Question

In: Finance

You want to buy a $255,000 home. You plan to pay 15% as a down payment,...

You want to buy a $255,000 home. You plan to pay 15% as a down payment, and take out a 30 year loan for the rest.

a) How much is the loan amount going to be? $

b) What will your monthly payments be if the interest rate is 5%? $

c) What will your monthly payments be if the interest rate is 6%? $

Solutions

Expert Solution

Answer a)

Loan Amount will be = 255000- Down Payment

= 255,000 - 15% * 255,000

= $ 216,750

Answer b )

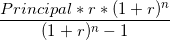

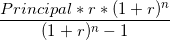

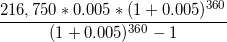

EMI =

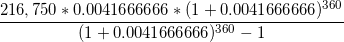

where is the rate of interest for a compounding period 5% / 12 = 0.41666666666%

n is the no of compounding periods i.e. 30 years *12 = 360 periods

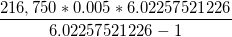

EMI =

=

= 4034.92157616 / 3.46774431294

= $ 1,163.56

Answer c)

EMI =

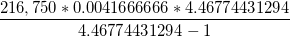

where is the rate of interest for a compounding period 6% / 12 = 0.5%

n is the no of compounding periods i.e. 30 years *12 = 360 periods

EMI =

=

= 6526.96588628 / 5.02257521226

= $ 1,299.53

NOTE: The answer to your question has been given below/above. If there is any query regarding the answer, please ask in the comment section. If you find the answer helpful, do upvote. Help us help you.

Related Solutions

You want to buy a $188,000 home. You plan to pay 20% as a down payment,...

You want to buy a $198,000 home. You plan to pay 20% as a down payment,...

You want to buy a home for $259,000. You plan to pay a 10% down payment,...

You want to buy a $201,000 home. You plan to pay 20% as a down payment,...

You want to buy a $240,000 home. You plan to pay 20% as a down payment,...

You want to buy a $252,000 home. You plan to pay 10% as a down payment,...

You want to buy a $197,000 home. You plan to pay 20% as a down payment,...

You want to buy a $202,000 home. You plan to pay 20% as a down payment,...

You want to buy a $218,000 home. You plan to pay 10% as a down payment,...

You want to buy a $249,000 home. You plan to pay 15% as a down payment, and take out a 30 year loan

- C PROGRAMMIMG I want to check if my 2 input is a number or not all...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

jeff jeffy answered 4 months ago

jeff jeffy answered 4 months ago