Question

In: Finance

In finance, what do we mean by the time value of money? How do we calculate it?

In finance, what do we mean by the time value of money? How do we calculate it?

Solutions

Expert Solution

Utilizing the equation over, how about we take a gander at a model where you have $5,000 and can hope to acquire 5% premium on that aggregate every year for the following two years. Accepting the interest is just accumulated yearly, the future worth of your $5,000 today can be determined as follows:

FV = $5,000 x (1 + (5%/1) ^ (1 x 2) = $5,512.50

Present Value of Future Money Formula

The equation can likewise be utilized to compute the current worth of cash to be gotten later on. You just separation the future worth instead of duplicating the current worth. This can be useful in thinking about two changing present and future sums. In our unique model, we considered the choices of somebody paying your $1,000 today versus $1,100 every year from now. In the event that you could bring in 5% on putting away the cash now, and needed to realize what present worth would approach the future worth of $1,100 – or how much cash you would require close by now to have $1,100 per year from now – the equation would be as per the following:

PV = $1,100/(1 + (5%/1) ^ (1 x 1) = $1,047

The estimation above shows you that, with an accessible return of 5% every year, you would have to get $1,047 in the present to rise to the future worth of $1,100 to be gotten per year from now.

To make things simple for you, there are various online adding machines to calculate the future worth or present worth of cash.

Net Present Value Example

The following is a representation of what the Net Present Value of a progression of incomes resembles. As should be obvious, the Future Value of incomes is recorded across the highest point of the chart and the Present Value of incomes is displayed in blue bars along the lower part of the graph.

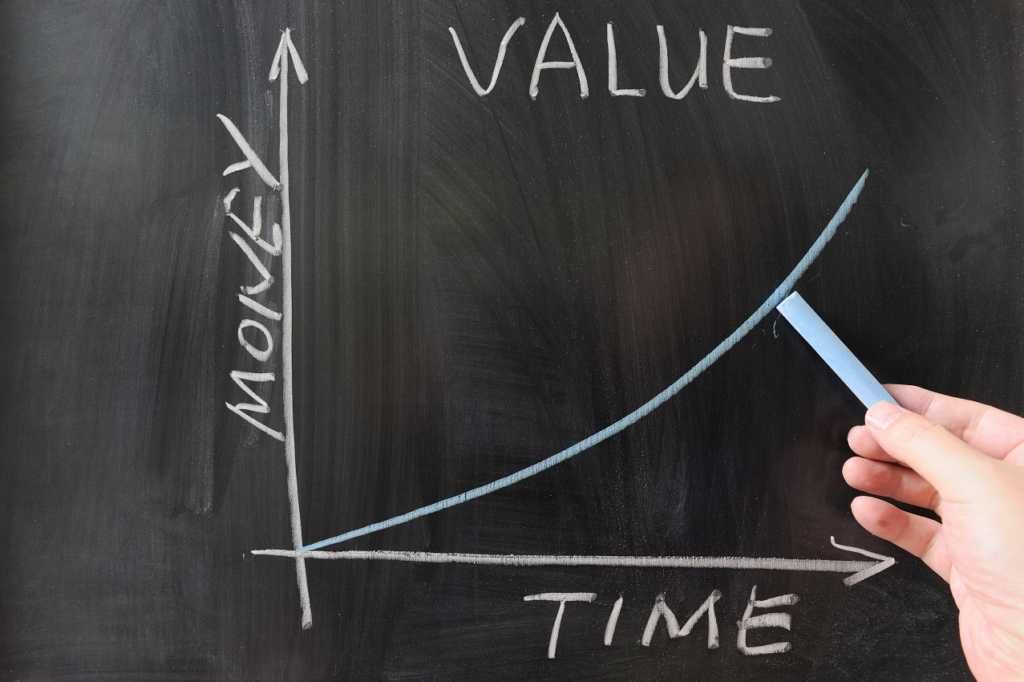

In finance time value of money is demonstrated as the basic financial conccept that verifies that, money at hand in the present is worth than the expected money to be received in future. At times time value of money is reffered to as the net present value (NPV) of money.

To caluculate time value of money only one specific formula is used in finding the future value of money to be compared to money at the present time. The formula is:

in this case;

FV - refers to the future value of money

PV - the present value

i - the interest rate or the returns from the money

t - the time span to be in consideration

n - the number of compounding periods of interest per year

Related Solutions

Managerial Finance Learning Objective: Calculate the time value of money Activity: Using the time value of...

Finance- Time Value of Money

Time Value of Money Overview: In corporate finance, students need to be able to calculate present...

How does the concept of Time Value of Money applied in accounting and finance?

How does Time Value of Money in conventional finance compare to the Islamic perspectives of time...

To calculate the time value of money, we need to consider all of the following except...

What is a sampling distribution? If we are considering the sample mean, how do we calculate...

Summarize the article and how does it relate to time value of money The finance department...

Time value of money How useful are the PV and FV for the firms? What do...

What is the Time Value of Money and how do financial managers use it to make...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

- How many grays is this?Part A A dose of 4.7 Sv of γ rays in a...

- how to operate a business?

Joseph Ndungu answered 4 years ago

Joseph Ndungu answered 4 years ago