Question

In: Finance

On Monday morning, your buy one CME British Pound futures contract (i.e., you buy BP) containing...

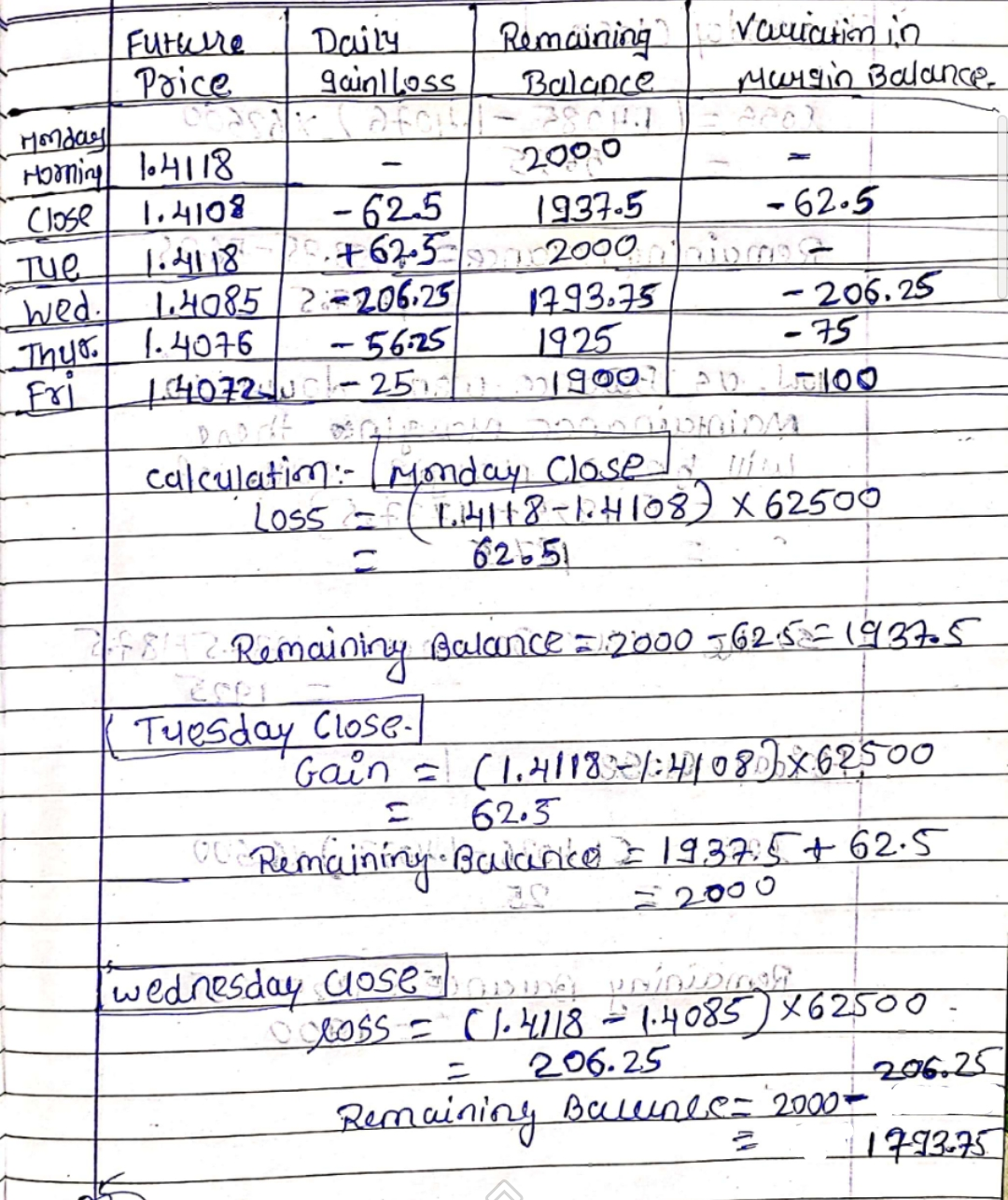

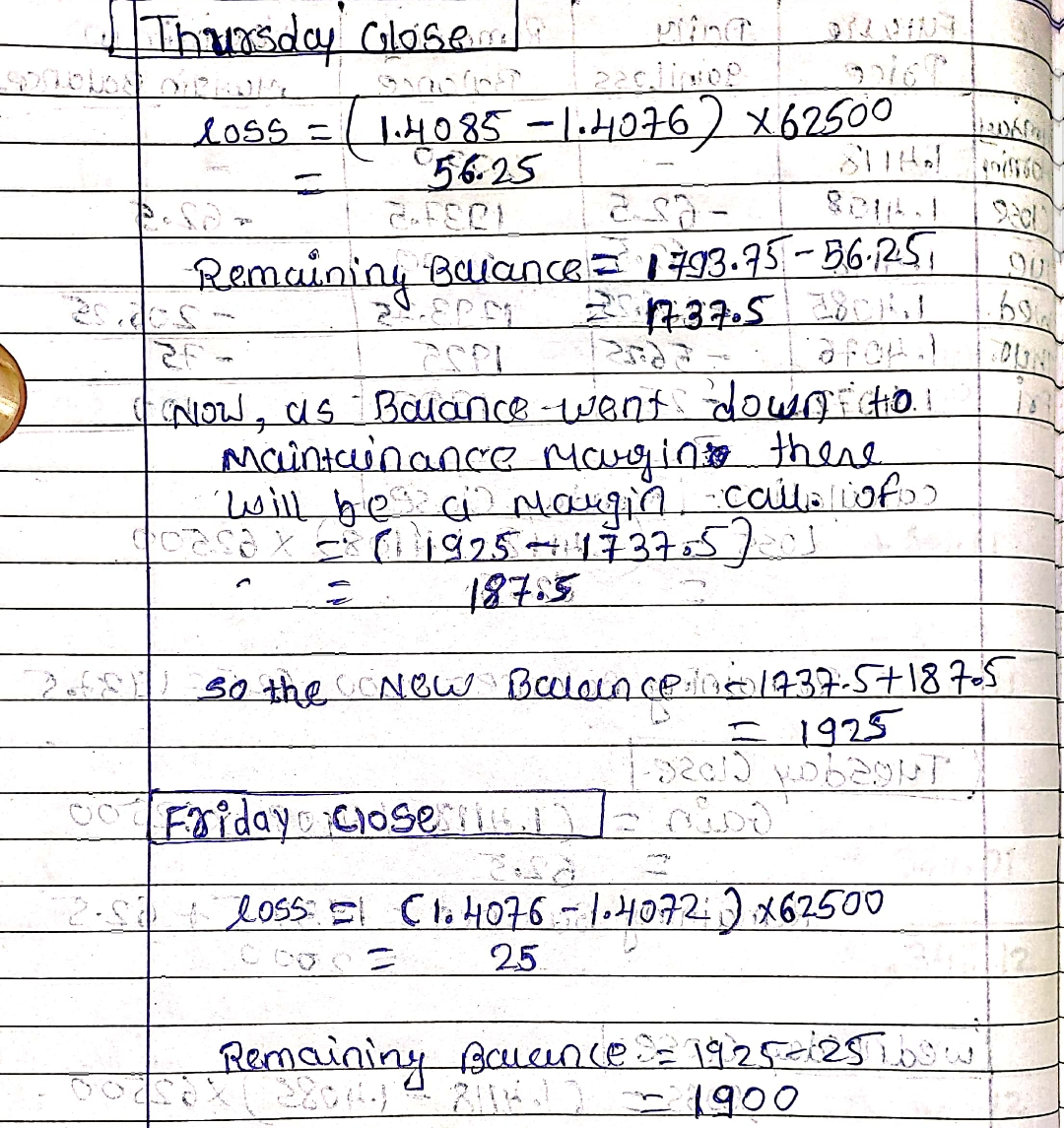

On Monday morning, your buy one CME British Pound futures contract (i.e., you buy BP) containing BP 62,500 at a price of $1.4118. Suppose the broker requires an initial margin of $1,925 and a maintenance margin of $1,750. The settlement prices for Monday through Friday are $1.4108, $1.4118, $1.4085, $1.4076, and $1.4072, respectively. Assume that you begin with an initial balance of $2,000 (not $1,925). Fill out the following tables. Make sure you show your calculation. (To get exact answers, show 4 digits after the decimal point. If your calculation can’t show 4 digits after the decimal point, use excel spread sheet for the calculation) (9 points)

|

|

Monday Morning |

Monday Close |

Tuesday Close |

Wednesday Close |

Thursday Close |

Friday Close |

|

Future price |

$1.4118 |

$1.4108 |

$1.4118 |

$1.4085 |

$1.4076 |

$1.4072 |

|

Daily gain/Loss |

||||||

|

Remaining Balance |

||||||

|

Variation Margin |

||||||

|

Balance |

Solutions

Related Solutions

On Monday morning you sell one June T-bond futures contract at 97:27, that is, for $97,843.75....

On Monday morning you sell one June T-bond futures contract at $98,622.75. The contract's face value...

1) You are US company, 500,000 BP (British Pound) payable to UK in one year. Answer...

Today's settlement price on a Chicago Mercantile Exchange (CME) € futures contract is $1.7537/€. Your initial...

Yesterday, you entered into a futures contract to buy €62,500 at $1.50 per €. Your initial...

A corn futures contract is 5,000 bushels. If you buy a contract of corn at 356...

You have a short position in one corn futures contract. Each futures contract calls for the...

Suppose you sold a pound futures contract three days ago at$1.33/£. Over the next three...

You enter into a futures contract to buy white maize for R1 845 per tonne. The...

1. Suppose you buy a call option on a $100,000 Treasury bond futures contract with an...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

jeff jeffy answered 3 months ago

jeff jeffy answered 3 months ago