overhead to jobs on the basis

of machine hours used.

Overhead costs are expected to total $456,789 4 for the year,

and machine usage is estimated at 126,000 hours

For the year, $432450 of overhead costs are incurred and 125,500

hours are used.

What is the predetermined overhead rate

What is the amount of overhead applied

Has it been over or underapplied?

Prepare the adjusting entry to adjust the cost of goods sold

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

ADVERTISEMENT

balaji rao answered 4 years ago

balaji rao answered 4 years ago