Question

In: Finance

6. In order to plan for their child’s college education two parents are trying to decide...

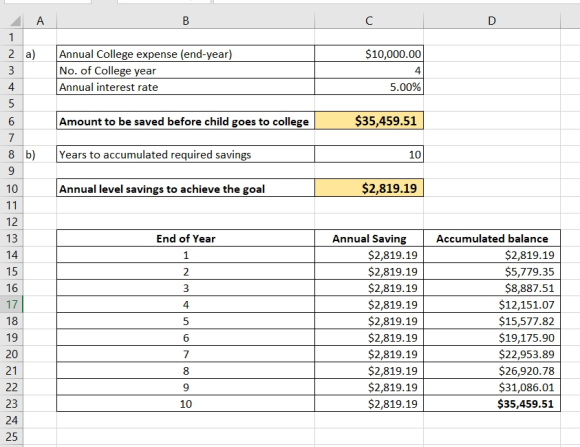

6. In order to plan for their child’s college education two parents are trying to decide on a savings goal. The parents would like to be able to provide $10,000 each year for four years to assist in paying for college expenses. If the parents are confident that their investments will grow at an effective annual interest rate of 5%:

(a) How much should the parents try to save before their child goes to college to completely cover these payments?

(b) If the parents have 10 years to accumulate these savings, design a savings plan(with level payments) which will allow them to meet this goal.

Solutions

Expert Solution

Please refer to below spreadsheet for calculation and answer. Cell reference also provided.

Cell reference -

Please note- It is assumed all payments are made at year end.

Related Solutions

In order to save money for their daughter's college education, new parents Ashley and John decide...

You are planning to save for you child’s college education which will start in 18 years....

Tom is working on his universe conquest plan and is trying to decide between two mutually...

If you invest $100/month for your child’s education at a nominal 6% rate of return with...

You anticipate having to pay $30,000 per year for your child’s college education starting 10 years...

From research, it is known that the opinions of US parents on whether a college education is worth the expense is the following

(TCO 5) Jane’s parents have created a savings account to save for her college education. If...

How much do you need to invest today in order to have enough money for your child’s college?

7) You are trying to decide whether to invest in a monthly income investment plan that...

______ 6. You are trying to decide whether to run your business as a corporation or...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago