Question

In: Finance

1. you want to buy your dream car which will cost you $5900. If you could...

1. you want to buy your dream car which will cost you $5900. If you could invest your entire savings of $3500 at an annual interest of 12%, how long (in years rounded to two decimal places) would you have to wait until you have accumulated enough money to buy the car? answer

2. You want to buy a house in 9 years and expect to need $25000 for a down payment. If you have $14000 to invest, how much interest do you have to earn (compounded annually) to reach your goal? (Enter your answers as a decimal rounded to 4 decimal places, not a percentage. For example, enter 0.0843 instead of 8.43%)

Solutions

Expert Solution

Part 1:

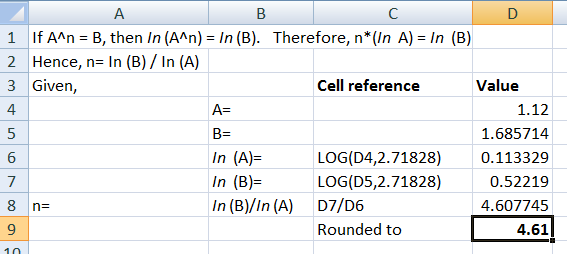

Number of years required for $3,500 to grow to $5,900 is 4.61 years, calculated using the following formula:

FV= PV*(1+r)^n

Where FV= Future Value ($5,900), PV= Present Value ($3,500), r= rate of interest (12%) and n= period (5 years).

Hence, 5900=3500*(1+12%)^n

1.12^n = 5900/3500= 1.685714

Number of years (Value of n) is calculated as follows:

Part 2:

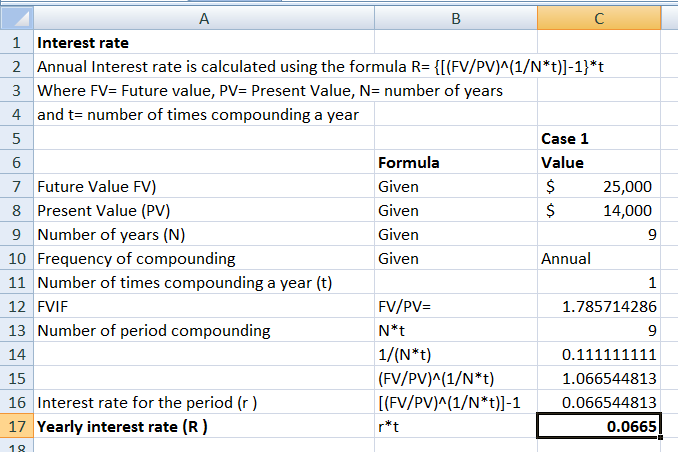

Interest rate required for $14,000 to grow to $25,000 in 9 years is 0.0665 as follows:

Related Solutions

You want to buy your dream car which will cost you $5400. If you could invest...

You want to buy a car which will cost you $10,000. You do not have sufficient...

You want to buy a car which will cost you $10,000. You do not have sufficient...

You want to buy a car which will cost you $10,000. You do not have sufficient...

You want to buy a car which will cost you $10,000. You do not have sufficient...

You want to buy a car which will cost you $10,000. You do not have sufficient...

You want to buy a car which will cost you $10,000. You do not have sufficient...

You want to buy a car which will cost you $10,000. You do not have sufficient...

You want to buy your dream house. You currently have $15,000 saved and you need to...

You recently got promoted at your job. You have since decided to buy your dream car...

- C PROGRAMMIMG I want to check if my 2 input is a number or not all...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

jeff jeffy answered 1 month ago

jeff jeffy answered 1 month ago