Question

In: Accounting

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 154,100 units...

Break-Even Sales Under Present and Proposed Conditions

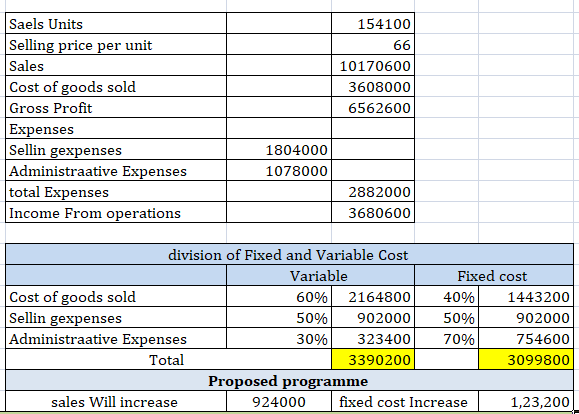

Darby Company, operating at full capacity, sold 154,100 units at a price of $66 per unit during the current year. Its income statement is as follows:

| Sales | $10,170,600 | ||

| Cost of goods sold | 3,608,000 | ||

| Gross profit | $6,562,600 | ||

| Expenses: | |||

| Selling expenses | $1,804,000 | ||

| Administrative expenses | 1,078,000 | ||

| Total expenses | 2,882,000 | ||

| Income from operations | $3,680,600 |

The division of costs between variable and fixed is as follows:

| Variable | Fixed | |||

| Cost of goods sold | 60% | 40% | ||

| Selling expenses | 50% | 50% | ||

| Administrative expenses | 30% | 70% | ||

Management is considering a plant expansion program for the following year that will permit an increase of $924,000 in yearly sales. The expansion will increase fixed costs by $123,200, but will not affect the relationship between sales and variable costs.

Required:

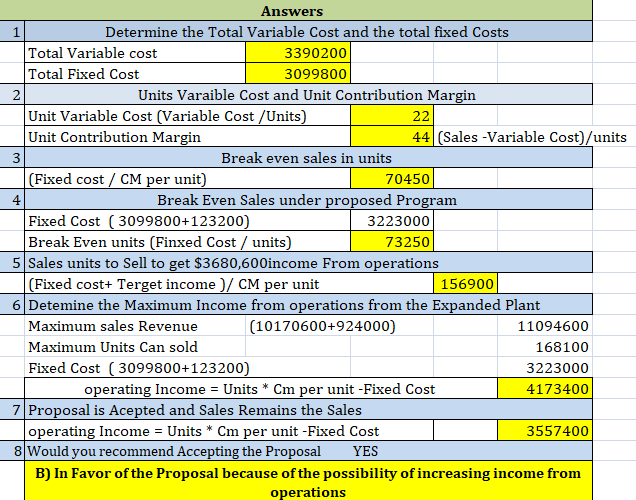

1. Determine the total variable costs and the total fixed costs for the current year.

| Total variable costs | $ |

| Total fixed costs | $ |

2. Determine (a) the unit variable cost and (b) the unit contribution margin for the current year.

| Unit variable cost | $ |

| Unit contribution margin | $ |

3. Compute the break-even sales (units) for the

current year.

units

4. Compute the break-even sales (units) under

the proposed program for the following year.

units

5. Determine the amount of sales (units) that

would be necessary under the proposed program to realize the

$3,680,600 of income from operations that was earned in the current

year.

units

6. Determine the maximum income from operations

possible with the expanded plant.

$

7. If the proposal is accepted and sales remain

at the current level, what will the income or loss from operations

be for the following year?

$

8. Based on the data given, would you recommend accepting the proposal?

- In favor of the proposal because of the reduction in break-even point.

- In favor of the proposal because of the possibility of increasing income from operations.

- In favor of the proposal because of the increase in break-even point.

- Reject the proposal because if future sales remain at the current level, the income from operations will increase.

- Reject the proposal because the sales necessary to maintain the current income from operations would be below the current year sales.

Choose the correct answer.

Solutions

Related Solutions

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 163,500 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 97,700 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 167,200 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 139,000 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 167,200 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 120,200 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 122,850 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 148,400 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 99,700 units...

Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 87,750 units...

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

ekkarill92 answered 2 months ago

ekkarill92 answered 2 months ago