Question

In: Economics

Assume that GDP (Y) is 7,500, which is also the full employment level of real GDP....

Assume that GDP (Y) is 7,500, which is also the full employment level of real GDP. Consumption (C) is given by C = 700 + 0.75(Y – T). Investment (I) is given by the equation I = 2000 – 200r, where r is the rate of interest in percent. Taxes (T) are 500 and government spending (G) is 500. The world interest rate (r*) is equal to 4 percent.

Use the data above to calculate:

Consumption = and National Saving =

Assuming domestic firms can borrow or lend as much as they want at the world rate of interest, Investment = . Therefore, net foreign investment = and net exports = .

Do these numbers imply that this country is a net lender or a net debtor?

Do these numbers imply that this country has a trade surplus or a trade deficit?

If government uses an expansionary fiscal policy, will the national saving function shift right or left?

Will the change in national saving resulting from an expansionary fiscal policy cause net exports to increase or decrease?

Solutions

Expert Solution

(a) We shall find consumption, national savings and net exports in following way:

- We find consumption level by substituting values of Y and T in

the consumption function.

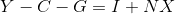

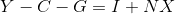

- The national saving can be calculated using following identity:

- We are provided that domestic firm can lend or borrow as much

it can at world interest rate of 4%. There investment in the

economy would be:

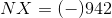

- Net foreign investment equals the amount that foreigners invest

in the domestic country minus the amount that domestic country

residents invest abroad. Net foreign investment generally

equals net exports.

- Gross foreign investment + Imports = Gross foreign savings + Exports.

- GFI - GFS = X-M

- Net foreign investment = Net exports.

- Using National income identity.

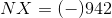

- The negative value implies we must be borrowing from the foreign countries. Therefore, country is Net Debtor.

- The negative value implies that imports exceed exports. This means country is running Trade Deficit.

(b) The expansionary fiscal policy may involve increase in the government expenditure or reduction in the taxes. The policy is aimed to boost consumption and reduce unemployment in the economy.

- Now, we must know that government will borrow from the public for an amount equal to the government expenditure.

- This government expenditure will raise budget deficit and cause decline in the public savings. This implies that National savings will fall with rise in G. (It involves leftward shift of the savings function)

- Using above identity, we can gauge that net exports will decline with fall in the national savings.

Related Solutions

How is the full employment level of real GDP determined? Assume expansionary fiscal or monetary policy...

The graph below depicts the full-employment level of output and the actual level of real GDP.

Assume that the United States economy is currently operating at the full employment level of real...

Starting from a full employment equilibrium, how do the real GDP and price level change in...

Starting from a full employment equilibrium,how do the real GDP and price level change in the...

The economy will not stay at a level of GDP above full employment GDP for too long because this will cause

(A) (B) (C) Price Level Real GDP Price Level Real GDP Price Level Real GDP 110...

If the Federal Reserve conducts a policy of keeping GDP above its full-employment level for a...

The United States economy is currently operating above the full employment level of GDP. Draw a...

4. Assume the full employment level of national income (YF ) is at $280 billion. In...

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

Rahul Sunny answered 1 year ago

Rahul Sunny answered 1 year ago