Questions

On July 1, 2020, Torvill Construction Company Inc. contracted to build an office building for Gabriella Corp

Construction Contract Accounting as per Percentage-of-Completion Method & Completed Contract Method.

Problem Four: Long-Term Contract

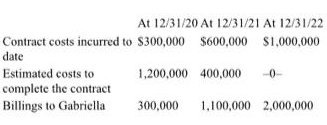

On July 1, 2020, Torvill Construction Company Inc. contracted to build an office building for Gabriella Corp. for a total contract price of S2,000,000. On July 1, Torvill estimated that it would take between 2 and 3 years to complete the building. On December 31, 2022, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Gabriella for 2020, 2021, and 2022.

Required:

a. Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2020, 2021, and 2022.

b. Using the completed-contract method, how much profit or loss will be recognized as a result of this contract for the years ended December 31, 2020, 2021, and 2022.

In: Accounting

On January 1, 2018, a machine was purchased for $117,500. The machine has an estimated salvage...

On January 1, 2018, a machine was purchased for $117,500. The machine has an estimated salvage value of $10,400 and an estimated useful life of 5 years. The machine can operate for 119,000 hours before it needs to be replaced. The company closed its books on December 31 and operates the machine as follows: 2018, 23,800 hrs; 2019, 29,750 hrs; 2020, 17,850 hrs; 2021, 35,700 hrs; and 2022, 11,900 hrs.

(a)

Compute the annual depreciation charges over the machine’s life assuming a December 31 year-end for each of the following depreciation methods. (Round answers to 0 decimal places, e.g. 45,892.)

| 1. | Straight-line Method |

$ |

||

| 2. | Activity Method | |||

| Year | ||||

| 2018 |

$ |

|||

| 2019 |

$ |

|||

| 2020 |

$ |

|||

| 2021 |

$ |

|||

| 2022 |

$ |

|||

| 3. | Sum-of-the-Years'-Digits Method | |||

| Year | ||||

| 2018 |

$ |

|||

| 2019 |

$ |

|||

| 2020 |

$ |

|||

| 2021 |

$ |

|||

| 2022 |

$ |

|||

| 4. | Double-Declining-Balance Method | |||

| Year | ||||

| 2018 |

$ |

|||

| 2019 |

$ |

|||

| 2020 |

$ |

|||

| 2021 |

$ |

|||

| 2022 |

$ |

In: Accounting

On December 31, 2019, Sarasota Inc. borrowed $3,960,000 at 13% payable annually to finance the construction...

On December 31, 2019, Sarasota Inc. borrowed $3,960,000 at 13% payable annually to finance the construction of a new building. In 2020, the company made the following expenditures related to this building: March 1, $475,200; June 1, $792,000; July 1, $1,980,000; December 1, $1,980,000. The building was completed in February 2021. Additional information is provided as follows.

| 1. | Other debt outstanding | |||

| 10-year, 14% bond, December 31, 2013, interest payable annually | $5,280,000 | |||

| 6-year, 11% note, dated December 31, 2017, interest payable annually | $2,112,000 | |||

| 2. | March 1, 2020, expenditure included land costs of $198,000 | |||

| 3. | Interest revenue earned in 2020 | $64,680 |

(a)

New attempt is in progress. Some of the new entries may impact the last attempt grading.Your answer is incorrect.

Determine the amount of interest to be capitalized in 2020 in relation to the construction of the building.

| The amount of interest |

$ |

In: Accounting

Two accountants for the firm of Elwes and Wright are arguing about the merits of presenting...

Two accountants for the firm of Elwes and Wright are arguing about the merits of presenting an income statement in a multiple-step versus a single-step format. The discussion involves the following 2020 information related to P. Bride Company ($000 omitted). Administrative expense Officers' salaries $4,900 Depreciation of office furniture and equipment 3,960 Cost of goods sold 60,570 Rent revenue 17,230 Selling expense Delivery expense 2,690 Sales commissions 7,980 Depreciation of sales equipment 6,480 Sales revenue 96,500 Income tax 9,070 Interest expense 1,860 Common shares outstanding for 2020 total 40,550 (000 omitted). Prepare an income statement for the year 2020 using the multiple-step form. (Round earnings per share to 2 decimal places, e.g. 1.48.) Prepare an income statement for the year 2020 using the single-step form. (Round earnings per share to 2 decimal places, e.g. 1.48.)

In: Accounting

Clemson Company had the following stockholders’ equity as of January 1, 2020. Common stock, $5 par...

Clemson Company had the following stockholders’ equity as of

January 1, 2020.

| Common stock, $5 par value, 20,000 shares issued | $100,000 | |

| Paid-in capital in excess of par—common stock | 300,000 | |

| Retained earnings | 320,000 | |

| Total stockholders’ equity | $720,000 |

During 2020, the following transactions occurred.

| Feb. 1 | Clemson repurchased 2,000 shares of treasury stock at a price of $19 per share. | |

| Mar. 1 | 800 shares of treasury stock repurchased above were reissued at $17 per share. | |

| Mar. 18 | 500 shares of treasury stock repurchased above were reissued at $14 per share. | |

| Apr. 22 | 600 shares of treasury stock repurchased above were reissued at $20 per share. |

Prepare the stockholders’ equity section as of April 30, 2020. Net income for the first 4 months of 2020 was $130,000. (Enter account name only and do not provide descriptive information.)

In: Accounting

In 2018, the Westgate Construction Company entered into a contract to construct a road for Santa...

In 2018, the Westgate Construction Company entered into a

contract to construct a road for Santa Clara County for

$10,000,000. The road was completed in 2020. Information related to

the contract is as follows:

| 2018 | 2019 | 2020 | |||||||

| Cost incurred during the year | $ | 2,072,000 | $ | 2,738,000 | $ | 2,849,000 | |||

| Estimated costs to complete as of year-end | 5,328,000 | 2,590,000 | 0 | ||||||

| Billings during the year | 2,160,000 | 2,650,000 | 5,190,000 | ||||||

| Cash collections during the year | 1,880,000 | 2,700,000 | 5,420,000 | ||||||

4. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years assuming the following costs incurred and costs to complete information. (Do not round intermediate calculations and round your final answers to the nearest whole dollar amount. Loss amounts should be indicated with a minus sign.)

| 2018 | 2019 | 2020 | |||||||

| Cost incurred during the year | $ | 2,072,000 | $ | 3,880,000 | $ | 3,280,000 | |||

| Estimated costs to complete as of year-end | 5,328,000 | 3,180,000 | 0 | ||||||

|

In: Accounting

Blue Company began operations on January 1, 2019, adopting the conventional retail inventory system. None of...

Blue Company began operations on January 1, 2019, adopting the

conventional retail inventory system. None of the company’s

merchandise was marked down in 2019 and, because there was no

beginning inventory, its ending inventory for 2019 of $38,200 would

have been the same under either the conventional retail system or

the LIFO retail system.

On December 31, 2020, the store management considers adopting the

LIFO retail system and desires to know how the December 31, 2020,

inventory would appear under both systems. All pertinent data

regarding purchases, sales, markups, and markdowns are shown below.

There has been no change in the price level.

|

Cost |

Retail |

|||||

|---|---|---|---|---|---|---|

|

Inventory, Jan. 1, 2020 |

$38,200 | $59,300 | ||||

|

Markdowns (net) |

12,900 | |||||

|

Markups (net) |

22,200 | |||||

|

Purchases (net) |

129,300 | 178,900 | ||||

|

Sales (net) |

169,700 | |||||

Determine the cost of the 2020 ending inventory under both (a) the

conventional retail method and (b) the LIFO retail method.

In: Accounting

INSTRUCTIONS: READ THE FOLLOWING SITUATION AND ANSWER THE QUESTIONS ARISING FOR THE CASE ANALYSIS. “STONYFIELD FARM...

INSTRUCTIONS: READ THE FOLLOWING SITUATION AND ANSWER THE QUESTIONS ARISING FOR THE CASE ANALYSIS.

“STONYFIELD FARM GOES TO THE BLOGS”

The Stonyfield Farm story is a kind of legend. In 1983, friends and social activists Gary Hirschberg and Samuel Kaymen started with a good yogurt recipe, seven cows, and a dream. They established an organic yogurt company in Wilton, New Hampshire, to take advantage of baby boomers' growing concerns about natural foods and health, and to revitalize the dairy industry in New England. Stonyfield Farms has grown to become the third largest organic company in the world, with annual sales of more than $ 50 million in 50 states. It produces more than 18 million glasses of yogurt each month.

Stonyfield Farrn's spectacular growth is attributable in part to its ability to offer a product to a special niche market - people who value healthy food and want to protect the environment. These values have become part of the "personality" of the company. Stonyfleld promises to use only natural ingredients and milk that has not been produced with antibiotics, synthetic growth hormones, or pesticides or toxic fertilizers. The company donates 10 percent of its profits each year to projects that help protect or restore the planet.

As the company expanded, management feared that it might lose touch with its loyal and committed customer base. Advertising based on traditional media was expensive and did not really help the company to "connect" with the kind of people it was trying to reach. This company prefers word-of-mouth techniques that deliver its message to customers in ways more compatible with its popular, organic, and activist-friendly image.

Stonyfield has multiple active email newsletters with more than 500,000 subscribers, and typically posts messages promoting causes that he supports on the tops of his yogurt glasses. Now she's turning to blogging to further personalize her customer relationships and reach even more people. Inspired by Howard Dean's presidential campaign and Dean's blogger tutorials, CEO Hirschberg became convinced that Stonyfield could use blogging to create a more personal relationship with consumers, different from the traditional sales relationship. "Blogs give us what we call a handshake with consumers" and "a little more access to us

Stonyfield now publishes two separate blogs on his website — Baby Babble and Bovine Bugle. At one time Stonyfield was running five blogs, but decided to withdraw three of them because they weren't attracting enough readers. Baby Babble provides a forum for Stonyfield employees and other parents of young children to meet and discuss child development and balance work with the family. Stonyfield created that blog because baby yogurts are one of its most popular product lines, and parenting blogs seem to appeal to a large number of readers. The Bovine Bugle provides reports about Jonathan's Organic Dairy Farm. Gates in Franklin, Vermont, a member of the organic cooperative that supplies milk for Stonyfield products.

This blog sparks a large number of nostalgic comments from readers who remember their childhood on a farm. As organic food grows in importance, these blogs help the company showcase the aspects that make it different from other brands and invite customers to help them in this endeavor. Stonyfield continually posts new content to each of the blogs. Readers can subscribe to any of them and automatically receive updates when available. And of course they can reply to these posts.

The benefits of blogging for Stonyfield have not yet been quantified so far, but management is confident there are real benefits. Blogs have created a positive response for the Stonyfield brand by providing readers with something that inspires them or sparks their interest -If blogs give new information to readers, inspire them to protect the environment or ask them for opinions, the administration believes that They will remember the brand when they are in front of the yogurt shelves in the supermarket or grocery store and that they will take a Stonyfleld product instead of a competitor when it is time to choose. Stonyfield has a fairly large website. Blogs offer a way to highlight some of the content on the Web that would otherwise be lost. This, too, helps drive some blog readers to buy Stonyfield products.

IV. What benefits does the introduction of an intranet and extranet bring to a company? Indicate and explain.

In: Operations Management

INSTRUCTIONS: READ THE FOLLOWING SITUATION AND ANSWER THE QUESTIONS ARISING FOR THE CASE ANALYSIS. “STONYFIELD FARM...

INSTRUCTIONS: READ THE FOLLOWING SITUATION AND ANSWER THE QUESTIONS ARISING FOR THE CASE ANALYSIS.

“STONYFIELD FARM GOES TO THE BLOGS”

The Stonyfield Farm story is a kind of legend. In 1983, friends and social activists Gary Hirschberg and Samuel Kaymen started with a good yogurt recipe, seven cows, and a dream. They established an organic yogurt company in Wilton, New Hampshire, to take advantage of baby boomers' growing concerns about natural foods and health, and to revitalize the dairy industry in New England. Stonyfield Farms has grown to become the third largest organic company in the world, with annual sales of more than $ 50 million in 50 states. It produces more than 18 million glasses of yogurt each month.

Stonyfield Farrn's spectacular growth is attributable in part to its ability to offer a product to a special niche market - people who value healthy food and want to protect the environment. These values have become part of the "personality" of the company. Stonyfleld promises to use only natural ingredients and milk that has not been produced with antibiotics, synthetic growth hormones, or pesticides or toxic fertilizers. The company donates 10 percent of its profits each year to projects that help protect or restore the planet.

As the company expanded, management feared that it might lose touch with its loyal and committed customer base. Advertising based on traditional media was expensive and did not really help the company to "connect" with the kind of people it was trying to reach. This company prefers word-of-mouth techniques that deliver its message to customers in ways more compatible with its popular, organic, and activist-friendly image.

Stonyfield has multiple active email newsletters with more than 500,000 subscribers, and typically posts messages promoting causes that he supports on the tops of his yogurt glasses. Now she's turning to blogging to further personalize her customer relationships and reach even more people. Inspired by Howard Dean's presidential campaign and Dean's blogger tutorials, CEO Hirschberg became convinced that Stonyfield could use blogging to create a more personal relationship with consumers, different from the traditional sales relationship. "Blogs give us what we call a handshake with consumers" and "a little more access to us

Stonyfield now publishes two separate blogs on his website — Baby Babble and Bovine Bugle. At one time Stonyfield was running five blogs, but decided to withdraw three of them because they weren't attracting enough readers. Baby Babble provides a forum for Stonyfield employees and other parents of young children to meet and discuss child development and balance work with the family. Stonyfield created that blog because baby yogurts are one of its most popular product lines, and parenting blogs seem to appeal to a large number of readers. The Bovine Bugle provides reports about Jonathan's Organic Dairy Farm. Gates in Franklin, Vermont, a member of the organic cooperative that supplies milk for Stonyfield products.

This blog sparks a large number of nostalgic comments from readers who remember their childhood on a farm. As organic food grows in importance, these blogs help the company showcase the aspects that make it different from other brands and invite customers to help them in this endeavor. Stonyfield continually posts new content to each of the blogs. Readers can subscribe to any of them and automatically receive updates when available. And of course they can reply to these posts.

The benefits of blogging for Stonyfield have not yet been quantified so far, but management is confident there are real benefits. Blogs have created a positive response for the Stonyfield brand by providing readers with something that inspires them or sparks their interest -If blogs give new information to readers, inspire them to protect the environment or ask them for opinions, the administration believes that They will remember the brand when they are in front of the yogurt shelves in the supermarket or grocery store and that they will take a Stonyfleld product instead of a competitor when it is time to choose. Stonyfield has a fairly large website. Blogs offer a way to highlight some of the content on the Web that would otherwise be lost. This, too, helps drive some blog readers to buy Stonyfield products.

1.What is Stonyfield farm's e-commerce model and business strategy? What challenges and problems does the company face?

In: Operations Management

5. Weston Company prepares annual adjusting entries only. During the third quarter of Fiscal Year 2018,...

5. Weston Company prepares annual adjusting entries only. During the third quarter of Fiscal Year 2018, Weston Company acquired the following trading securities: Date Company # of Shares Price per Share 8/15 X Company 1,500 $40 9/25 Y Company 1,250 25 9/30 Z Company 1,000 20 On November 10th, Weston Company sold the Y Company stock for $31 per share. On December 15th, Z Company paid dividends of $0.12 per share. The following were the year-end market values: Company FMV per Share X Company $45 Y Company 20 Z Company 30 What the total dollar values that Weston Company should record for the Unrealized Gain or (Loss) on Trading Securities for 2018? Enter a Loss as a negative number.

In: Accounting