Questions

A five (5) year old girl is repeatedly brought to the clinic with history of diarrhea...

A five (5) year old girl is repeatedly brought to the clinic with history of diarrhea and vomiting accompanied by abdominal cramps. History taking reveals that the family stays in a crowded area with very poor sanitation. There is no toilet in their compound and the family uses nearby bushes. The family enjoys vegetable salads. The only source of water for the family and domestic animals is an unprotected nearby stream which is always infested with rotten dead animals. In addition, dirty water is discarded any how around the compound and sometimes it is used in the garden.

Use the above scenario to answer the questions that follow:

a. Explain any five (5) instructive measures you would provide to this family to stop prevent recurrences of diarrhea and vomiting. Explain your points with reasons

b. Describe any five (5) skills required for health history taking. (10 marks

In: Nursing

Manning Company had the following inventory balances at the beginning and end of the year: January...

Manning Company had the following inventory balances at the

beginning and end of the year:

|

January 1 |

December 31 |

|

|

Raw material |

$60,000 |

$50,000 |

|

Work in process |

140,000 |

180,000 |

|

Finished goods |

280,000 |

255,000 |

During the year, the company purchased $100,000 of raw material and

incurred $340,000 of direct labor costs.

Other data: manufacturing overhead incurred, $440,000; manufacturing overhead applied, $450,000

Sales, $1,560,000;

Selling and administrative expenses, $90,000;

Income tax rate, 30%.

Required:

A. Calculate cost of goods manufactured.

B. Calculate cost of goods sold.

C. Determine Manning's net income. (prepare an income

statement)

In: Accounting

Note: This problem is for the 2018 tax year. Lance H. and Wanda B. Dean are...

Note: This problem is for the 2018 tax year.

Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501. Lance works for the convention bureau of the local Chamber of Commerce, while Wanda is employed part-time as a paralegal for a law firm.

During 2018, the Deans had the following receipts:

|

Wanda was previously married to John Allen. When they divorced several years ago, Wanda was awarded custody of their two children, Penny and Kyle. (Note: Wanda has never issued a Form 8332 waiver.) Under the divorce decree, John was obligated to pay alimony and child support—the alimony payments were to terminate if Wanda remarried.

In July, while going to lunch in downtown Santa Fe, Wanda was injured by a tour bus. As the driver was clearly at fault, the owner of the bus, Roadrunner Touring Company, paid her medical expenses (including a one-week stay in a hospital). To avoid a lawsuit, Roadrunner also transferred $90,000 to her in settlement of the personal injuries she sustained.

The Deans had the following expenditures for 2018:

|

The life insurance policy was taken out by Lance several years ago and designates Wanda as the beneficiary. As a part-time employee, Wanda is excluded from coverage under her employer's pension plan. Consequently, she provides for her own retirement with a traditional IRA obtained at a local trust company. Because the mayor is a member of the local Chamber of Commerce, Lance felt compelled to make the political contribution.

The Deans' household includes the following, for whom they provide more than half of the support:

|

Penny graduated from high school on May 9, 2018, and is undecided about college. During 2018, she earned $8,500 (placed in a savings account) playing a harp in the lobby of a local hotel. Wayne is Wanda's widower father who died on January 20, 2018. For the past few years, Wayne qualified as a dependent of the Deans.

Federal income tax withheld is $5,200 (Lance) and $2,100 (Wanda). The proper amount of Social Security and Medicare tax was withheld.

Required:

Determine the Federal income tax for 2018 for the Deans on a joint return by providing the following information that would appear on Form 1040 and Schedule A. They do not want to contribute to the Presidential Election Campaign Fund. All members of the family had health care coverage for all of 2018. If an overpayment results, it is to be refunded to them.

Make realistic assumptions about any missing data.

Enter all amounts as positive numbers.

If an amount box does not require an entry or the answer is zero, enter "0".

When computing the tax liability, do not round your immediate calculations. If required round your final answers to the nearest dollar.

Provide the following that would be reported on Lance and Wanda Dean's Form 1040.

1. Filing status and dependents: The taxpayers'

filing status:

Married filing jointly

Qualifies as the taxpayers' dependent: Select "Yes" or

"No".

Penny: Yes

Kyle: Yes

2. Calculate taxable gross income.

3. Calculate the total adjustments for AGI.

4. Calculate adjusted gross income.

5. Calculate the greater of the standard deduction or itemized deductions.

6. Calculate total taxable income.

7. Calculate the income tax liability.

8. Calculate the total tax credits available.

9 Calculate total withholding and tax payments.

10. Calculate the amount overpaid (refund):

11. Calculate the amount of taxes

owed:

Schedule A Tax Items

Provide the following that would be reported on Lance and Wanda Dean's Schedule A.

1. Calculate the deduction allowed for medical expenses.

2. Calculate the deduction for taxes.

3. Calculate the deduction for interest.

4. Calculate the charitable contribution deduction allowed.

5. Calculate total itemized deductions.

2018 Tax Rate Schedules

Use the 2018 Tax Rate Schedules to compute the tax.

Note: Because the tax rate schedules are used instead of the tax tables, the amount of tax computed may vary slightly from the amount listed in the tables. This variation occurs because the tax for a particular income range in the tax table is based on the midpoint amount.

| 2018 Tax Rate Schedules | |||||||||||||||||||

| Single—Schedule X | Head of household—Schedule Z | ||||||||||||||||||

| If taxable income is: Over— |

But not over— |

The tax is: | of the amount over— |

If taxable income is: Over— |

But not over— |

The tax is: | of the amount over— |

||||||||||||

| $0 | $9,525 | . . . . . . | 10% | $0 | $0 | $13,600 | . . . . . . | 10% | $0 | ||||||||||

| 9,525 | 38,700 | $952.50 | + | 12% | 9,525 | 13,600 | 51,800 | $1,360.00 | + | 12% | 13,600 | ||||||||

| 38,700 | 82,500 | 4,453.50 | + | 22% | 38,700 | 51,800 | 82,500 | 5,944.00 | + | 22% | 51,800 | ||||||||

| 82,500 | 157,500 | 14,089.50 | + | 24% | 82,500 | 82,500 | 157,500 | 12,698.00 | + | 24% | 82,500 | ||||||||

| 157,500 | 200,000 | 32,089.50 | + | 32% | 157,500 | 157,500 | 200,000 | 30,698.00 | + | 32% | 157,500 | ||||||||

| 200,000 | 500,000 | 45,689.50 | + | 35% | 200,000 | 200,000 | 500,000 | 44,298.00 | + | 35% | 200,000 | ||||||||

| 500,000 | . . . . . . | 150,689.50 | + | 37% | 500,000 | 500,000 | . . . . . . | 149,298.00 | + | 37% | 500,000 | ||||||||

| Married filing jointly or Qualifying widow(er)—Schedule Y-1 | Married filing separately—Schedule Y-2 | ||||||||||||||||||

| If taxable income is: Over— |

But not over— |

The tax is: | of the amount over— |

If taxable income is: Over— |

But not over— |

The tax is: | of the amount over— |

||||||||||||

| $0 | $19,050 | . . . . . . | 10% | $0 | $0 | $9,525 | . . . . . . | 10% | $0 | ||||||||||

| 19,050 | 77,400 | $1,905.00 | + | 12% | 19,050 | 9,525 | 38,700 | $952.50 | + | 12% | 9,525 | ||||||||

| 77,400 | 165,000 | 8,907.00 | + | 22% | 77,400 | 38,700 | 82,500 | 4,453.50 | + | 22% | 38,700 | ||||||||

| 165,000 | 315,000 | 28,179.00 | + | 24% | 165,000 | 82,500 | 157,500 | 14,089.50 | + | 24% | 82,500 | ||||||||

| 315,000 | 400,000 | 64,179.00 | + | 32% | 315,000 | 157,500 | 200,000 | 32,089.50 | + | 32% | 157,500 | ||||||||

| 400,000 | 600,000 | 91,379.00 | + | 35% | 400,000 | 200,000 | 300,000 | 45,689.50 | + | 35% | 200,000 | ||||||||

| 600,000 | . . . . . . | 161,379.00 | + | 37% | 600,000 | 300,000 | . . . . . . | 80,689.50 | + | 37% | 300,000 | ||||||||

In: Accounting

Suppose that it is January, and your bank makes a $1 million loan with a one-year...

In: Finance

A 48-year-old woman comes to the clinic for a routine wellness checkup. In speaking with the...

A 48-year-old woman comes to the clinic for a routine wellness checkup. In speaking with the nurse, the patient reports she has an intermittent aching feeling in her left lower abdomen and feels sluggish at times. She describes herself as a “couch potato” and says she gets a lot of exercise at her job and driving her sons to various activities. When the nurse palpates the abdominal area, the patient denies pain at the time but expresses that she is getting tired of feeling this ache and cannot explain why it is there. The patient is a busy mother of three boys and works from 7 am to 3 pm daily in a day care center near her home.

- Identify the clinical problem(s) in the case study.

- In speaking further with the patient, the nurse discovers that the patient does not eat breakfast because of her early work schedule and that she routinely eats a lunch consisting of a banana, diet soda, and pizza. The patient also reports her last bowel movement was 3 days ago, which is a change in her bowel habits. Based on all the information so far, what problem(s) should the nurse consider the patient may have?

- After a thorough examination and testing, it is determined that the patient’s symptoms are due to constipation. Explain what education the nurse can provide to the patient to assist her in dealing with this problem.

In: Nursing

The statement of profit or loss for Blue Cross (Pty) Ltd for the financial year ended...

The statement of profit or loss for Blue Cross (Pty) Ltd for the financial year ended 28 February 2019 is as follows:

R

Sales (note 1) 2000 000

Cost of sales (800 000)

Gross profit 1200 000

Salaries (450 000)

Depreciation (note 3) (100 000)

Repairs (15 000)

Profit from the sale of machinery (note 4) 30 000

Local dividends received 35 000

Interest received 28 000

Profit before tax 728 000

Note 1

Blue Cross (Pty) Ltd received a payment in advance of R40 000 from a customer. At year-end the goods still had to be delivered to the customer. This amount has not yet been recognised as revenue for accounting purposes.

Note 2

Blue Cross (Pty) Ltd entered into learnership agreements that qualify for allowances in terms of s 12H. The allowance amounts to R60 000.

Note 3

The equipment qualified for an accelerated allowance of R150 000 in terms of s 12C during the 2019 year of assessment.

Note 4

The machinery was sold for R320 000 on 30 August 2018. The recoupment of allowance for tax purposes amounted to R20 000. A capital gain of R50 000 arose on the disposal.

Statutory tax rate is 28%

Calculate the normal taxable payable by Blue Cross (Pty) Ltd for year of assessment ended on 28 February 2019.

In: Accounting

The Construction cost of the bypass is 20 million and 500,000 would be required each year...

The Construction cost of the bypass is 20 million and 500,000 would be required each year for annual maintenance. The annual benefits to the public have been estimated to be 2 million. If the study period is 50 years and the government interest rates is 8% per year, a.) Should the bypass be constructed? B.)What impact does a social interest rate of 4% per year have on the B-C ratio of the project

In: Economics

A manufacturer of the famous swimwear line needs help planning production for next year.

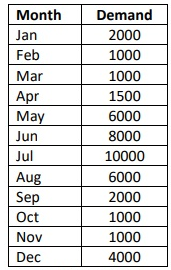

A manufacturer of the famous swimwear line needs help planning production for next year. Demand for swimwear follows a seasonal pattern, as shown below. Given the following costs and demand forecasts

Beginning workforce: 12 workers

Beginning inventory: 0

Subcontracting capacity: unlimited

Overtime capacity: 2000 units/month

Production rate per worker: 200 units/month

Regular wage rate : $10 per unit

Overtime wage rate: $20 per unit

Subcontracting cost: $25 per unit

Hiring cost: $150 per worker Firing cost: $250 per worker

Holding cost: $0.75 per unit/month

Backordering cost: $5 per unit/month

a. Level production with overtime and subcontracting, as needed.

b. Level production with backorders as needed.

c. 4000 units regular production from May through September and as much regular, over- time, and subcontracting production in the other months as needed to meet annual demand.

d. Which strategy would you recommend?

In: Finance

We are in year 2012. In this question, we will calculate Rosengarten’s enterprise value in 2012...

We are in year 2012. In this question, we will calculate Rosengarten’s enterprise value in 2012 using the discounted cash flow approach (as opposed to the multiples approach). For your convenience, Rosengarten’s projected free cash flows for the next three years are repeated in the table below.

| 2013 | 2014 | 2015 | |

| FCF ($M) | -501.5 | 101 | 305.9 |

Rosengarten projects that its free cash flows will grow at a

constant rate of 5% after 2015. The cost of capital for

Rosengarten’s assets is 10%.

a) What is Rosengarten’s free cash flow in 2016?

b) What is Rosengarten’s enterprise value in 2015 afterthe

firmgenerates the year’s free cash flow?

c) What is Rosengarten’s enterprise value in 2012?

In: Finance

1. The current interest rate in the US is 8% per year, while it is 10%...

In: Finance