Question

In: Finance

Zippen Industries 9.250% bonds mature August 2, 2028. The bond is callable August 2, 2019 at...

Zippen Industries 9.250% bonds mature August 2, 2028. The bond is callable August 2, 2019 at 5.125 call premium. The offer on the bond to settle August 2, 2015 is currently 107.884

The Yield to Maturity is %

and the Yield to Call is %

Solutions

Expert Solution

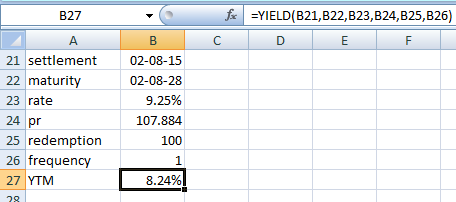

YTM is calculated using YIELD function in Excel :

settlement = August 2, 2015 (current date)

maturity = August 2, 2028 (redemption date)

rate = 9.250% (coupon rate)

pr = 107.884 (current price per $100 of face value)

redemption = 100 (redemption value)

frequency = 1 (number of coupon payments per year)

YTM = 8.24%

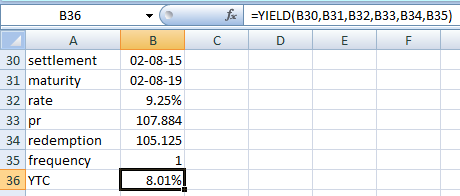

YTC is calculated using YIELD function in Excel :

settlement = August 2, 2015 (current date)

maturity = August 2, 2019 (call date)

rate = 9.250% (coupon rate)

pr = 107.884 (current price per $100 of face value)

redemption = 105.125 (call price = face value * (1 + call premium %) = 100 * (1 + 5.125%))

frequency = 1 (number of coupon payments per year)

YTC = 8.01%

Related Solutions

Tardis Intertemporal 9.125% bonds mature March 7, 2028. The bond is callable March 7, 2019 at...

Zippen Industries 10.750% bonds mature December 12, 2026. The bond is callable December 12, 2022 at...

A 8.93% semiannual-pay corporate bond matures 15 August 2028 and makes coupon payments on 15 February...

A 9.81% semiannual-pay corporate bond matures 15 August 2028 and makes coupon payments on 15 February...

A 9.17% semiannual-pay corporate bond matures 15 August 2028 and makes coupon payments on 15 February...

Define a callable bond. How is a callable bond different from a non-callable bond? - Consider...

A.Define a callable bond. How is a callable bond different from a non-callable bond? Consider a...

Valuing Callable Bonds Williams Industries has decided to borrow money by issuing perpetual bonds with a...

ABC Inc. recently is doing the following financing: (1) The firm's non-callable bonds mature in 20...

ABC Inc. recently is doing the following financing: (1) The firm's non-callable bonds mature in 30...

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago