Question

In: Economics

Section I: Derivation of Hicksian Demand Curve Joyce’s utility function is as follows: U= 10X3Y2 Where,...

Section I: Derivation of Hicksian Demand Curve

Joyce’s utility function is as follows:

U= 10X3Y2

Where, X, is the quantity of good X consumed, Y, is the quantity of good Y consumed and, U, is Joyce’s utility function.

The general budget constraint for the two goods is a follow:

B= PXX + PYY

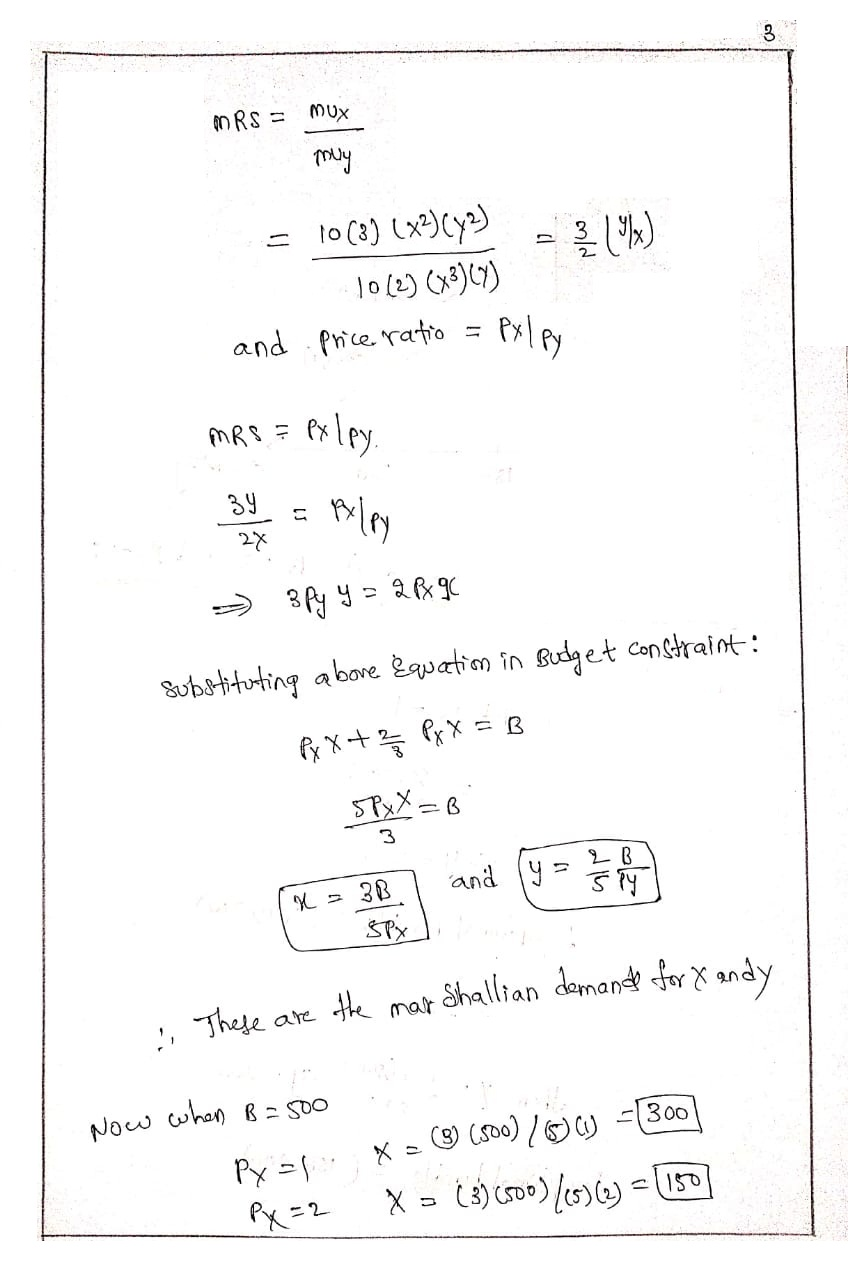

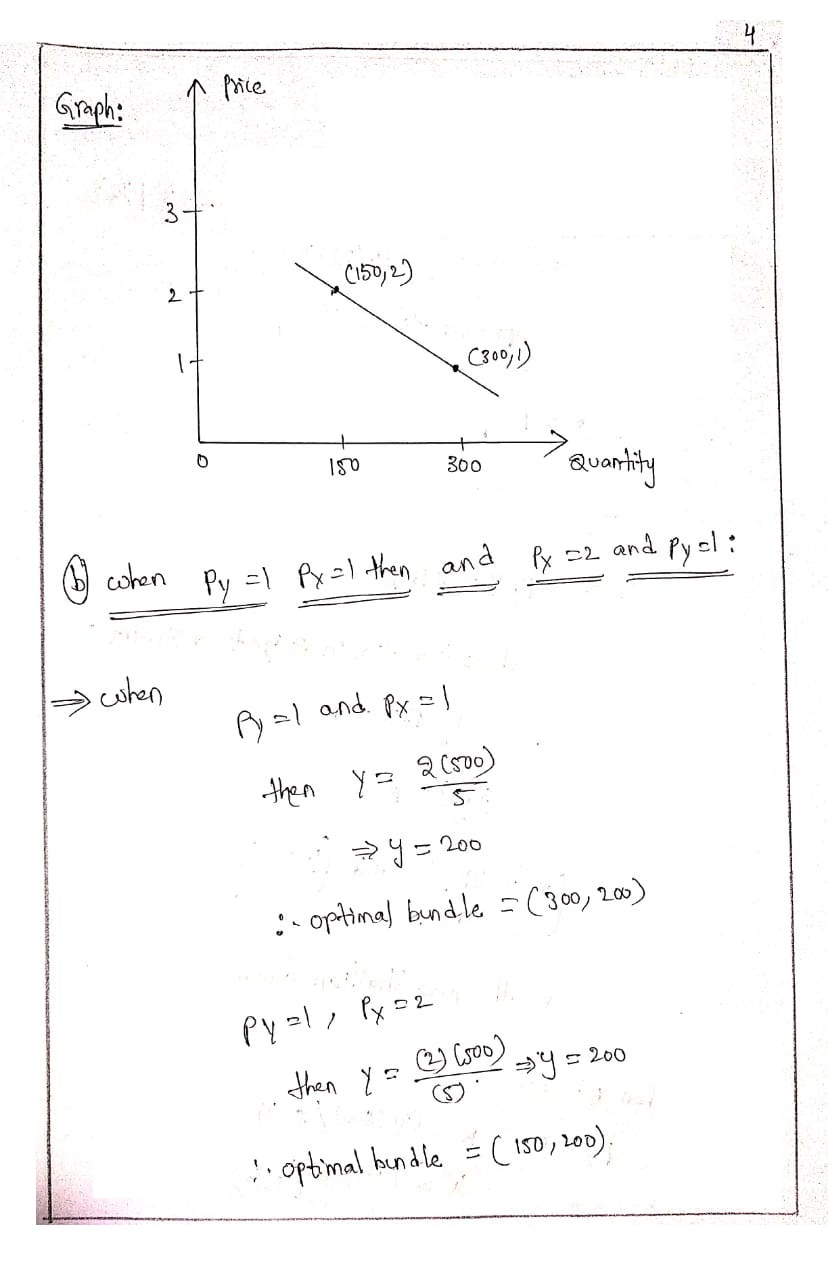

Derive Joyce’s Marshallian demand equation for good X. Also compute her demand for good X when B= 500, and the price of good X is 1 and 2. Also draw the Marshallian demand curve for X at these prices.

What is Joyce’s optimal amount of good Y purchased if PY= 1 and Px=1 and if Px=2 and PY= 1?

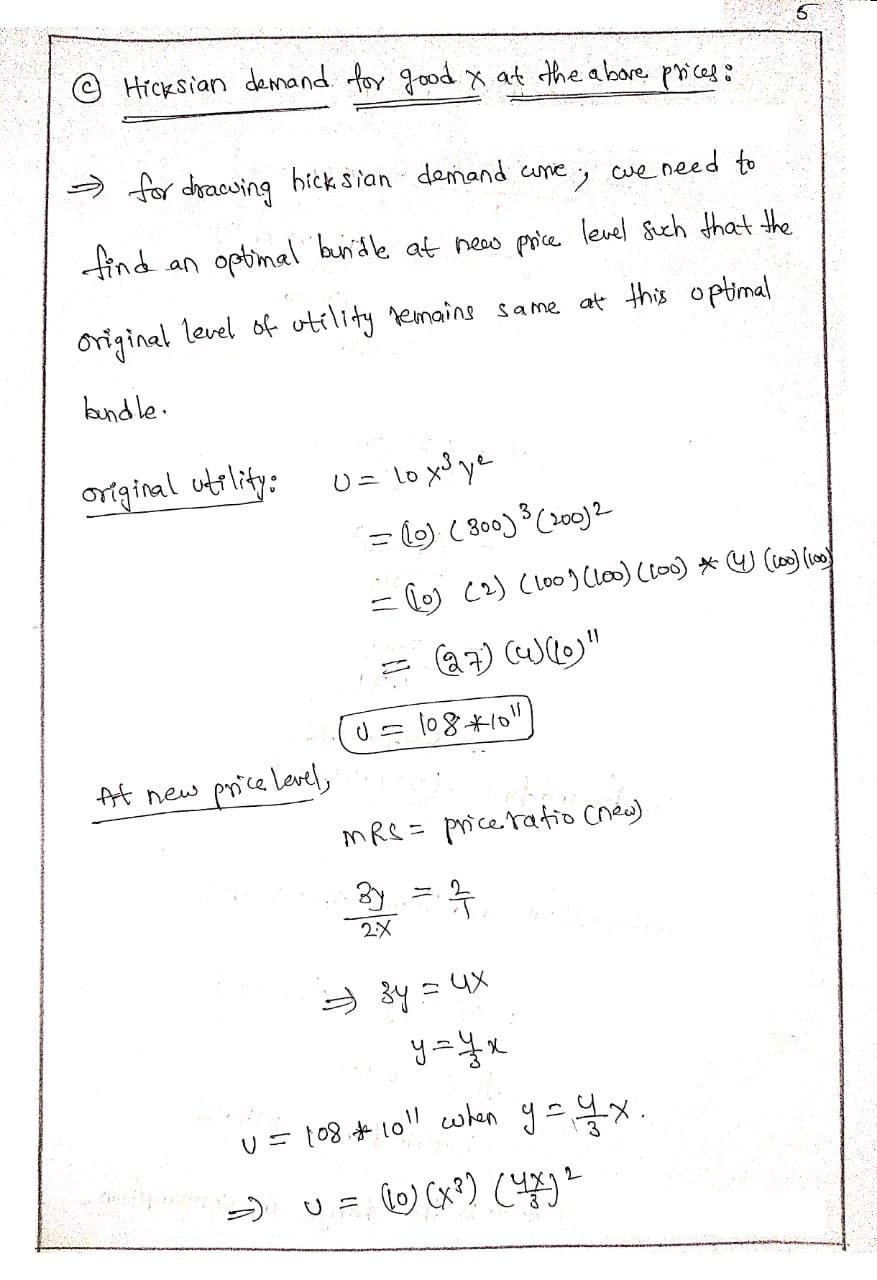

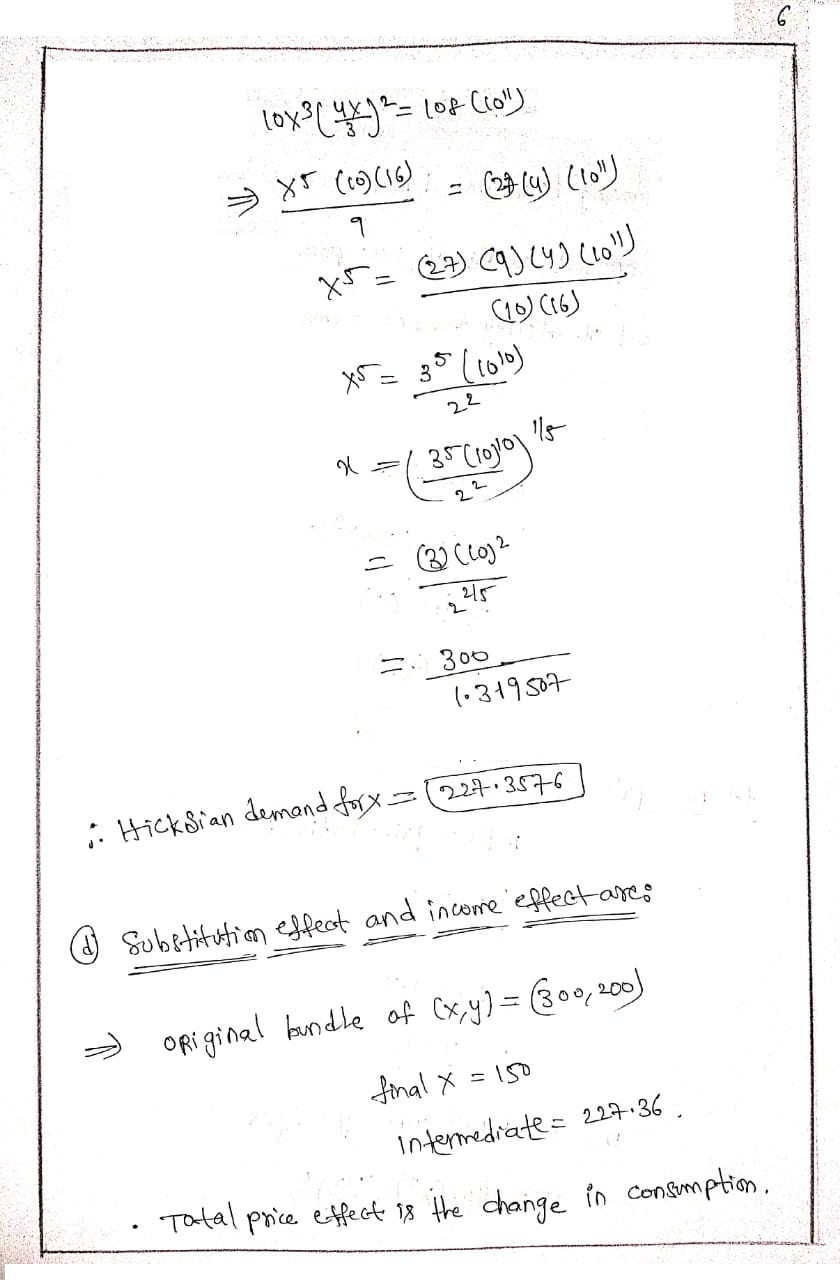

Derive the Hicksian demand for good X at these prices. Hint, you need to choose the three correct equations you’ve derived above and solve simultaneously. Also, draw both demand curves on the same graph.

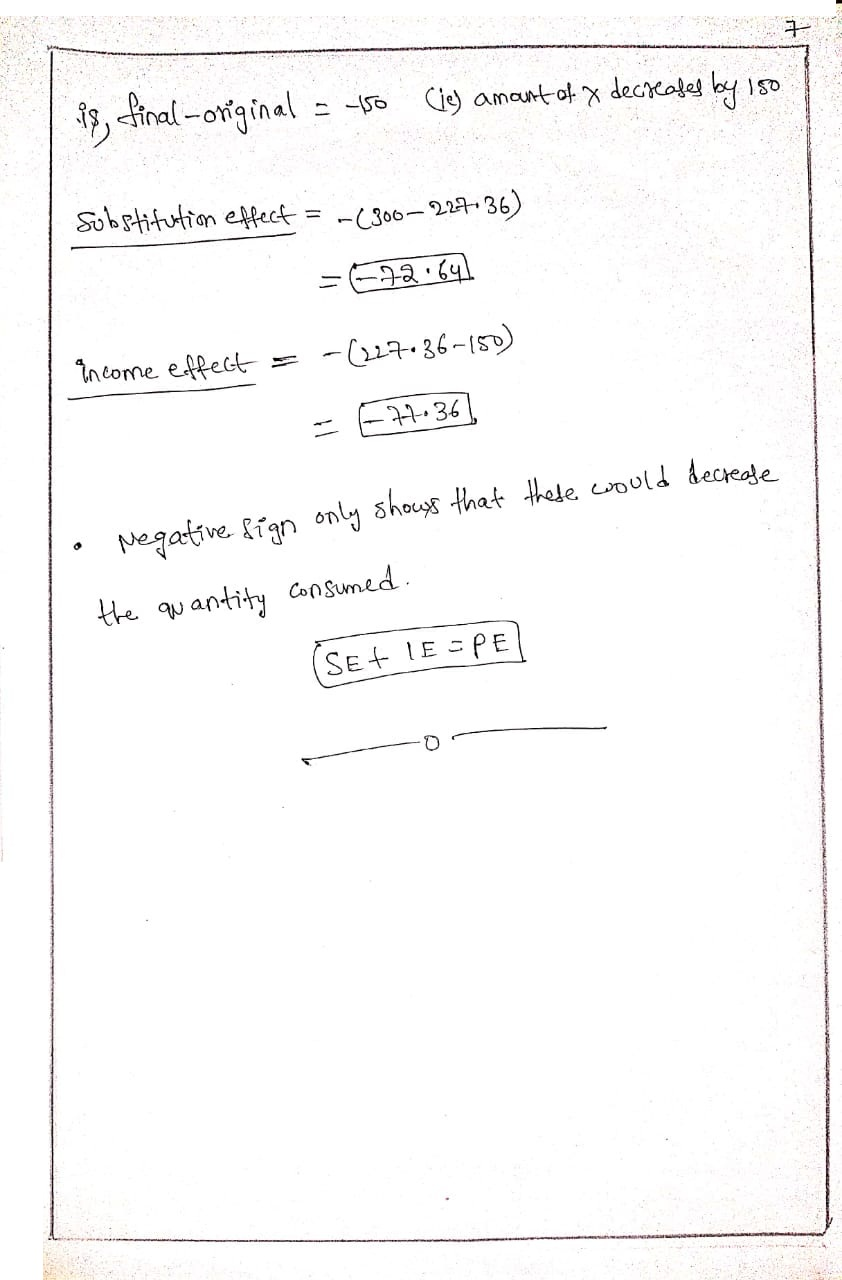

Using the information derived in parts A and B, what is the substitution effect and income effect obtained when changing the price of good x from a value of 1 to a value of 2.

Solutions

Related Solutions

Albert's utility function is U(I) = 100I2 , where Iis income.Stock I generates net-payoffs...

Consider the utility function of U(X,Y) = X0.2Y0.4 Derive the Marshallian demand curve for X Derive...

Suppose that an individual has a utility function of the form U = Y½ where U...

What is the relationship between the expenditure function and the Hicksian demand function?

A basic feature of the utility function (demand curve) is the law of diminishing marginal utility....

16.Suppose the utility function of Nathasha was given U(I)=(ROOT10I). Where' I' represents annual income (in $1,000)....

Amy’s utility function is U = √ C, where C is consumption and is given by...

A consumer’s utility function is U = logx + logy2 , where and y are two...

The consumer’s utility function is U(a,b) = ab2, where a denotes the quantity of good A...

Suppose that Elizabeth has a utility function U= (or U=W^(1/3) ) where W is her wealth...

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

Rahul Sunny answered 1 month ago

Rahul Sunny answered 1 month ago