Questions

Suppose a perfectly competitive firm has the followingtotal cost function for the short run (STC):...

Suppose a perfectly competitive firm has the following total cost function for the short run (STC):

STC = 5,000 + 150Q – 12Q2 + (1/3)Q3.

a. Determine its profit-maximizing or loss-minimizing output for the short run, given that the market price of its product is $330 per unit.

b. What will be the firm’s short-run profit or loss?

c. Now disregard the preceding cost function, and suppose its long-run total cost (LTC) is

LTC = 660Q – 9Q2 + 0.05Q3

i. Write an equation for long-run average cost.

ii. Indicate the firm’s long-run price, quantity sold, and profit, assuming the industry is in long-run equilibrium.

In: Economics

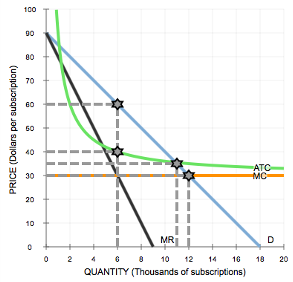

9. Regulating a natural monopoly Consider the local telephone company, a natural monopoly. The following graph...

9. Regulating a natural monopoly

Consider the local telephone company, a natural monopoly. The following graph shows the monthly demand curve for phone services and the company's marginal revenue (MR), marginal cost (MC), and average total cost (ATC) curves.

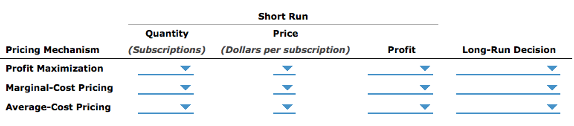

Suppose that the government has decided not to regulate this industry, and the firm is free to maximize profits, without constraints.

Complete the first row of the following table.

Suppose that the government forces the monopolist to set the price equal to average total cost.

Complete the third row of the previous table.

True or False: Over time, the telephone company has a very strong incentive to lower costs when subject to average-cost pricing regulations.

True

False

In: Economics

The controller of Blossom Production has collected the following monthly expense data for analyzing the cost...

The controller of Blossom Production has collected the following

monthly expense data for analyzing the cost behavior of electricity

costs.

| Total Electricity Costs |

Total Machine Hours |

|||||||

| January | $2,660 | 230 | ||||||

| February | 3,050 | 330 | ||||||

| March | 3,520 | 460 | ||||||

| April | 4,770 | 690 | ||||||

| May | 3,190 | 420 | ||||||

| June | 4,960 | 790 | ||||||

| July | 4,030 | 650 | ||||||

| August | 3,870 | 590 | ||||||

| September | 5,040 | 670 | ||||||

| October | 4,270 | 610 | ||||||

| November | 3,260 | 330 | ||||||

| December | 6,720 | 810 | ||||||

What electricity cost does the cost equation estimate for a

level of activity of 790 machine hours?

| Electricity costs | $ |

By what amount does this differ from June’s observed cost for 790

machine hours?

| Amount differ | $ |

In: Accounting

Question 5 The extra cost that results from carrying out one additional unit of an activity...

Question 5

The extra cost that results from carrying out one additional unit

of an activity is the _____ of the activity.

⦁ marginal benefit

⦁ reservation cost

⦁ marginal cost

⦁ opportunity cost

Question 7

The demand for a good is said to be elastic with respect to price

if the absolute value of its price elasticity is ____________ than

1.

A. smaller as well as greater

B. greater

C. smaller

D. equal to and greater

Question 10

Marginal utility is defined as the:

A. additional utility gained by consuming an extra

unit of a good.

B. total utility from all units consumed of a

good.

C. average utility gained by consuming an average

amount of the good.

D. total utility gained by consuming an extra unit of

a good.

In: Accounting

Lampshire Inc. is considering using stocks of an old raw material in a special project. The...

Lampshire Inc. is considering using stocks of an old raw material in a special project. The special project would require all 160 kilograms of the raw material that are in stock and that originally cost the company $2,336 in total. If the company were to buy new supplies of this raw material on the open market, it would cost $7.85 per kilogram. However, the company has no other use for this raw material and would sell it at the discounted price of $7.15 per kilogram if it were not used in the special project. The sale of the raw material would involve delivery to the purchaser at a total cost of $87 for all 160 kilograms. What is the relevant cost of the 160 kilograms of the raw material when deciding whether to proceed with the special project?

In: Accounting

The costs per unit and period for Milligan Exploration for all relevant ranges of activity is...

The costs per unit and period for Milligan Exploration for all relevant ranges of activity is as follows:

Cost per Unit Cost per Period

Selling price per unit 14.25

Direct materials 5.00

Direct labor 2.90

Variable manufacturing overhead 1.25

Fixed manufacturing overhead - $21,000

Sales commissions 1.00

Variable administrative expense 0.55

Fixed selling and administrative exp. $7,500

1. If Milligan produces 4,200 units, what is the total amount of direct manufacturing cost incurred?

2. If 5,000 units are produced by Milligan, what is the total amount of indirect manufacturing overhead cost incurred?

3. What is Milligan’s contribution margin per unit sold?

In: Accounting

Process Costing Tempe Manufacturing Company makes a single product that is produced on a continuous basis...

Process Costing Tempe Manufacturing Company makes a single product that is produced on a continuous basis in one department. All materials are added at the beginning of production. The total cost per equivalent unit in process in March 2009 was $4.60, consisting of $3.00 for materials and $1.60 for conversion. During the month, 8,700 units of product were transferred to finished goods inventory; on March 31, 2,000 units were in process, 10 percent converted. The company uses weighted average costing.

(a) Determine the cost of goods transferred to finished goods inventory.

40,020

(b) Determine the cost of the ending work-in-process inventory.

(c) What was the total cost of the beginning work-in-process inventory plus the current manufacturing costs?

In: Accounting

3) SportsMart sells 500,000 baseballs annually. The baseballs cost SportsMart $24 per dozen ($2.00 each). Annual...

3) SportsMart sells 500,000 baseballs annually. The baseballs cost SportsMart $24 per dozen ($2.00 each). Annual inventory carrying costs are 25% of inventory value and the cost of placing and receiving an order are $78. Determine the:

A) Economic Order Quantity

B) Total annual inventory costs of this policy

C) Optimal ordering frequency

4) Nike sells 1,000,000 basketballs annually. The baseballs cost Nike $180 per dozen ($15.00 each). Annual inventory carrying costs are 20% of inventory value and the cost of placing and receiving an order are $150. Determine the:

A) Economic Order Quantity

B) Total annual inventory costs of this policy

C) Optimal ordering frequency

In: Finance

Jarvene Corporation uses the FIFO method in its process costing system. The following data are for...

Jarvene Corporation uses the FIFO method in its process costing system. The following data are for the most recent month of operations in one of the company’s processing departments:

| Units in beginning inventory | 440 |

| Units started into production | 4,260 |

| Units in ending inventory | 280 |

| Units transferred to the next department | 4,420 |

| Materials | Conversion | |||

| Percentage completion of beginning inventory | 70 | % | 30 | % |

| Percentage completion of ending inventory | 70 | % | 50 | % |

The cost of beginning inventory according to the company’s costing system was $7,896 of which $4,847 was for materials and the remainder was for conversion cost. The costs added during the month amounted to $179,388. The costs per equivalent unit for the month were:

| Materials | Conversion | |

| Cost per equivalent unit | $18.00 | $23.00 |

Required:

1. Compute the total cost per equivalent unit for the month.

2. Compute the equivalent units of material and conversion in the ending inventory.

3. Compute the equivalent units of material and conversion that were required to complete the beginning inventory.

4. Compute the number of units started and completed during the month.

5. Compute the cost of ending work in process inventory for materials, conversion, and in total for the month.

6. Compute the cost of the units transferred to the next department for materials, conversion, and in total for the month.

In: Accounting

Rip Tide Company manufactures surfboards. Its standard cost information follows: Standard Quantity Standard Price (Rate) Standard...

Rip Tide Company manufactures surfboards. Its standard cost

information follows:

| Standard Quantity | Standard Price (Rate) | Standard Unit Cost | ||||||

| Direct materials (fiberglass) | 15 | sq. ft. | $ | 5 | per sq. ft. | $ | 75.00 | |

| Direct labor | 10 | hrs. | $ | 15 | per hr. | 150.00 | ||

| Variable manufacturing overhead (based on direct labor hours) | 10 | hrs. | $ | 6 | per hr. | 60.00 | ||

| Fixed manufacturing overhead ($24,000 ÷ 300 units) | 80.00 | |||||||

Rip Tide has the following actual results for the month of

June:

| Number of units produced and sold | 316 | |

| Number of square feet of fiberglass used | 4,960 | |

| Cost of fiberglass used | $ | 28,272 |

| Number of labor hours worked | 3,100 | |

| Direct labor cost | $ | 48,050 |

| Variable overhead cost | $ | 15,190 |

| Fixed overhead cost | $ | 24,800 |

Required:

1. Calculate the direct materials price, quantity,

and total spending variances for Rip Tide.

2. Calculate the direct labor rate, efficiency, and total spending variances for Rip Tide.

3. Calculate the variable overhead rate, efficiency, and total spending variances for Rip Tide.

4. Calculate the fixed overhead spending (budget) and volume variances for Rip Tide.

In: Accounting