Questions

Posie Bags (PB) is a designer of high-quality backpacks and purses. Each design is made in...

Posie

Bags (PB) is a designer of high-quality backpacks and purses. Each design is made in small batches. Each spring, PB comes out with new designs for the backpack and the purse. The company uses these designs for a year and then moves on to the next trend. The bags are all made on the same fabrication equipment that is expected to operate at capacity. The equipment must be switched over to a new design and set up to prepare for the production of each new batch of products. When completed, each batch of products is immediately shipped to a wholesaler. Shipping costs vary with the number of shipments. Budgeted information for the year is as follows:

LOADING...

(Click the icon to view the budgeted information.)Read the requirements

LOADING...

.

Requirement 1. Identify the cost hierarchy level for each cost category.

|

Cost |

Cost Hierarchy Level |

|

Direct materials—purses |

Output unit-level cost |

|

Direct materials—backpacks |

Output unit-level cost |

|

Direct labor—purses |

Output unit-level cost |

|

Direct labor—backpacks |

Output unit-level cost |

|

Setup |

Batch-level cost |

|

Shipping |

Batch-level cost |

|

Design |

Product-sustaining cost |

|

Plant utilities and administration |

Facility-sustaining cost |

Requirement 2. Identify the most appropriate cost driver for each cost category. Explain briefly your choice of cost driver.

|

Cost |

Cost Driver |

Reason |

|

Direct materials—purses |

Number of purses |

|

|

Direct materials—backpacks |

Number of backpacks |

|

|

Direct labor—purses |

Number of purses |

|

|

Direct labor—backpacks |

Number of backpacks |

|

|

Setup |

Number of batches |

|

|

Shipping |

Number of batches |

|

|

Design |

Number of designs |

|

|

Plant utilities and administration |

Hours of production |

Choose from any drop-down list and then click Check Answer.

|

Clear All |

Check Answer |

Data Table

|

Posie Bags |

|

|

Budget for Costs and Activities |

|

|

For the Year Ended February 29, 2020 |

|

|

Direct materials—purses |

$342,200 |

|---|---|

|

Direct materials—backpacks |

470,850 |

|

Direct manufacturing labor—purses |

87,000 |

|

Direct manufacturing labor—backpacks |

116,100 |

|

Setup |

90,675 |

|

Shipping |

71,370 |

|

Design |

165,000 |

|

Plant utilities and administration |

221,000 |

|

Total |

$1,564,195 |

Other budget information follows:

|

Backpacks |

Purses |

Total |

|

|---|---|---|---|

|

Number of bags |

6,450 |

2,900 |

9,350 |

|

Hours of production |

1,665 |

2,585 |

4,250 |

|

Number of batches |

115 |

80 |

195 |

|

Number of designs |

4 |

2 |

6 |

PrintDone

Requirements

|

1. |

Identify the cost hierarchy level for each cost category. |

|

2. |

Identify the most appropriate cost driver for each cost category. Explain briefly your choice of cost driver. |

|

3. |

Calculate the budgeted cost per unit of cost driver for each cost category. |

|

4. |

Calculate the budgeted total costs and cost per unit for each product line. |

|

5. |

Explain how you could use the information in requirement 4 to reduce costs. |

In: Accounting

Sweeten Company had no jobs in progress at the beginning ofMarch and no beginning inventories....

Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments—Molding and Fabrication. It started, completed, and sold only two jobs during March—Job P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March):

| Molding | Fabrication | Total | |||||||

| Estimated total machine-hours used | 2,500 | 1,500 | 4,000 | ||||||

| Estimated total fixed manufacturing overhead | $ | 14,500 | $ | 17,700 | $ | 32,200 | |||

| Estimated variable manufacturing overhead per machine-hour | $ | 3.20 | $ | 4.00 | |||||

| Job P | Job Q | |||||

| Direct materials | $ | 31,000 | $ | 17,000 | ||

| Direct labor cost | $ | 35,400 | $ | 14,700 | ||

| Actual machine-hours used: | ||||||

| Molding | 3,500 | 2,600 | ||||

| Fabrication | 2,400 | 2,700 | ||||

| Total | 5,900 | 5,300 | ||||

Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month.

Assume that Sweeten Company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units.

Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis

In: Accounting

Lansing, Inc. provides the following information for one of its department’s operations for June (no new...

Lansing, Inc. provides the following information for one of its department’s operations for June (no new material is added in Department T):

| WIP inventory—Department T | ||

| Beginning inventory (15,000 units, 60% complete with respect to Department T costs) | ||

| Transferred-in costs (from Department S) | $ | 116,000 |

| Department T conversion costs | 53,150 | |

| Current work (35,000 units started) | ||

| Prior department costs | 280,000 | |

| Department T costs | 209,050 | |

The ending inventory has 5,000 units, which are 20 percent complete with respect to Department T costs and 100 percent complete for prior department costs.

Required:

a. Complete the production cost report using the weighted-average method. (Round "Cost per equivalent unit" to 2 decimal places.)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In: Accounting

A manufacturing company employs job order costing to account for its costs. There are two production...

A manufacturing company employs job order costing to account for its costs. There are two production departments, and separate departmental overhead application rates are employed because the operations of the departments are distinct. All jobs generally pass through both production departments. Data regarding the hourly direct labor rates, overhead application rates, and three jobs on which work was done during the month appear below. Job 101 and Job 102 were completed during the current month. (CIA Examination adapted)

|

Production Departments |

Direct Labor Rate / hr |

MOH Rate |

|

|

Department 1 |

$21.00 |

50% |

of direct materials |

|

Department 2 |

$26.00 |

75% |

of direct labor cost |

|

Job 101 |

Job 102 |

|

|

Beginning Work-in-Process |

$25,500 |

$32,400 |

|

Direct materials added: |

||

|

Department 1 |

$40,000 |

$26,000 |

|

Department 2 |

$3,000 |

$5,000 |

|

Direct labor hours added: |

||

|

Department 1 |

500 |

400 |

|

Department 2 |

200 |

250 |

QUESTION: What is the total manufacturing cost of Job 102? (Round to the nearest dollar.)

QUESTION: What are the total manufacturing costs added to Job 101 in Department 2? (Round to the nearest dollar.)

QUESTION: What is the total manufacturing cost of Job 101? (Round to the nearest dollar.)

QUESTION: What are the total manufacturing costs added to Job 102 in Department 2? (Round to the nearest dollar.)

QUESTION: What are the total manufacturing costs added to Job 101 in Department 1? (Round to the nearest dollar.)

In: Accounting

COST MANAGEMENT: PLEASE SHOW ALL COMPUTATIONS IN DETAIL PLEASE AND THANK YOU 4. Lau & Lau,...

COST MANAGEMENT: PLEASE SHOW ALL COMPUTATIONS IN DETAIL PLEASE AND THANK YOU

4. Lau & Lau, Ltd. of Hong Kong manufacture two products for the same market. Its budget and operating results for the year just completed follow:

Actual Budget

Unit of sales

Product A 30,000 35,000

Product B 60,000 65,000

Contribution per unit

Product A $4.00 $3.00

Product B 10.00 12.00

Selling price per unit

Product A $10.00 $12.00

Product B 25.00 24.00

At the time of budget preparation, the budgeting department and sales department agreed that the industry volume for the year would likely be 1,500,000 units. Actual industry volume turned out to be 2,000,000 units.

Required:(you may round fractions to three decimal places)

A. What is the average budgeted contribution margin per unit?

B. What is the sales volume contribution margin variance for each product?

C. What is the sales mix contribution margin variance for each product?

D. What is the sales quantity contribution margin variance for each product?

E. What is the market size contribution margin variance?

F. What is the market share contribution margin variance?

G. What is the total flexible budget contribution margin variance?

H. What is the total variable cost price variance if the total contribution margin price variance is $50,000 favorable?

I. What is the total variable cost efficiency variance if the total contribution margin price variance is $50,000 favorable?

In: Accounting

Calculate the following based on 2018 numbers using the attached financial statements for XYZ Corp. Assume...

Calculate the following based on 2018 numbers using the attached financial statements for XYZ Corp. Assume the only variable cost is the cost of goods sold.

- Survival revenues (EBITDA breakeven – includes interest).

- B.NOPAT Breakeven

c) Interpret these values and indicate what you would expect to happen to them if a large addition is made to fixed assets.

Financial Statements for XYZ Corp.

Balance Sheet for Period Ending December 31.

|

Assets |

2017 |

2018 |

|

Cash and Marketable Securities |

40 |

15 |

|

Accounts Receivable |

160 |

80 |

|

Inventories |

250 |

370 |

|

Total Current Assets |

450 |

465 |

|

Gross Plant and Equipment |

675 |

855 |

|

less: Accumulated Depreciation |

250 |

300 |

|

Net Plant and Equipment |

425 |

555 |

|

Total Assets |

875 |

1020 |

|

Liabilities and Equity |

||

|

Accounts Payable |

15 |

30 |

|

Short-term Bank Loans |

35 |

40 |

|

Accrued Liabilities |

55 |

60 |

|

Total Current Liabilities |

105 |

130 |

|

Long-Term Debt |

265 |

360 |

|

Common Stock |

180 |

180 |

|

Retained Earnings |

325 |

350 |

|

Total Equity |

505 |

530 |

|

Total Liabilities and Equity |

875 |

1020 |

Income Statement for the Period Ending December 31.

|

2018 |

|

|

Sales |

1500 |

|

Cost of Goods Sold |

1272 |

|

Gross Profit Margin |

228 |

|

Administrative Expense |

40 |

|

Marketing Expense |

30 |

|

Research and Development |

20 |

|

Depreciation |

50 |

|

Earnings before Interest and Taxes |

88 |

|

Interest Expense |

39 |

|

Income before Taxes |

49 |

|

Income Taxes @ 40% |

20 |

|

Net Income |

29 |

In: Finance

Assume that a bus company increased costs and fears that it will make a loss. What...

Assume that a bus company increased costs and fears that it will

make a loss. What should it do, if to rise the fares may be a wrong

policy.

To help it decide what to do it commissions a survey to estimate

passenger demand at three different fares: the current face of 10c

per km, a higher fare of 12c per km, and a lower fare of 8c. The

results of the survey are shown in the first two columns:

| Fares | Estimated Demand | Total Revenue | Old total cost | New total cost | ||||

| 8 | 6 | 480000 | 360000 | 440000 | ||||

| 10 | 4 | 400000 | 360000 | 440000 | ||||

| 12 | 3 | 360000 | 360000 | 440000 | ||||

Demand turns to be elastic. TR can be increased by reducing the price from current 10 to 8$.

What will happen to the company profits? Its profit is the difference between the total revenue from passengers and its total costs of operating the service. If buses are currently under-utilised , then is possible that the extra passengers can be carried without the need for extra buses with no extra cost..

At the fare of 10c , old profit was 40000. After the rase, a 10c now gives a loss of 40.000$. By raising the fare to 12c- loss increased to 80000$.

Questions:

1) Estimate the price elasticity of demand between 8c and 10c and between 10c and 12c. Show all detailed calculations.

2) 10c fare the best fare originally? Explain your answer detailed.

3) If the company considers lowering the fare to 6c and estimates the demand will be 8.5 million passenger km. What is your opinion, it is good idea? How should it decide?

In: Economics

Wesley power tools manufactures a wide variety of tools and accessories. One of its more popular...

In: Accounting

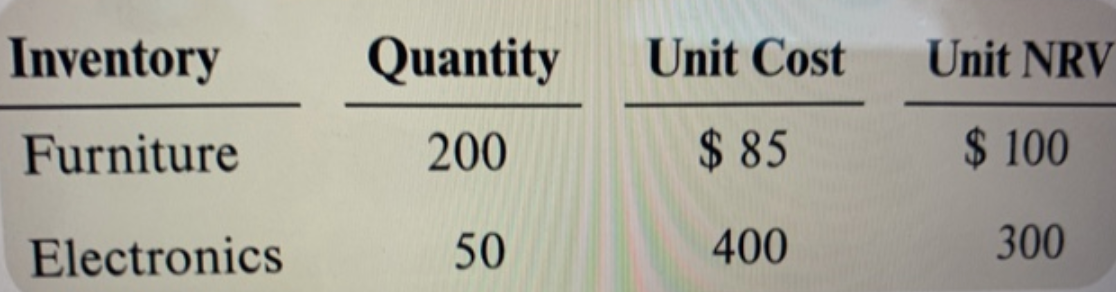

Home furnishings reports inventory using the lower of cost and net realizable value (NRV).

Home furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory.

Required:

1. Calculate the total recorded cost of ending inventory before any adjustments.

2. Calculate ending inventory using the lower of cost and net realizable value.

3. Record any necessary adjustment to inventory.

4. Explain the impact of the adjustment in the financial statements.

In: Accounting

You are appraising a five-year-old, single-family residence. The total square footage of the livable area is...

You are appraising a five-year-old, single-family residence. The total square footage of the livable area is 2,700. The garage is 500 square feet. According to figures obtained from a cost-estimating service, the base construction cost per square foot of livable area is $125 and $80 per square foot for the garage. The lot is valued at $98,000. What is the reproduction cost of the new structure?

SHOW ALL STEPS

In: Finance