Questions

Other things the same, if the exchange rate changes from 30 Thai bhat per dollar to...

Other things the same, if the exchange rate changes from 30 Thai bhat per dollar to 25 Thai bhat per dollar, then the dollar has

|

|||

|

|||

|

|||

|

In: Economics

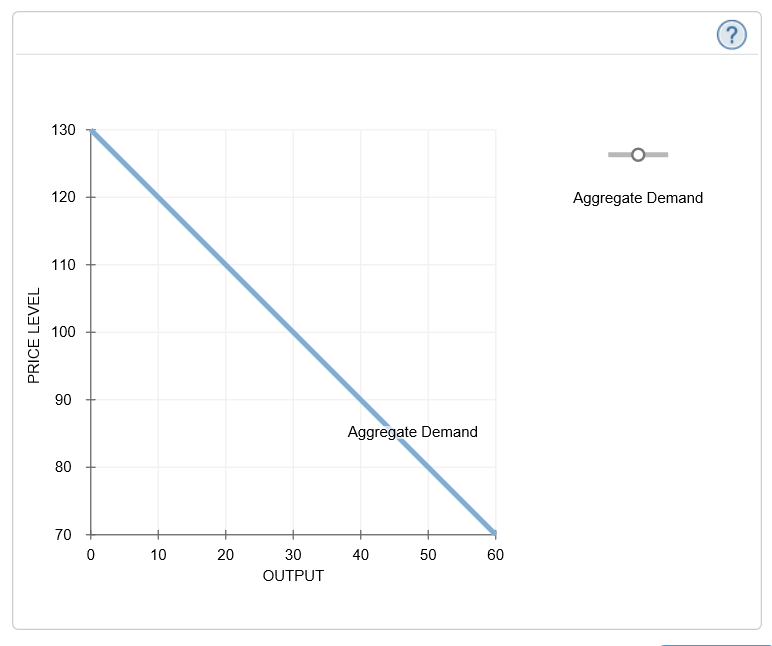

6. Changes in taxes The following graph shows the aggregate demand curve. Shift the aggregate demand...

6. Changes in taxes

The following graph shows the aggregate demand curve.

Shift the aggregate demand curve on the graph to show the impact of a tax cut.

Suppose the governments of two different economies, economy X and economy Y, implement a permanent tax cut of the same size. The marginal propensity to consume (MPC) in economy X is 0.75 and the MPC in economy Y is 0.8. The economies are identical in all other respects.

The tax cut will have a larger impact on aggregate demand in the economy with the (larger MPC/ smaller MPC)

In: Economics

1.) A physician changes the battery for a single chamber permanent pacemaker pulse generator inserted one...

1.) A physician changes the battery for a single chamber permanent pacemaker pulse generator inserted one year-ago and repairs (and reconnects) the existing transvenous lead. How should these services be reported?

2.) Immediately prior to performing a single coronary artery bypass graft procedure, the same physician harvested a vein from the left arm to be used for the graft. What add-on, if any, would be reported for the harvesting of the vein?

3.) A physician performed a coronary artery bypass graft procedure involving two grafts – a venous graft to the right coronary artery and a separate venous graft to the left anterior descending artery. How should these services be reported?

In: Nursing

Using your knowledge of supply curves, show the impact of the following changes on the respective supply curves:

Using your knowledge of supply curves, show the impact of the following changes on the respective supply curves:

An increase in construction workers’ wages on the supply curve for a new houses;

The development of a new pesticide on the supply curve for wheat;

The effect of a drought on the supply curve for corn; and

The effect of an increase in the price of shoes on the supply of shoes.

In: Economics

What is the net effect on 2019 income of exchange rate changes due to the sale and the forward contract?

On November 16, 2019, a U.S. company makes a sale to a customer in Germany. Under the sale terms, the customer will pay the company €100,000 on March 16. On November 16, the company also enters a forward contract to sell €100,000 on March 16, 2020. On March 16, the company receives €100,000 from the customer and sells it using the forward contract. The company's accounting year ends December 31. Rates on the dates specified appear below:

Spot Rate | Forward Rate for March 16, 2020 Delivery | |

November 16, 2019 | $ 1.250 | $ 1.248 |

December 31, 2019 | 1.260 | 1.255 |

March 16, 2020 | 1.265 | 1.265 |

What is the net effect on 2019 income of exchange rate changes due

to the sale and the forward contract?

| A. | no effect | |

| B. | $1,700 net gain | |

| C. | $300 net loss | |

| D. | $300 net gain |

In: Accounting

Burns Corporation's net income last year was $92,800. Changes in the company's balance sheet accounts for...

Burns Corporation's net income last year was $92,800. Changes in the company's balance sheet accounts for the year appear below:

| Increases (Decreases) |

|||

| Asset and Contra-Asset Accounts: | |||

| Cash and cash equivalents | $ | 21,300 | |

| Accounts receivable | $ | 13,400 | |

| Inventory | $ | (17,600 | ) |

| Prepaid expenses | $ | 4,200 | |

| Long-term investments | $ | 11,000 | |

| Property, plant, and equipment | $ | 71,400 | |

| Accumulated depreciation | $ | 33,500 | |

| Liability and Equity Accounts: | |||

| Accounts payable | $ | (18,400 | ) |

| Accrued liabilities | $ | 17,000 | |

| Income taxes payable | $ | 4,200 | |

| Bonds payable | $ | (64,200 | ) |

| Common stock | $ | 43,200 | |

| Retained earnings | $ | 88,400 | |

The company did not dispose of any property, plant, and equipment, sell any long-term investments, issue any bonds payable, or repurchase any of its own common stock during the year. The company declared and paid a cash dividend of $4,400.

Required:

a. Prepare the operating activities section of the company's statement of cash flows for the year. (Use the indirect method.)

b. Prepare the investing activities section of the company's statement of cash flows for the year.

c. Prepare the financing activities section of the company's statement of cash flows for the year.

Prepare the financing activities section of the company's statement of cash flows for the year. (Amounts to be deducted and cash outflows should be indicated with a minus sign.)

|

|||||||||||||||

In: Accounting

Changes in Shareholders' Equity On January 1, 2016, the Osgood Film Studios reported the following alphabetical...

Changes in Shareholders' Equity

On January 1, 2016, the Osgood Film Studios reported the following alphabetical list of shareholders' equity items:

| Additional paid-in capital on common stock | $135,575 |

| Additional paid-in capital on preferred stock | 14,200 |

| Common stock, $2 par | 63,800 |

| Preferred stock, $100 par | 71,000 |

| Retained earnings | 171,000 |

During 2016, the company sold 4,400 shares of common stock for $13 per share and 350 shares of preferred stock for $127 per share. It also earned income of $94,000 and paid dividends of $7 per share on the preferred stock and $1.20 per share on the common stock outstanding at the end of 2016.

Required:

The following partially completed schedule will help you to organize the information for this exercise.

| Preferred Stock $100 par |

Common Stock $2 par |

Additional Paid-in Capital on Preferred Stock |

Additional Paid-in Capital on Common Stock |

Retained Earnings |

Total |

|

| Balances, 1/1/16 | $71,000 | $63,800 | $14,200 | $135,575 | $171,000 | $455,575 |

| Common stock issued | ||||||

| Preferred stock issued | ||||||

| Net income | ||||||

| Cash dividend paid on preferred | ||||||

| Cash dividend paid on common | ||||||

| Balances, 12/31/16 | 600,245 |

In: Accounting

Lena frequently changes job and as a result, had 3 separate 1 month gaps in health...

Lena frequently changes job and as a result, had 3 separate 1 month gaps in health insurance coverage in 2018 if she is not exempt from the individuals share responsibility payment for how many months must she pay a penalty?

In: Finance

Describe the major physical, cognitive, and social developmental changes that occur from infancy to adulthood. Describe...

Describe the major physical, cognitive, and social developmental changes that occur from infancy to adulthood.

Describe different types of psychological disorders, schools of thought on possible causes, and how society responds to people living with mental disorders.

In: Psychology

Burns Corporation's net income last year was $98,300. Changes in the company's balance sheet accounts for...

Burns Corporation's net income last year was $98,300. Changes in the company's balance sheet accounts for the year appear below:

| Increases (Decreases) |

|||

| Asset and Contra-Asset Accounts: | |||

| Cash and cash equivalents | $ | 25,000 | |

| Accounts receivable | $ | 14,200 | |

| Inventory | $ | (17,100 | ) |

| Prepaid expenses | $ | 4,100 | |

| Long-term investments | $ | 11,000 | |

| Property, plant, and equipment | $ | 72,100 | |

| Accumulated depreciation | $ | 33,800 | |

| Liability and Equity Accounts: | |||

| Accounts payable | $ | (19,600 | ) |

| Accrued liabilities | $ | 17,300 | |

| Income taxes payable | $ | 4,200 | |

| Bonds payable | $ | (62,400 | ) |

| Common stock | $ | 42,000 | |

| Retained earnings | $ | 94,000 | |

The company did not dispose of any property, plant, and equipment, sell any long-term investments, issue any bonds payable, or repurchase any of its own common stock during the year. The company declared and paid a cash dividend of $4,300.

Required:

a. Prepare the operating activities section of the company's statement of cash flows for the year. (Use the indirect method.)

Prepare the operating activities section of the company's statement of cash flows for the year. (Use the indirect method.) (Amounts to be deducted and cash outflows should be indicated with a minus sign.)

|

|||||||||||||||||||||||||||||||||||||||||||

b. Prepare the investing activities section of the company's statement of cash flows for the year.

Prepare the investing activities section of the company's statement of cash flows for the year. (Amounts to be deducted and cash outflows should be indicated with a minus sign.)

|

|||||||||||||

c. Prepare the financing activities section of the company's

statement of cash flows for the year.

Prepare the financing activities section of the company's statement of cash flows for the year. (Amounts to be deducted and cash outflows should be indicated with a minus sign.)

|

|||||||||||||||

In: Accounting