Questions

a. ABC Co. issues $100,000, 4%, 10 year bonds when the prevailing market rate of interest...

a. ABC Co. issues $100,000, 4%, 10 year bonds when the prevailing market rate of interest is 5%. The bonds pay interest annually. Compute the issue price of the bonds.

b. ABC Co. issues $100,000, 4%, 10 year bonds when the prevailing market rate of interest is 5%. The bonds pay interest semi-annually. Compute the issue price of the bonds.

c. ABC Co. issues $500,000, 10%, 10 year bonds when the prevailing market rate of interest is 9%. The bonds pay interest annually. Compute the issue price of the bonds.

d. ABC Co. issues $500,000, 10%, 10 year bonds when the prevailing market rate of interest is 9%. The bonds pay interest semi-annually. Compute the issue price of the bonds.

In: Accounting

On 1/1/X1, Tractor Co. sold a new combine to Jim’s U-Pick farm. The purchase agreement 8.4...

In: Accounting

ABC Construction Co. signed a $2,000,000 contract to construct an office building for the State of...

ABC Construction Co. signed a $2,000,000 contract to construct an office building for the State of Arizona. The project will begin in 2017 and be completed in 2018. The cost of construction is expected to be $1,875,000.

Below is a summary of events for 2017 and 2018:

|

2017 |

2018 |

||

|

Costs incurred during the year |

$ 712,500 |

$1,138,250 |

|

|

Estimated costs to complete |

1,037,500 |

0 |

|

|

Billings during the year |

850,000 |

1,150,000 |

|

|

Cash collections during the year |

750,000 |

1,000,000 |

ABC Construction Co. recognizes revenue upon completion when accounting for long-term contracts.

a. Prepare all journal entries to record costs, billings, collections, and any profit recognition for ABC Construction Co. activities for 2017 only.

b. Prepare any journal entry needed for profit recognition only for ABC Construction Co. activities for 2018.

In: Accounting

write a one page summmary on Minutes of the Federal Open Market Committee Developments in Financial...

write a one page summmary on Minutes of the Federal Open Market Committee

Developments in Financial Markets and Open Market

Operations

The deputy manager of the System Open Market Account (SOMA)

provided a summary of developments in domestic and global financial

markets over the intermeeting period; she also reported on open

market operations and related issues. Financial markets experienced

a notable bout of volatility early in the intermeeting period;

volatility was particularly pronounced in equity markets. Market

participants pointed to incoming economic data released in early

February--particularly data on average hourly earnings--as raising

concerns about the prospects for higher inflation and higher

interest rates. These concerns reportedly contributed to a steep

decline in equity prices and an associated rise in measures of

volatility. Some reports suggested that the increase in volatility

was amplified by the unwinding of trading positions based on

various types of volatility trading strategies. Measures of equity

market volatility declined over subsequent weeks but remained above

levels that prevailed earlier in the year, and stock prices

finished lower, on net, over the intermeeting period. Interest

rates rose modestly over the period. Respondents to the Open Market

Desk's surveys of primary dealers and market participants suggested

that revisions in investors' views regarding the fiscal outlook

were an important factor boosting yields and contributing to a

slightly steeper expected trajectory of the federal funds rate. The

deputy manager noted that a rapid and sizable increase in Treasury

bill issuance over recent weeks had put upward pressure on money

market yields over the period. Three-month Treasury bill yields

moved up significantly and those increases passed through to rates

on other short-term instruments such as three-month Eurodollar

deposits and commercial paper. The spread of market rates on

overnight repurchase agreements over the offering rate at the

Federal Reserve's overnight reverse repurchase (ON RRP) facility

widened, and take-up at the facility fell to quite low levels as a

result. Rates on overnight federal funds and Eurodollar

transactions edged higher relative to the interest rate on excess

reserves. The Desk continued to execute the FOMC's balance sheet

normalization plan initiated in October of last year.

By unanimous vote, the Committee ratified the Open Market Desk's domestic transactions over the intermeeting period. There were no intervention operations in foreign currencies for the System's account during the intermeeting period

In: Economics

Problem 17-07 Your answer is partially correct. Try again. The following information relates to the debt...

Problem 17-07

| Your answer is partially correct. Try again. | |

The following information relates to the debt securities investments of Vaughn Company.

| 1. | On February 1, the company purchased 11% bonds of Gibbons Co. having a par value of $316,800 at 100 plus accrued interest. Interest is payable April 1 and October 1. | |

| 2. | On April 1, semiannual interest is received. | |

| 3. | On July 1, 9% bonds of Sampson, Inc. were purchased. These bonds with a par value of $212,400 were purchased at 100 plus accrued interest. Interest dates are June 1 and December 1. | |

| 4. | On September 1, bonds with a par value of $60,000, purchased on February 1, are sold at 98 plus accrued interest. | |

| 5. | On October 1, semiannual interest is received. | |

| 6. | On December 1, semiannual interest is received. | |

| 7. | On December 31, the fair value of the bonds purchased February 1 and July 1 are 94 and 92, respectively. |

(a)

Prepare any journal entries you consider necessary, including

year-end entries (December 31), assuming these are

available-for-sale securities. (Note to instructor: Some

students may debit Interest Receivable at date of purchase instead

of Interest Revenue. This procedure is correct, assuming that when

the cash is received for the interest, an appropriate credit to

Interest Receivable is recorded.) (Credit account

titles are automatically indented when amount is entered. Do not

indent manually. If no entry is required, select "No Entry" for the

account titles and enter 0 for the amounts.)

|

No. |

Date |

Account Titles and Explanation |

Debit |

Credit |

|

(1) |

Feb. 1 | |||

|

(2) |

Feb. 1Apr. 1Jul. 1Sep 1Oct. 1Dec. 1Dec. 31 |

|||

|

(3) |

Jul. 1 | |||

|

(4) |

Sep. 1 | |||

|

(5) |

Feb. 1Apr. 1Jul. 1Sep 1Oct. 1Dec. 1Dec. 31 |

|||

|

(6) |

Feb. 1Apr. 1Jul. 1Sep 1Oct. 1Dec. 1Dec. 31 |

|||

|

(7) |

Feb. 1Apr. 1Jul. 1Sep 1Oct. 1Dec. 1Dec. 31 |

|||

|

(To record interest.) |

||||

|

(To record adjustment.) |

|

SHOW LIST OF ACCOUNTS |

In: Accounting

Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Perpetual...

Determine the costs assigned to ending inventory and to cost of goods sold using FIFO.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

+

Choose your template

FPOspreadsheet

FPOgeneral journal

FPO

Hemming Co. reported

the following current-year purchases and sales for its only

product.

| Date | Activities | Units Acquired at Cost | Units Sold at Retail | |||||||||||||

| Jan. | 1 | Beginning inventory | 290 | units | @ $13.60 | = | $ | 3,944 | ||||||||

| Jan. | 10 | Sales | 260 | units | @ $43.60 | |||||||||||

| Mar. | 14 | Purchase | 500 | units | @ $18.60 | = | 9,300 | |||||||||

| Mar. | 15 | Sales | 430 | units | @ $43.60 | |||||||||||

| July | 30 | Purchase | 490 | units | @ $23.60 | = | 11,564 | |||||||||

| Oct. | 5 | Sales | 470 | units | @ $43.60 | |||||||||||

| Oct. | 26 | Purchase | 190 | units | @ $28.60 | = | 5,434 | |||||||||

| Totals | 1,470 | units | $ | 30,242 | 1,160 | units | ||||||||||

Required:

Hemming uses a perpetual inventory system.

1. Determine the costs assigned to ending

inventory and to cost of goods sold using FIFO.

2. Determine the costs assigned to ending

inventory and to cost of goods sold using LIFO.

3. Compute the gross margin for FIFO method and

LIFO method.

In: Accounting

Question 2 Although Sahra now pays Stone & Co Accounting Specialists Pty Ltd to manage the...

Question 2

Although Sahra now pays Stone & Co Accounting Specialists Pty Ltd to manage the accounting function of the business, she likes to prepare a few journals when she has time. The following general journal entries for the business ‘Vacation’ were prepared by Sahra for transactions occurring in October, however she needs your assistance in posting them to the General Ledger. Sahra has posted the opening balances into the general ledger and they are correct.

Required:

Post the General Journals recorded below to the General Ledger provided on the following page. Remember to foot each ledger to determine the ledger balance.

|

Date |

Details |

Debit ($) |

Credit ($) |

|

2 November |

I.T. Expense |

4 000 |

|

|

Cash at Bank |

500 |

||

|

Accounts Payable |

3 500 |

||

|

(Upgrade of webpage functionality and layout) |

|||

|

10 November |

Equipment |

2 895 |

|

|

Cash at Bank |

2 895 |

||

|

(business purchased speakers for the shop) |

|||

|

16 November |

Cash at Bank |

285 |

|

|

Equipment |

285 |

||

|

(Sold old sewing machine for cash) |

|||

|

21 November |

Sewing Mannequin |

395 |

|

|

Capital |

395 |

||

|

(Sahra contributed a sewing mannequin from her home to the business) |

|||

|

26 November |

Accounts Payable |

3 897 |

|

|

Cash at Bank |

3 897 |

||

|

(Paid for supplies purchased in October) |

|||

|

30 November |

Cash at Bank |

1 200 |

|

|

Beachwear Sales |

1 200 |

||

|

(Sales of beachwear at local surfing event) |

|||

Post the journals from above to the General Ledger provided below. All ledgers below must be footed (the balance must be made clear either by way of ‘c/d’ / ‘b/d’ notation, the wording ‘balance’ next to the amount, highlight the balance or with a circle around the balance).

Cash at Bank (CAB)

|

November 1 |

Balance |

23 000 |

Sewing Mannequin

|

Balance $395 |

Equipment

Accounts Payable

|

November 1 |

Balance |

1 500 |

Capital

|

November 1 |

Balance |

32 000 |

Beachwear Sales

|

November 1 |

Balance |

129 320 |

I.T. Expense

|

November 1 |

Balance |

6 239 |

In: Accounting

Hemming Co. reported the following current-year purchases and sales for its only product Date Activities Units...

Hemming Co. reported the following current-year purchases and sales for its only product

| Date | Activities | Units Acquired at Cost | Units Sold at Retail | |||||||||||||

| Jan. | 1 | Beginning inventory | 210 | units | @ $10.40 | = | $ | 2,184 | ||||||||

| Jan. | 10 | Sales | 170 | units | @ $40.40 | |||||||||||

| Mar. | 14 | Purchase | 310 | units | @ $15.40 | = | 4,774 | |||||||||

| Mar. | 15 | Sales | 270 | units | @ $40.40 | |||||||||||

| July | 30 | Purchase | 410 | units | @ $20.40 | = | 8,364 | |||||||||

| Oct. | 5 | Sales | 380 | units | @ $40.40 | |||||||||||

| Oct. | 26 | Purchase | 110 | units | @ $25.40 | = | 2,794 | |||||||||

| Totals | 1,040 | units | $ | 18,116 | 820 | units | ||||||||||

Required:

Hemming uses a perpetual inventory system.

1. Determine the costs assigned to

ending inventory and to cost of goods sold using FIFO.

2. Determine the costs assigned to ending

inventory and to cost of goods sold using LIFO.

3. Compute the gross margin for FIFO method and

LIFO method.

Determine the costs assigned to ending inventory and to cost of

goods sold using FIFO.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In: Accounting

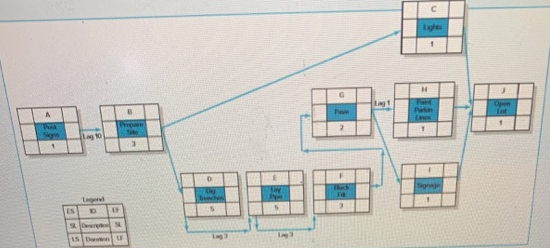

Given the following information, compute the early, late, and slack times for the project network.

Given the following information, compute the early, late, and slack times for the project network. Which activities on the critical path have only the start or finish of the activity on the critical path?

In: Operations Management

1. What does it mean in Greek? When was it first used?

1. What does it mean in Greek? When was it first used?

2. What is the difference between how the early Greeks used the term atomand how it is used today?

In: Chemistry