Question

In: Accounting

The current asset section of the Excalibur Tire Company's balance sheet consists of cash, marketable securities

The current asset section of the Excalibur Tire Company's balance sheet consists of cash, marketable securities, accounts receivable and inventories. The December 31, 2018, balance sheet revealed the following:

Solutions

Expert Solution

Ans: Here we have to calculate different amounts by using formulas & substituting values in them.

So let’s start with Current Ratio & Acid Test ratio

Given that Current ratio = 2.2 and Acid test ratio = 1.20

Current ratio = Current

assets & Acid Test Ratio = (Current

Assets-Inventory)

Current

Liability

Current Liability

Inventory is given as $ 1,000,000, substituting it in formula, we get,

Acid Test Ratio = (Current Assets-Inventory) = CA –

1000000 = 1.20

Current

Liability

C.L.

= CA – 1000000 = 1.20 CL

= CA = 1.20 C.L + 1000000 ----------------- (1)

Now substituting value of CA in formula of Current ratio

Current Ratio = (Current Assets) = 2.20

Current

Liability

= 1.20 CL + 1000000 = 2.20 CL

= 1 CL = 1000000, So Value of Current Liabilities = $ 1,000,000

So now we can calculate some values as follows:-

Current Liabilities = $ 1,000,000

Current Assets = $ 2,200,000

Total Assets = $ 3,500,000

Inventory = $ 1,000,000

Long term Assets = Total assets – Current assets = $3,500,000 - $ 2,200,000 = $ 1,300,000.

Now using the information of next ratio, Debt to Equity Ratio,

Debt to Equity ratio =________Total

Debts______ = 1.50

Shareholder’s Fund/Net Worth

Now using analytical skills, we will solve it further.

This ratio means that for every $ 1.50 of debt, we have $ 1 of Shareholder’s fund &

We know that, Total Liabilities + Shareholder’s fund = Total Assets

Let Total Debts = 1.50x , Shareholder’s fund = 1x

Now we have the value of Total assets, i.e $ 3,500,000,

Substituting values in formula of total assets we get,

= 1.50x + 1x = 3,500,000

= 2.50x = 3,500,000

X = 3500000 = $

1,400,000

2.50

X = Shareholder’s fund = $ 1,400,000

& Total Debts = 1.50x = 1.50*1400000 = $ 2,100,000

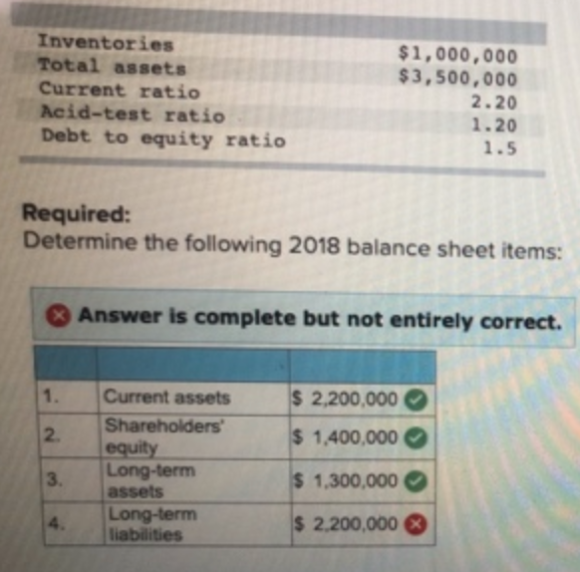

So the values required are as follows :-

- Current Assets = $ 2,200,000

- Shareholder’s fund = $ 1,400,000

- Long term Assets = $ 1,300,000

- Long term Liabilities = Total Debt – Current

Liabilities = $ 2,100,000 - $ 1,000,000

= $ 1,100,000.

Related Solutions

The current asset section of the Excalibur Tire Company’s balance sheet consists of cash, marketable securities,...

The current asset section of the Excalibur Tire Company’s balance sheet consists of cash, marketable securities,...

The current asset section of the Excalibur Tire Company’s balance sheet consists of cash, marketable securities,...

The current asset section of the Excalibur Tire Company’s balance sheet consists of cash, marketable securities,...

The following items are reported on a company's balance sheet: Cash $292,600 Marketable securities 93,000 Accounts...

The following items are reported on a company's balance sheet: Cash $247,900 Marketable securities 88,000 Accounts...

SNIDER CORPORATION Balance Sheet December 31, 20X1 Assets Current assets: Cash $ 57,100 Marketable securities 26,100...

The most recent balance sheet is as follow: Cash 1,000,000 Accounts payable 700,000 Marketable securities 800,000...

4) Common-Size Balance Sheet 2016 Cash and marketable securities $ 550 1.7 % Accounts receivable 5,990...

Temporary excess cash can be invested in marketable securities. What are the characteristics of marketable securities?...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

ekkarill92 answered 3 years ago

ekkarill92 answered 3 years ago