Question

In: Economics

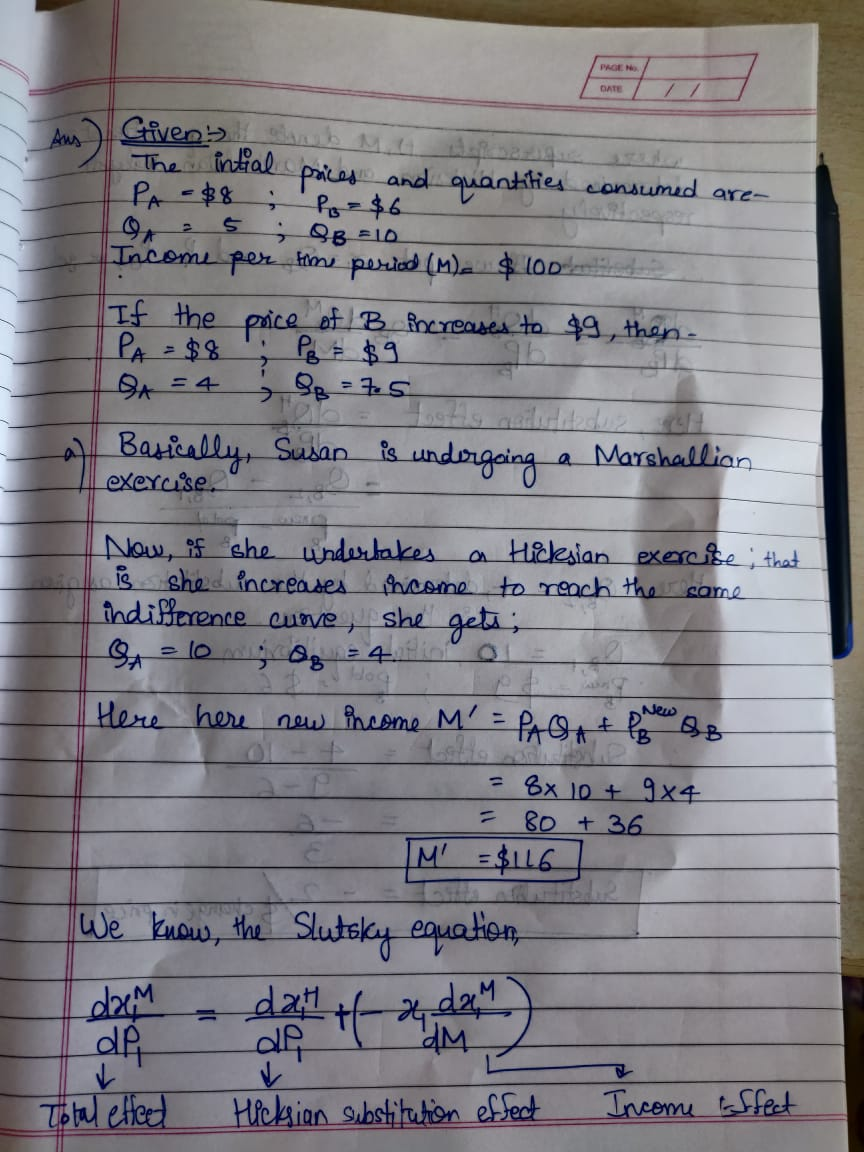

The following data pertain to products A and B, both of which are purchased by Susan....

The following data pertain to products A and B, both of which

are purchased by Susan. A is on vertical axis and B is on

horizontal axis. Initially, the prices of the products and

quantities consumed are:

PA= $8, QA= 5, PB= $6, QB= 10.

Susan has $100 to spend per time period. After an increase in price

of B, the prices and quantities consumed are:

PA= $8, QA= 4, PB = $9, QB= 7.5.

Assume that Susan maximizes utility under both price conditions

above. Also, note that if after the price increase enough income

were given back to Susan to put her back on the original

indifference curve, she would consume this combination of A and

B:

QA= 10,QB= 4

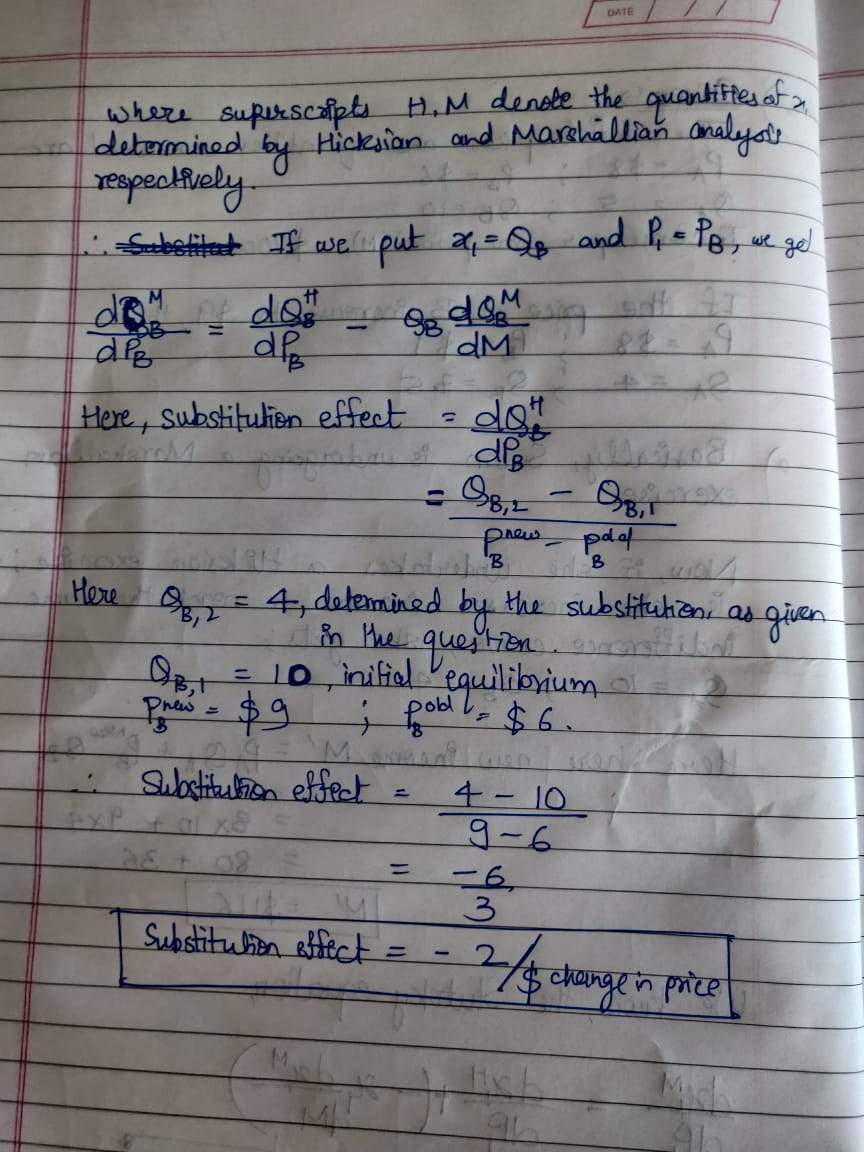

a. Determine the change in consumption rate of good B due to (1)

the substitution effect and (2) the income effect.

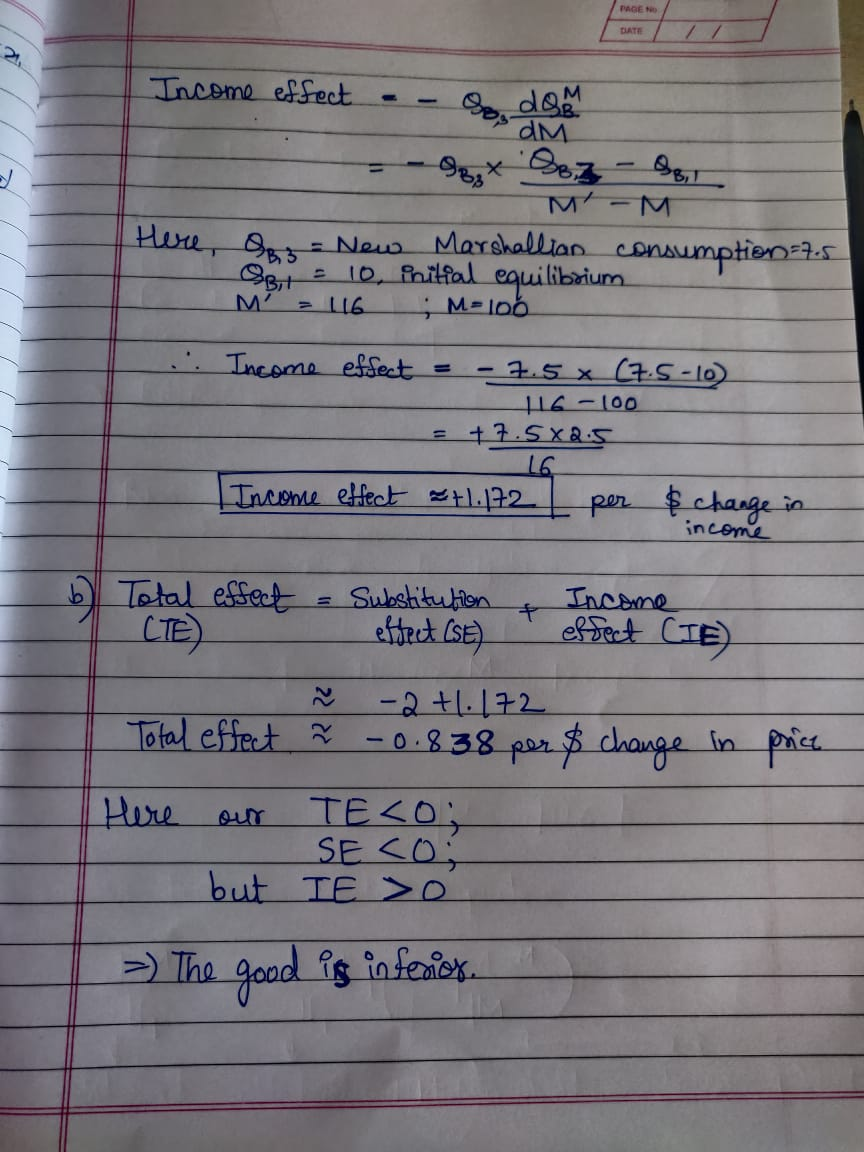

b. Determine if product B is a normal, inferior, or Giffengood.

Explain.

Solutions

Expert Solution

Do note that TE<0; SE<0

and IE>0 are the three necessary and sufficient conditions for

proving a good to be inferior according to general economic theory

relating to microeconomics.

Do note that TE<0; SE<0

and IE>0 are the three necessary and sufficient conditions for

proving a good to be inferior according to general economic theory

relating to microeconomics.

Related Solutions

Inventory TableClose The following data pertain to Company A’s inventory that was purchased on January 5,...

Trend Analysis - The following data pertain to Company B: (in thousands) Year 2 Year 1...

The following data pertain to April pertain for Jennings Manufacturing Company: Beginning Inventory……………….3,000 Unit...

susan is employed in the family business, which is a medium sized accounting firm. Both her...

Consider the reaction A + B → Products From the following data obtained at a certain...

a. Purchased materials on account, $480,000. b. Incurred total manufacturing wages of $117,000, which included both...

[The following information applies to the questions displayed below.] The following data pertain to the Aquarius...

Susan is employed in the family business, which is a medium-sized accounting firm. Both her parents...

Question The following data pertain to the operations of a manufacturing company for the year 2018...

Snow Inc. is a manufacturing company that specializes in snowmobiles. The following data pertain to the...

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

Rahul Sunny answered 3 months ago

Rahul Sunny answered 3 months ago