Questions

Perth Corporation has two operating divisions, a casino and a hotel. The two divisions meet the...

Perth Corporation has two operating divisions, a casino and a

hotel. The two divisions meet the requirements for segment

disclosures. Before transactions between the two divisions are

considered, revenues and costs are as follows:

| Casino | Hotel | |||||

| Revenues | $ | 35,000,000 | $ | 21,000,000 | ||

| Costs | 16,000,000 | 13,000,000 | ||||

The casino and the hotel have a joint marketing arrangement by

which the hotel gives coupons redeemable at casino slot machines

and the casino gives discount coupons good for stays at the hotel.

The value of the coupons for the slot machines redeemed during the

past year totaled $5,000,000. The discount coupons redeemed at the

hotel totaled $1,000,000. As of the end of the year, all coupons

for the current year expired.

Required:

What are the operating profits for each division considering the effects of the costs arising from the joint marketing agreement? (Enter your answers in thousands.)

Operating Profits

casino

hotel

In: Accounting

Comparing occupancy for two hotels Sunrise Suites and Nationwide Inns operate competing hotel chains across the...

Comparing occupancy for two hotels

Sunrise Suites and Nationwide Inns operate competing hotel chains across the region. Hotel capacity information for both hotels is as follows:

| Number of Hotels | Average Number of Rooms per Hotel | |||||||||

| Sunrise Suites | 120 | 90 | ||||||||

| Nationwide Inns | 150 | 76 | ||||||||

Information on the number of guests for each hotel and the average length of visit for June were as follows:

| Number of Guests | Average Length of Visit (in Nights) | |||||||||

| Sunrise Suites | 183,600 | 1.5 | ||||||||

| Nationwide Inns | 228,000 | 1.2 | ||||||||

a. Determine the guest nights for each hotel in June. Guest Nights Sunrise Suites: Nationwide Inns:

b. Determine the room nights for each hotel in June. Room Nights Sunrise Suites: Nationwide Inns:

c. Determine the occupancy rate of each hotel in June. Occupancy Rate Sunrise Suites % Nationwide Inns

In: Accounting

On July 1, 2020, Torvill Construction Company Inc. contracted to build an office building for Gabriella Corp

Construction Contract Accounting as per Percentage-of-Completion Method & Completed Contract Method.

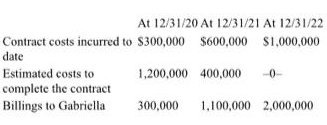

Problem Four: Long-Term Contract

On July 1, 2020, Torvill Construction Company Inc. contracted to build an office building for Gabriella Corp. for a total contract price of S2,000,000. On July 1, Torvill estimated that it would take between 2 and 3 years to complete the building. On December 31, 2022, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Gabriella for 2020, 2021, and 2022.

Required:

a. Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2020, 2021, and 2022.

b. Using the completed-contract method, how much profit or loss will be recognized as a result of this contract for the years ended December 31, 2020, 2021, and 2022.

In: Accounting

We have provided you the Hotel database to be used with SQLite DBMS. You should use...

We have provided you the Hotel database to be used with SQLite DBMS. You should use this database in SQLite to extract the necessary information as per the following query requirements.

The sqlite script is based on the following relational schema:

•Hotel (hotelNo, hotelName, city)

• Room (roomNo, hotelNo, type, price)

• Booking (hotelNo, guestNo, dateFrom, dateTo, roomNo)

•Guest (guestNo, guestName, guestAddress)

Note the following details of the hotel database;

•Hotel contains hotel details and hotelNo is the primary key;

•Room contains room details for each hotel and (roomNo, hotelNo) forms the primary key;

•Booking contains details of bookings and (hotelNo,guestNo,dateFrom) forms the primary key;

•Guest contains guest details and guestNo is the primary key.

Write an SQLite script for querying data.

•List hotelNo, type and price of each double or deluxe room with a price more than $99.

•List hotelNo who have more than 2 double rooms.

•List number of different guests who visited Ridge Hotel.

•What is the total income from bookings for the Grosvenor Hotel? .

•List all the guests who have stayed in a hotel.

Task 3 [3 marks]

Perform the following tasks.

•Write commands to insert rows in each of the Hotel database tables .

•Write a command to delete the row you inserted in the table Guest .

•Write a command to update the price of all rooms by 10% (1 mark).

In: Computer Science

Pacific Hotels operates a centralized call center for the reservation needs of its hotels. Costs associated...

Pacific Hotels operates a centralized call center for the reservation needs of its hotels. Costs associated with use of the center are charged to the hotel group (luxury, resort, standard, and budget) based on the length of time of calls made (time usage). Idle time of the reservation agents, time spent on calls in which no reservation is made, and the fixed cost of the equipment are allocated based on the number of reservations made in each group. Due to recent increased competition in the hotel industry, the company has decided that it is necessary to better allocate its costs in order to price its services competitively and profitably. During the most recent period for which data are available, the use of the call center for each hotel group was as follows:

Division Time Usage Number of Reservation

Luxury 400 120

Resort 200 150

Standard 800 360

Budget 600 870

Call center costs for personnel $840,000

Call center costs for equipment $650,000

Determine the allocation to each of the divisions using the following:

1. A single rate based on time used.

2. Dual rates based on time used (for personnel costs) and number of reservations (for equipment and other cost).

|

Department |

Time Usage |

Number of Reservation |

|

Luxury |

||

|

Resort |

||

|

Standard |

||

|

Budget |

||

|

Total |

Allocation based on time usage

|

Department |

Proportion of Total Time |

Allocated Cost |

|

Luxury |

||

|

Resort |

||

|

Standard |

||

|

Budget |

||

|

Total of Allocation Cost |

Dual Allocation

|

Department |

Proportion of Time Usage |

Allocated Time Cost |

Proportion of Reservation |

Allocated Equip Cost |

Total Allocated |

|

Luxury |

|||||

|

Resort |

|||||

|

Standard |

|||||

|

Budget |

|||||

|

--------------- |

------------------- |

---------------- |

--------------------- |

----------------- |

In: Accounting

1. PepsiCo, near the top of Table 2-5 in the chapter, is a company that provides...

1. PepsiCo, near the top of Table 2-5 in the chapter, is a

company that provides

comprehensive financial statements. Go to finance.yahoo.com. In the

box next to

“Get Quotes,” type in its ticker symbol PEP and click.

2. Scroll all the way down to “Financials” and click on “Income

Statement.” Compute

the annual percentage change between the three years for the

following:

a. Total revenue.(PLEASE SHOW ALL WORK AS TO HOW YOU ARRIVED AT THE

ANSWER)

b. Net income applicable to common shares.(PLEASE SHOW ALL WORK AS

TO HOW YOU ARRIVED AT THE ANSWER)

3. Now click on “Balance Sheet” and compute the annual percentage

change

between the three years for the following: (PLEASE SHOW ALL WORK AS

TO HOW YOU ARRIVED AT THE ANSWER)

a. Total assets.(PLEASE SHOW ALL WORK AS TO HOW YOU ARRIVED AT THE

ANSWER)

b. Total liabilities.(PLEASE SHOW ALL WORK AS TO HOW YOU ARRIVED AT

THE ANSWER)

4. Write a one-paragraph summary of how the company is doing.

TO FIND THE DATA:

1. PepsiCo, near the top of Table 2-5 in the chapter, is a

company that provides

comprehensive financial statements. Go to finance.yahoo.com. In the

box next to

“Get Quotes,” type in its ticker symbol PEP and click.

2. Scroll all the way down to “Financials” and click on “Income

Statement.” Compute

the annual percentage change between the three years for the

following:

In: Finance

Overview For this assignment, write a program that will calculate the amount that a customer spends...

Overview

For this assignment, write a program that will calculate the amount that a customer spends on tickets at a movie theater.

This program will be continued in program 3 so it is important that this program is completed.

Basic Program Logic

The basic logic for this program is similar to program 1: the user is asked to enter values, a calculation is performed, and the result of the calculation is displayed.

For this program, prompt the user for the number of adult tickets they would like to purchase. This is an integer value and must be placed into an int variable.

Prompt the user for the number of childrens tickets they would like to purchase. This value should also be placed in an int variable.

Calculate the user's purchase amount using a cost of $11.25 for a single adult ticket and $4.50 for a single child ticket. The purchase amount is the cost of adult tickets plus the cost of childrens tickets.

After the calculation, display the number of adult tickets that were purchased, the number of childrens tickets that were purchased, and the total purchase amount. Use the setw manipulator to line up the last digit of the number of tickets that were purchased and the total purchase amount. The total purchase amount should be displayed with exactly 2 digits after the decimal point, including zeroes.

Program Requirements

-

At the top of the C++ source code, include a documentation box that resembles the one from program 1.Make sure the Date Due and Purpose are updated to reflect the current program.

-

Include line documentation. There is no need to document every single line, but logical "chunks" of code should be preceded by a line or two that describes what the "chunk" of code does. This will be a part of every program that is submitted for the remainder of the semester.

-

The calculated dollar amount should be displayed with exactly 2 digits after the decimal point.

-

The numeric values read in from the user should all be integer values. Use meaningful variable names.

-

Make sure and test the program with values other than the ones supplied in the sample output.

-

Hand in a copy of the source code (CPP file) using Blackboard.

Sample Output

A few runs of the program should produce the following results:

Run 1

Enter the number of adult tickets that are being purchased: 2

Enter the number of child tickets that are being purchased: 5

************************************

Theater Sale

************************************

Number of adult tickets: 2

Number of child tickets: 5

Total purchase: 45.00

Run 2

Enter the number of adult tickets that are being purchased: 1

Enter the number of child tickets that are being purchased: 2

************************************

Theater Sale

************************************

Number of adult tickets: 1

Number of child tickets: 2

Total purchase: 20.25

Run 3

Enter the number of adult tickets that are being purchased: 21

Enter the number of child tickets that are being purchased: 0

************************************

Theater Sale

************************************

Number of adult tickets: 21

Number of child tickets: 0

Total purchase: 236.25

Run 4

Enter the number of adult tickets that are being purchased: 0

Enter the number of child tickets that are being purchased: 0

************************************

Theater Sale

************************************

Number of adult tickets: 0

Number of child tickets: 0

Total purchase: 0.00In: Computer Science

A hotel has 200 rooms and charges two different room rates: rL =$100/ night for...

A hotel has 200 rooms and charges two different room rates: rL = $100/ night for discount fares and rH = $500/ night targeting business travelers. Demand for the discounted rooms exceeds the 200 room hotel capacity.

A. What is the Co (overage cost), in $?

B.What is the Cu, underage cost, in $?

C. What is the critical ratio (round to two digits)?

D. Assuming the demand for high fare rooms has a Normal distribution with mean =50 and standard deviation =15, how many rooms should we protect for high paying customers? (Remember, use whole numbers only)

E. Where should we set our booking limit? (Remember to use whole numbers only)

In: Operations Management

Please show me step by step. Exercise 6A-1 High-Low Method [LO6-10] The Cheyenne Hotel in Big...

Please show me step by step.

Exercise 6A-1 High-Low Method [LO6-10] The Cheyenne Hotel in Big Sky, Montana, has accumulated records of the total electrical costs of the hotel and the number of occupancy-days over the last year. An occupancy-day represents a room rented for one day. The hotel's business is highly seasonal, with peaks occurring during the ski season and in the summer. Month Occupancy-Days Electrical Costs January 1,736 $ 4,127 February 1,904 $ 4,207 March 2,356 $ 5,083 April 960 $ 2,857 May 360 $ 1,871 June 744 $ 2,696 July 2,108 $ 4,670 August 2,406 $ 5,148 September 840 $ 2,691 October 124 $ 1,588 November 720 $ 2,454 December 1,364 $ 3,529 Required: 1. Using the high-low method, estimate the fixed cost of electricity per month and the variable cost of electricity per occupancy-day. (Do not round your intermediate calculations. Round your Variable cost answer to 2 decimal places and Fixed cost element answer to nearest whole dollar amount.) 2. What other factors in addition to occupancy-days are likely to affect the variation in electrical costs from month to month? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Seasonal factors like winter or summer. unchecked Systematic factors like guests, switching off fans and lights. unchecked Number of days present in a month. unchecked Fixed salary paid to hotel receptionist. unchecked Income taxes paid on hotel income. unchecked

In: Accounting

Curtiss Construction Company, Inc., entered into a fixed-price contract with Axelrod Associates on July 1, 2021,...

Curtiss Construction Company, Inc., entered into a fixed-price contract with Axelrod Associates on July 1, 2021, to construct a four-story office building. At that time, Curtiss estimated that it would take between two and three years to complete the project. The total contract price for construction of the building is $4,600,000. The building was completed on December 31, 2023. Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Axelrod under the contract were as follows: At 12-31-2021 At 12-31-2022 At 12-31-2023 Percentage of completion 10 % 60 % 100 % Costs incurred to date $ 369,000 $ 2,940,000 $ 4,960,000 Estimated costs to complete 3,321,000 1,960,000 0 Billings to Axelrod, to date 730,000 2,370,000 4,600,000 Required: 1. Compute gross profit or loss to be recognized as a result of this contract for each of the three years. Curtiss concludes that the contract does not qualify for revenue recognition over time. 2. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute gross profit or loss to be recognized in each of the three years. 3. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute the amount to be shown in the balance sheet at the end of 2021 and 2022 as either cost in excess of billings or billings in excess of costs.

Complete this question by entering your answers in the tabs below.

- Req 1 and 2

- Req 3

1. Compute gross profit or loss to be recognized as a result of this contract for each of the three years. Curtiss concludes that the contract does not qualify for revenue recognition over time. 2. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute gross profit or loss to be recognized in each of the three years. (Leave no cells blank - be certain to enter "0" wherever required. Loss amounts should be indicated with a minus sign.)

Show less

|

In: Accounting