Question

In: Finance

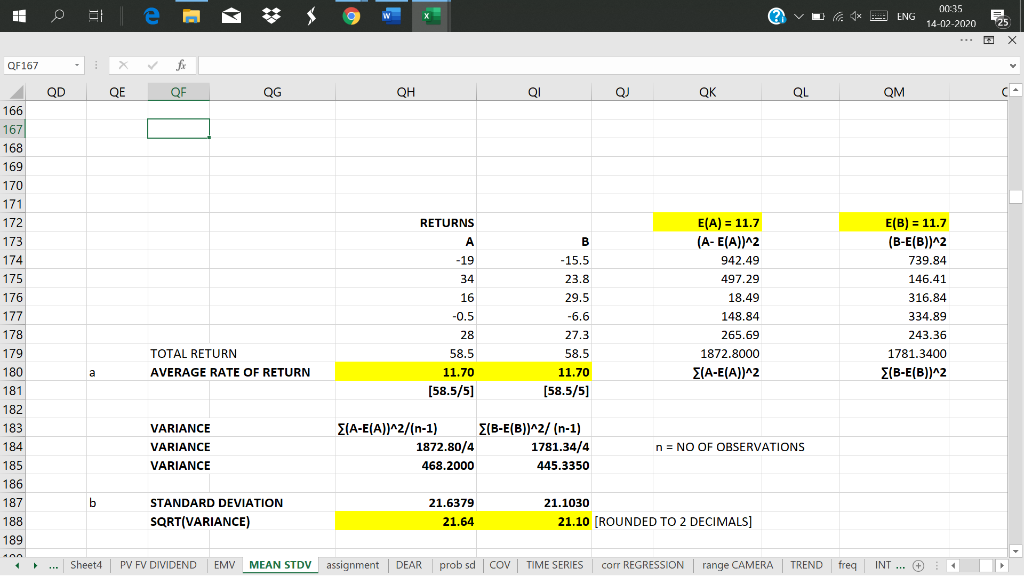

Stocks A and B have the following historical returns: Year Stock A's returns Stock B's returns...

Stocks A and B have the following historical returns:

| Year | Stock A's returns | Stock B's returns |

|---|---|---|

| 2003 | −19.00% | −15.50% |

| 2004 | 34.00% | 23.80% |

| 2005 | 16.00% | 29.50% |

| 2006 | −0.50% | −6.60% |

| 2007 | 28.00% | 27.30% |

(a) Calculate the average rate of return and standard deviation of returns (as percents) for each stock during the 5-year period. (Round your standard deviations to two decimal places.)

stock A average rate of return %

standard deviation %

stock B average rate of return %

standard deviation %

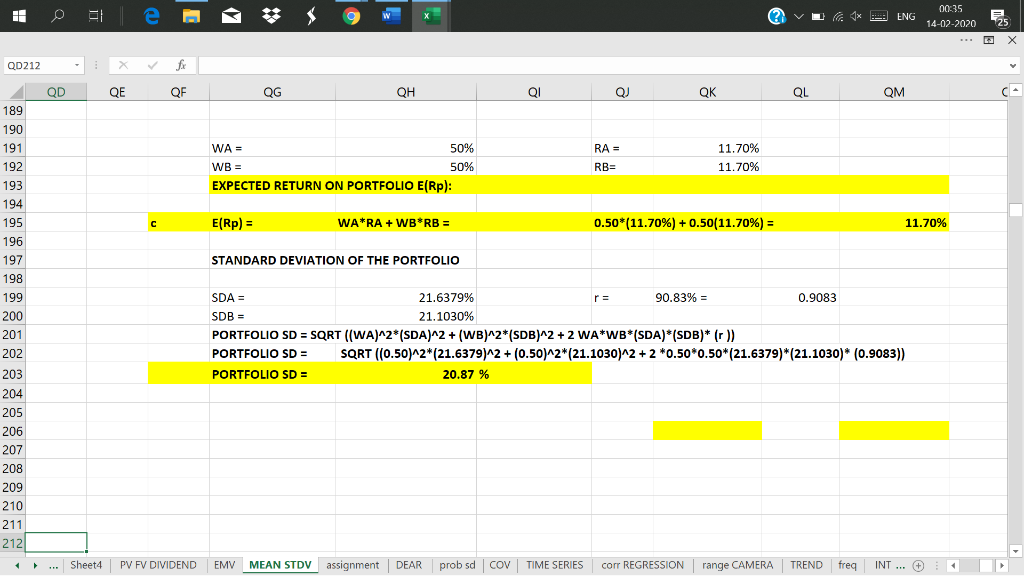

(b) Assume that someone held a portfolio consisting of 50% of stock A and 50% of stock B and that the average annual realized returns and past volatility of each stock are unbiased estimators of their expected returns and future volatility. What is the portfolio's expected return and the volatility of next year's returns (as percents)? The correlation between the returns of the two stock is 90.83%. (Round your answers to two decimal places.)

expected return %

volatility %

Solutions

Related Solutions

Stocks A and B have the following historical returns: Year Stock A's Returns, rA Stock B's...

Stocks A and B have the following historical returns: Year Stock A's Returns, rA Stock B's...

Stocks A and B have the following historical returns: Year Stock A's Returns, rA Stock B's...

Stocks A and B have the following historical returns: Year Stock A's Returns, rA Stock B's...

Stocks A and B have the following historical returns: Year Stock A's Returns, rA Stock B's...

Stocks A and B have the following historical returns: Year Stock A's Returns, rA Stock B's...

REALIZED RATES OF RETURN Stocks A and B have the following historical returns: Year Stock A's...

Historical Realized Rates of Return Stocks A and B have the following historical returns: Year 2012...

Year Stock A's Returns Stock B's Returns 2014 -18.0% -14.5% 2015 33.0% 21.8% 2016 15.0% 30.5%...

Stocks A and B have the following returns: Stock A Stock B 1 0.11 ...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

jeff jeffy answered 2 months ago

jeff jeffy answered 2 months ago