Question

In: Finance

What is the yield to maturity of a five-year, $10,000 bond with a 4.8% coupon rate...

What is the yield to maturity of a five-year, $10,000 bond with a 4.8% coupon rate and semiannual coupons if this bond is currently trading for a price of $9,546?

|

7.03% |

||

|

5.86% |

||

|

8.21% |

||

|

2.93% |

Solutions

Expert Solution

Given,

Par value = $10000

Coupon rate = 4.8%

Years to maturity = 5 years

Current price = $9546

Solution :-

Semi annual coupon payment = $10000 x 4.8% x 1/2 = $240

Semi annual maturity = 5 years x 2 = 10

So, we have,

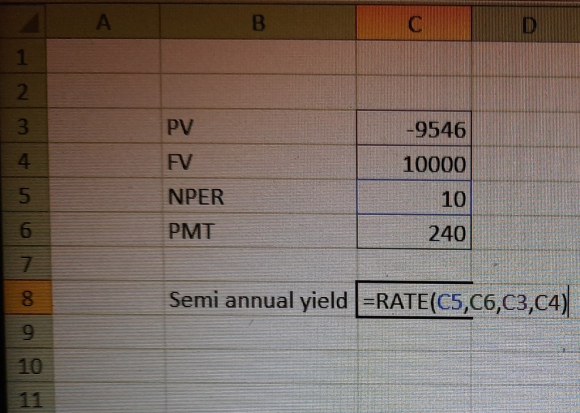

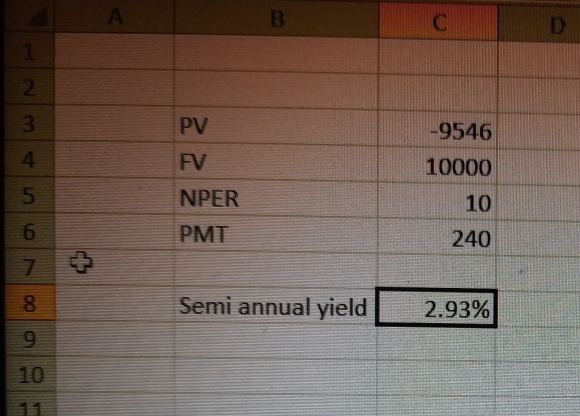

PV = -9546

FV = 10000

NPER = 10

PMT = 240

Yield to maturity = 2.93% x 2 = 5.86%

Thus, yield to maturity is 5.86%

Related Solutions

What is the yield to maturity of a five-year, $10,000 bond with a 4.1% coupon rate...

What is the yield to maturity of a five-year, $10,000

bond with a 4.1% coupon rate and semiannual coupons if this bond

is currently trading for a price of

$9,227?

A. 7.09%

B. 2.95%

C. 8.27%

D. 5.91%

What is the yield to maturity of a eight-year, $10,000 bond with a 5.1% coupon rate...

What is the yield to maturity of a eight-year, $10,000 bond with

a 5.1% coupon rate and semiannual coupons if this bond is currently

trading for a price of $8,928?

8.24%

6.86%

3.43%

9.61%

What is the yield to maturity of a eight-year, $5,000 bond with a 4.5% coupon rate...

What is the yield to maturity of a eight-year, $5,000 bond with

a 4.5% coupon rate and semiannual coupons if this bond is

currently trading for a price of $4,615?

A.5.71%

B.8%

C.6.85%

D.2.86%

A $47,000 loan is taken out on a boat with the terms 3% APR for

36 months. How much are the monthly payments on this loan?

A.$1,640.18

B.$1,366.82

C.$1,776.86

D. $1,503.50

A pottery factory purchases a continuous belt conveyor kiln for

$46,000. A 9% APR loan...

What is the coupon rate of an annual coupon bond that has a yield to maturity...

What is the coupon rate of an annual coupon bond that has a

yield to maturity of 5.5%, a current price of $949.81, a par value

of $1,000 and matures in 15 years?

6.33%

4.70%

3.07%

5.00%

A ten year bond has a coupon rate of 7% and a yield to maturity of...

A ten year bond has a coupon rate of 7% and a yield to maturity

of 9%, will you be willing to pay $1100 for this bond. Please

explain.

Consider a five-year bond with a 10% coupon selling at a yield to maturity of 8%....

Consider a five-year bond with a 10% coupon selling at a yield

to maturity of 8%. If interest rates remain constant, one year from

now the price of this bond will be:

A. Higher

B. Lower

C. The same

D. Par

If the yield to maturity and the coupon rate are the same, then the bond should...

If the yield to maturity and the coupon rate are the same, then the

bond should sell for ______.

a. a premium b. a discount c. par value

You buy a five-year bond that has a 7% yield to maturity and a 7% coupon...

You buy a five-year bond that has a 7% yield to maturity and a

7% coupon paid annually. In one year, promised yields to maturity

have fallen to 6%. What is your holding period return? Answer in

percentages with two decimal places.

What is the yield to maturity of the following bond? Current year: 2019 Coupon 9% Maturity...

What is the yield to maturity of the following bond?

Current year: 2019

Coupon 9%

Maturity date 2027

Interest paid semiannually

Par Value $1000

Market price $955.00

What is the current yield of bond ?

what is the yield to maturity of a ten year $5000 bond with a 5.4% coupon...

what is the yield to maturity of a ten year $5000 bond with a 5.4%

coupon rate and semiannual coupons if this bond is currently

trading for a price of $4725.70?

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

ADVERTISEMENT

jeff jeffy answered 3 years ago

jeff jeffy answered 3 years ago