Question

In: Accounting

Gustav Leasing Company agrees to lease equipment to Julliard Corporation on January 1, 2017. The following...

Gustav Leasing Company agrees to lease equipment to Julliard Corporation on January 1, 2017. The

following information relates to the lease agreement.

1. The term of the lease is 6 years with no renewal option, and the machinery has an estimated

economic life of 8 years.

2. The cost of the machinery is $310,000, and the fair value of the asset on January 1, 2017, is $424,000.

3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of

$35,000. Julliard estimates that the expected residual value at the end of the lease term will be $35,000.

Julliard amortizes all of its leased equipment on a straight-line basis.

4. The lease agreement requires equal annual rental payments, beginning on January 1, 2017.

5. The collectability of the lease payments is probable.

6. Gustav desires a 6% rate of return on its investments. Julliard’s incremental borrowing rate is 8%, and

the lessor’s implicit rate is unknown.

(Assume the accounting period ends on December 31)

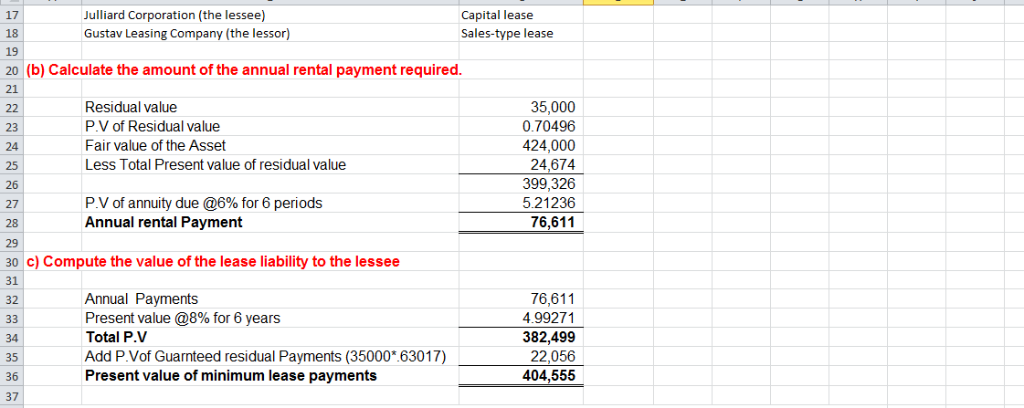

(a) Discuss the nature of this lease for both the lessee and the lessor.

(b) Calculate the amount of the annual rental payment required.

(c) Compute the value of the lease liability to the lessee.

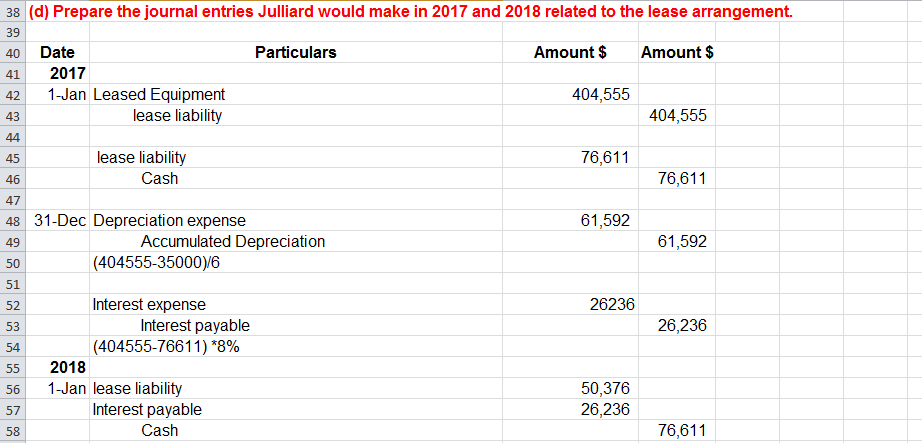

(d) Prepare the journal entries Julliard would make in 2017 and 2018 related to the lease arrangement.

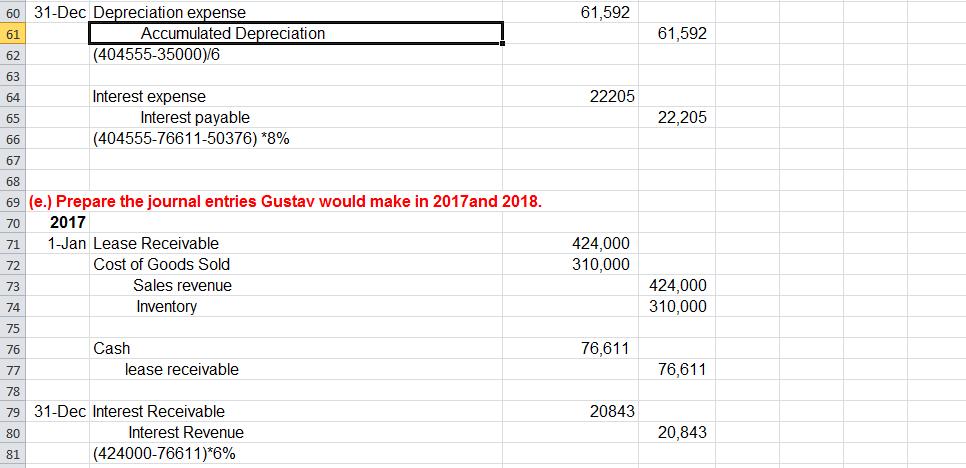

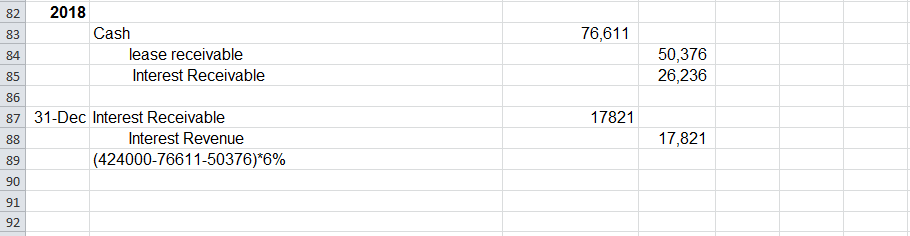

(e) Prepare the journal entries Gustav would make in 2017 and 2018 related to the lease arrangement.

(f) Suppose Julliard expects the residual value at the end of the lease term to be $28,000 but still

guarantees a residual of $35,000. Compute the value of the lease liability at lease commencement.

(g) Suppose the residual value is unguaranteed, how would Gustav’s journal entries change?

Solutions

Related Solutions

Glaus Leasing Company agrees to lease equipment to Jensen Corporation on January 1, 2017. The following...

Riverbed Leasing Company agrees to lease equipment to Marin Corporation on January 1, 2017. The following...

Sheffield Leasing Company agrees to lease machinery to Tamarisk Corporation on January 1, 2017. The following...

Glaus Leasing Company agrees to lease machinery to Jensen Corporation on January 1, 2017. The following...

Monty Leasing Company agrees to lease machinery to Flounder Corporation on January 1, 2017. The following...

Kingbird Leasing Company agrees to lease machinery to Oriole Corporation on January 1, 2017. The following...

Vaughn Leasing Company agrees to lease machinery to Bramble Corporation on January 1, 2017. The following...

Blue Leasing Company agrees to lease equipment to Kingbird Corporation on January 1, 2020. The following...

Grouper Leasing Company agrees to lease equipment to Monty Corporation on January 1, 2020. The following...

Gerbil Leasing Company agrees to lease equipment to Playa Corporation on January 1, 2014. The following...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

ekkarill92 answered 4 months ago

ekkarill92 answered 4 months ago