Questions

PROBLEM 2-21B Predetermined Overhead Rate; Disposition of Underapplied or Overapplied Overhead (LO1, LO7) CHECK FIGURE (2)...

PROBLEM 2-21B Predetermined Overhead Rate; Disposition of Underapplied or Overapplied Overhead (LO1, LO7)

CHECK FIGURE

(2) Underapplied: $68,600

Adriana Company is highly automated and uses computers to control manufacturing operations. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of computer-hours. The following estimates were used in preparing the predetermined overhead rate at the beginning of the year:

|

Computer-hours |

82,000 |

|

Fixed manufacturing overhead cost |

$1,278,000 |

|

Variable manufacturing overhead per computer-hour |

$3.40 |

During the year, a severe economic recession resulted in cutting back production and a buildup of inventory in the company’s warehouse. The company’s cost records revealed the following actual cost and operating data for the year:

|

Computer-hours |

60,000 |

|

Manufacturing overhead cost |

$1,208,000 |

|

Inventories at year-end: |

|

|

Raw materials |

$420,000 |

|

Work in process |

$120,000 |

|

Finished goods |

$1,030,000 |

|

Cost of goods sold |

$2,770,000 |

Required:

1. Compute the company’s predetermined overhead rate for the year.

2. Compute the underapplied or overapplied overhead for the year.

3. Assume the company closes any underapplied or overapplied overhead directly to cost of goods sold. Prepare the appropriate entry. Will this entry increase or decrease net operating income?

Schedules of Cost of Goods Manufactured and Cost of Goods Sold; Income Statement (LO6)

CHECK FIGURE

Direct labor: $57,000

Alexsandar Company provided the following account balances for the year ended December 31 (all raw materials are used in production as direct materials):

|

Selling expenses |

$217,000 |

|

Purchases of raw materials |

$263,000 |

|

Direct labor |

? |

|

Administrative expenses |

$151,000 |

|

Manufacturing overhead applied to work in process |

$336,000 |

|

Total actual manufacturing overhead costs |

$359,000 |

Inventory balances at the beginning and end of the year were as follows:

|

Beginning of Year |

End of Year |

|

|

Raw materials |

$59,000 |

$30,000 |

|

Work in process |

? |

$29,000 |

|

Finished goods |

$37,000 |

? |

The total manufacturing costs for the year were $685,000; the cost of goods available for sale totaled $725,000; the unadjusted cost of goods sold totaled $663,000; and the net operating income was $39,000. The company’s overapplied or underapplied overhead is closed entirely to cost of goods sold.

Required:

Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement. (Hint: Prepare the income statement and schedule of cost of goods sold first followed by the schedule of cost of goods manufactured.)

In: Accounting

Koshu Corporation

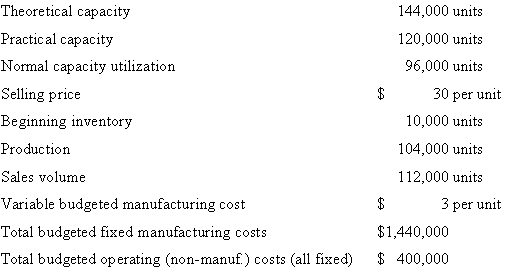

Denominator-level choices, changes in inventory levels, effect on operating income. Koshu Corporation is a manufacturer of computer accessories. It uses absorption costing based on standard costs and reports the following data for 2009:

There are no price spending, or efficiency variances. Actual operating costs equal budgeted operating costs. The production-volume variance is written off to cost of goods sold. For each choice of denominator level, the budgeted production cost per unit is also the cost per unit of beginning inventory..

1. What is the production-volume variance in 2009 when the denominator level is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization?

2. Prepare absorption costing—based income statements for Koshu Corporation using theoretical capacity, practical capacity, and normal capacity utilization as the denominator levels.

3. Why is the operating income under normal capacity utilization lower than the other two scenarios?

4. Reconcile the difference in operating income based on theoretical capacity and practical capacity with the difference in fixed manufacturing overhead included in inventory.

In: Statistics and Probability

Fancy Foot Cat Biscuits Company manufactures cat treats. The company has the following actual data for...

Fancy Foot Cat Biscuits Company manufactures cat treats. The company has the

following actual data for January and February 20xx.

January February

Beginning inventory in kilograms 0 2,000

Production in kilograms 20,000 20,000

Sales in kilograms 18,000 21,000

Variable manufacturing costs per unit produced $8 $8

Variable marketing costs per unit sold $2 $2

Fixed manufacturing costs $30,000 $30,000

Fixed marketing costs $5,000 $5,000

The selling price per kilogram is $20.00. The budgeted level of

production used to calculate the budgeted fixed manufacturing cost

per unit is 20,000 kilograms. There

is no price, efficiency or spending variance. Any production-volume

variance is written off to cost of goods sold in the month in which

it occurs.

1. Prepare the January and February income statements for Fancy Foot Cat

Biscuits under: a) variable costing and b) absorption costing

2. Prepare a numerical reconciliation and explanation of the difference in the

income each month between variable costing and absorption costing.

In: Accounting

i. if the typical market basket of goods and services cost $400 in 1995, and the...

i. if the typical market basket of goods and services cost $400 in 1995, and the price index (base year 1992 )for 1995 is 120, then if this same typical bundle cost $420 in 1996, the price index in 1996 would be:

a.120

b.between 120 and 125

c.125

d.above 125

ii.supposez the non-institutionalized population over age 15 is 20 million, 10 million of whome are female, the labour force is 16 million, 6 million of whome are female, and the number of people employed is 15 million, 5.5 million of whome are female. the female participation rate is:

a. 10/20

b. 6/16

c. 5.5/15

d. 6/10

iii.consider an economy in which the current level of income is $700b, the multiplier is 3, the marginal tax rate is 20%, and the current budget deficit is $20b. suppose the government increases the spending to increase GDP to $715b, the budget dificit becomes:

a. less than or equal to $20b

b. more than $20b but not more than $23b

c. more than $23b but not more than $26b

d. more than $26b

In: Economics

Nascar Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to April...

Nascar Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to April and May 2017 are as follows:

|

April |

May |

|

|

Unit data: |

||

|

Beginning inventory |

0 |

50 |

|

Production |

600 |

525 |

|

Sales |

550 |

545 |

|

Variable costs: |

||

|

Manufacturing cost per unit produced |

$9,000 |

$9,000 |

|

Operating (marketing) cost per unit sold |

4,000 |

4,000 |

|

Fixed costs: |

||

|

Manufacturing costs |

$2,250,000 |

$2,250,000 |

|

Operating (marketing) costs |

725,000 |

725,000 |

The selling price per vehicle is $29,000. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 600 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to the cost of goods sold in the month in which it occurs.

| Prepare April and May 2017 income statements for Nascar Motors under (a) variable costing and (b) absorption costing. |

|

|

2. |

Prepare a numerical reconciliation and explanation of the difference between operating income for each month under variable costing and absorption costing. |

In: Accounting

Briefly answer the following questions. Consider the followingstatements In a Mixed economy there is only private...

Briefly answer the following questions.

- Consider the followingstatements

- In a Mixed economy there is only private ownership of means of production

- In a communist nation, the means of production are owned by the state

- In a free-market economy there is minimum role of the government.

Which of the above three statements is/are true?

b. Answer the following:

- Who is credited with bringing the term the ‘’invisible hand’’ in economics? And what it means?

- Why intermediate goods are not included to calculate the final output? Explain with an example

- If we compare GDP and GNP, then, GNP= GDP+ net income from abroad explain true or false.

- What policy options might be used by Government to lower unemployment? Reduce government spending or Increase interest rates or lower taxation and why?

- Explain the Monetary Policy, its types and its importance in GDP growth? What type of monetary policy does Pakistan have and what repercussions have we faced due to our monetary policy in history? ( time frame; 2000 onwards)

- Evaluate money supply with reference to inflation and unemployment? Explain by graphical representation.

In: Economics

For this question, specify what happens in the money market, goods market and labor market, when...

In: Economics

1) Albert has an investment worth 275,042 dollars. The investment will make a special payment of...

1) Albert has an investment worth 275,042 dollars. The investment will make a special payment of X dollars to Albert in 7 month(s) and the investment also will make regular, fixed monthly payments of 2,390 dollars to Albert forever. The expected return for the investment is 0.92 percent per month and the first regular, fixed monthly payment of 2,390 dollars will be made to Albert in 1 month. What is X, the amount of the special payment that will be made to Albert in 7 month(s)?

2) An investment is expected to generate annual cash flows forever. The first annual cash flow is expected in 1 year and all subsequent annual cash flows are expected to grow at a constant rate annually. We know that the cash flow expected in 3 year(s) from today is expected to be 1,600 dollars and the cash flow expected in 8 years from today is expected to be 3,320 dollars. What is the cash flow expected to be in 5 years from today?

3) An investment, which has an expected return of 13.2 percent, is expected to make annual cash flows forever. The first annual cash flow is expected in 1 year and all subsequent annual cash flows are expected to grow at a constant rate of 2.28 percent per year. The cash flow in 1 year from today is expected to be 33,260 dollars. What is the present value (as of today) of the cash flow that is expected to be made in 4 years?

4) Indigo River Banking just bought a new race track. To pay for the race track, the company took out a loan that requires Indigo River Banking to pay the bank a special payment of 19,710 dollars in 7 month(s) and also pay the bank regular payments. The first regular payment is expected to be 4,860 dollars in 1 month and all subsequent regular payments are expected to increase by 0.31 percent per month forever. The interest rate on the loan is 1.9 percent per month. What was the price of the race track?

5) You own a store that is expected to make annual cash flows forever. The cost of capital for the store is 10.72 percent. The next annual cash flow is expected in one year from today and all subsequent cash flows are expected to grow annually by 1.27 percent. What is the value of the store if you know that the cash flow in 7 years from today is expected to be 13,100?

6) Goran has an investment worth 75,779 dollars. The investment will make a special payment of X to Goran in 5 quarters in addition to making regular quarterly payments to Goran forever. The first regular quarterly payment to Goran is expected to be 2,000 dollars and will be made in 3 months. All subsequent regular quarterly payments are expected to increase by 0.42 percent per quarter forever. The expected return for the investment is 3.6 percent per quarter. What is X, the amount of the special payment that will be made to Goran in 5 quarters?

In: Finance

Thalassines Kataskeves, S.A., of Greece makes marine equipment. The company has been experiencing losses on its...

|

Thalassines Kataskeves, S.A., of Greece makes marine equipment. The company has been experiencing losses on its bilge pump product line for several years. The most recent quarterly contribution format income statement for the bilge pump product line follows: |

|

Thalassines Kataskeves, S.A. Income Statement—Bilge Pump For the Quarter Ended March 31 |

||||||

| Sales | $ | 440,000 | ||||

| Variable expenses: | ||||||

| Variable manufacturing expenses | $ | 133,000 | ||||

| Sales commissions | 41,000 | |||||

| Shipping | 23,000 | |||||

| Total variable expenses | 197,000 | |||||

| Contribution margin | 243,000 | |||||

| Fixed expenses: | ||||||

| Advertising | 29,000 | |||||

| Depreciation of equipment (no resale value) | 116,000 | |||||

| General factory overhead | 49,000 | * | ||||

| Salary of product-line manager | 113,000 | |||||

| Insurance on inventories | 9,000 | |||||

| Purchasing department | 47,000 | † | ||||

| Total fixed expenses | 363,000 | |||||

| Net operating loss | $ | (120,000 | ) | |||

| *Common costs allocated on the basis of machine-hours. |

| †Common costs allocated on the basis of sales dollars. |

|

Discontinuing the bilge pump product line would not affect sales of other product lines and would have no effect on the company’s total general factory overhead or total Purchasing Department expenses. |

| Required | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| a. |

Compute the increase or decrease of net operating income if the product line is continued or discontinued. (Decreases should be indicated by a minus sign.)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| b. | Would you recommend that the bilge pump product line be discontinued? | ||||

|

In: Accounting

During 2021, its first year of operations, Hollis Industries recorded sales of $10,600,000 and experienced returns...

During 2021, its first year of operations, Hollis Industries recorded sales of $10,600,000 and experienced returns of $720,000. Cost of goods sold totaled $6,360,000 (60% of sales). The company estimates that 8% of all sales will be returned. Prepare the year-end adjusting journal entries to account for anticipated sales returns under the assumption that all sales are made for cash (no accounts receivable are outstanding).

In: Accounting