Question

In: Accounting

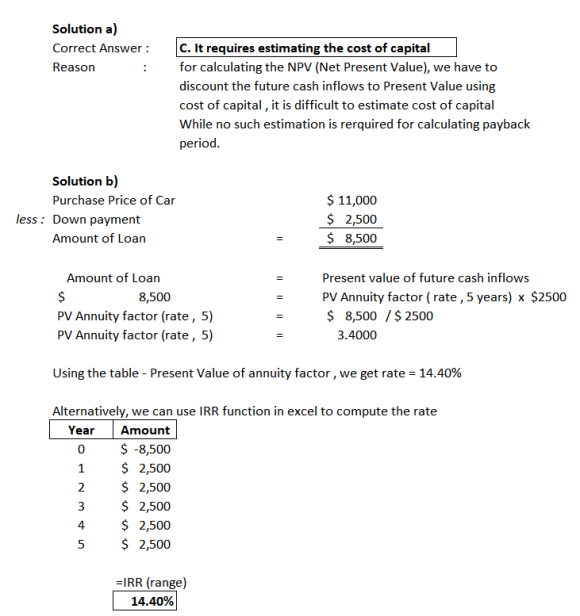

a)What weakness does the NPV method have that is not present in the payback method? -The...

a)What weakness does the NPV method have that is not present in the payback method?

-The NPV method is easier to understand.

-Initial cash flows are ignored.

-It requires estimating the cost of capital.

-It takes into account the time value of money.

b)A dealer offers you financing to purchase a car priced at $11,000. Under the finance plan, you would pay $2,500 now and $2,500 at the end of each year for 5 years. The finance plan has an implied annual interest rate (to the nearest percent) of_________

Solutions

Expert Solution

]Rounding

the rate of return to the nearest % = 14%

]Rounding

the rate of return to the nearest % = 14%

In case of any doubts or Issues, please comment below

Related Solutions

Compare and contrast the Payback method of capital budgeting and Net Present Value (NPV) method. Might...

Compare and contrast the Payback method of capital budgeting and

Net Present Value (NPV) method. Might one be a better alternative

in some situations, if so which?

Please explain why the net present value (NPV) method is preferred over the payback method when...

Please explain why the net present value (NPV) method is

preferred over the payback method when evaluating alternative

capital budgeting projects.

Please explain why the net present value (NPV) method is preferred over the payback method when...

Please explain why the net present value (NPV) method is

preferred over the payback method when evaluating alternative

capital budgeting projects.

11. The NPV and payback period What information does the payback period provide? Payback period essentially...

11. The NPV and payback period

What information does the payback period provide?

Payback period essentially provides the number of years it would

take for a project to recover the initial investment from its

operating cash flows. As the model was criticized, the model

evolved incorporating time value of money to create the discounted

payback method. The models still reflected faulty ranking criteria

but they provided important information about liquidity and

risk.

The ______(shorter or longer)____ the payback, other things...

5. The NPV and payback period What information does the payback period provide? Suppose you are...

5. The NPV and payback period

What information does the payback period provide?

Suppose you are evaluating a project with the expected future

cash inflows shown in the following table. Your boss has asked you

to calculate the project’s net present value (NPV). You don’t know

the project’s initial cost, but you do know the project’s regular,

or conventional, payback period is 2.50 years.

Year

Cash Flow

Year 1

$275,000

Year 2

$450,000

Year 3

$425,000

Year 4

$450,000

If...

5. The NPV and payback period Part A What information does the payback period provide? Suppose...

5. The NPV and payback period

Part A

What information does the payback period provide?

Suppose Acme Manufacturing corp CFO is evaluating a project w

the following cash Inflows. She does not know the project's initial

cost; however he does know that the projects regular payback period

is 2.5 years.

Year Cash flow

1. $350,000

2. $400,000

3. $400,000

4. $400,000

If the project's weighted average cost of capital (WACC) is 10%,

what is its NPV?

answer options: $326,990; $299,741;...

8. The NPV and payback period What information does the payback period provide? Suppose you are...

8. The NPV and payback period

What information does the payback period provide?

Suppose you are evaluating a project with the expected future

cash inflows shown in the following table. Your boss has asked you

to calculate the project’s net present value (NPV). You don’t know

the project’s initial cost, but you do know the project’s regular,

or conventional, payback period is 2.50 years.

Year

Cash Flow

Year 1

$375,000

Year 2

$500,000

Year 3

$500,000

Year 4

$450,000

If...

7. The NPV and payback period What information does the payback period provide? Suppose you are...

7. The NPV and payback period

What information does the payback period provide?

Suppose you are evaluating a project with the expected future

cash inflows shown in the following table. Your boss has asked you

to calculate the project’s net present value (NPV). You don’t know

the project’s initial cost, but you do know the project’s regular,

or conventional, payback period is 2.50 years.

Year

Cash Flow

Year 1

$325,000

Year 2

$425,000

Year 3

$500,000

Year 4

$425,000

If...

The NPV and payback period What information does the payback period provide? Suppose you are evaluating...

The NPV and payback period

What information does the payback period provide?

Suppose you are evaluating a project with the expected future

cash inflows shown in the following table. Your boss has asked you

to calculate the project’s net present value (NPV). You don’t know

the project’s initial cost, but you do know the project’s regular,

or conventional, payback period is 2.50 years.

Year

Cash Flow

Year 1

$275,000

Year 2

$475,000

Year 3

$400,000

Year 4

$475,000

If the...

7. The NPV and payback period What information does the payback period provide? Suppose you are...

7. The NPV and payback period

What information does the payback period provide?

Suppose you are evaluating a project with the expected future

cash inflows shown in the following table. Your boss has asked you

to calculate the project’s net present value (NPV). You don’t know

the project’s initial cost, but you do know the project’s regular,

or conventional, payback period is 2.50 years.

Year

Cash Flow

Year 1

$275,000

Year 2

$500,000

Year 3

$450,000

Year 4

$450,000

If...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

ADVERTISEMENT

ekkarill92 answered 3 years ago

ekkarill92 answered 3 years ago