Questions

In 2017, NB Inc.'s federal taxable income was $242,000. Compute the required installment payments of 2018...

In 2017, NB Inc.'s federal taxable income was $242,000. Compute the required installment payments of 2018 tax in each of the following cases: NB’s 2018 taxable income is $593,000. NB’s 2018 taxable income is $950,000. NB’s 2018 taxable income is $1,400,000.

In: Accounting

A firm's Net Property, Plant & Equipment balance is $14,300,000 on January 1, 2018 and $12,850,000...

A firm's Net Property, Plant & Equipment balance is $14,300,000 on January 1, 2018 and $12,850,000 on December 31, 2018. The firm's Accumulated Depreciation balance is $4,500,000 on January 1, 2018 and $5,650,000 on December 31, 2018. What is the net purchases or net sales of Property, Plant and Equipment in 2018?

Multiple Choice

-

$1,450,000 net purchase

-

$1,450,000 net sale

-

$300,000 net sale

-

$300,000 net purchase

In: Finance

For the year ended 30 June 2018, Alexander Ltd recognised a liability ‘revenue received in advance’...

For the year ended 30 June 2018, Alexander Ltd recognised a liability ‘revenue received in advance’ of $18 000. This revenue was assessable in the year ended 30 June 2018.

Required

(a) What is the carrying amount of the liability on 30 June 2018?

(b) What is the tax base of the liability on 30 June 2018?

(c) If the tax rate is 30%, what would be the deferred tax asset or liability associated with this liability on 30 June 2018?

(d) How would your answers to (a), (b) and (c) above be different if the revenue was assessable in the 2018/2019 financial year?

In: Accounting

Horner Construction Co. uses the percentage-of-completion method. In 2018, Horner began work on a contract for...

Horner Construction Co. uses the percentage-of-completion

method. In 2018, Horner began work on a contract for

$22,000,000; it was completed in 2019. The following cost data

pertain to this contract for the year-ended 2018... Cost incurred

during the year: $7,800,000... Estimated costs to complete:

$5,200,000. The following cost data pertain to this contract for the

year-ended 2019... Cost incurred during the year: $5,600,000...

Estimated costs to complete: n/a. If the completed-contract method

of accounting was used, the amount of gross profit (loss)to be

recognized for years 2018 and 2019 would be

a. 2018: $9,000,000... 2019: $ 0

b. 2018: $8,600,000... 2019: ($400,000)

c. 2018: $ 0... 2019: $8,600,000

d. 2018: $ 0... 2019: $9,000,000

In: Accounting

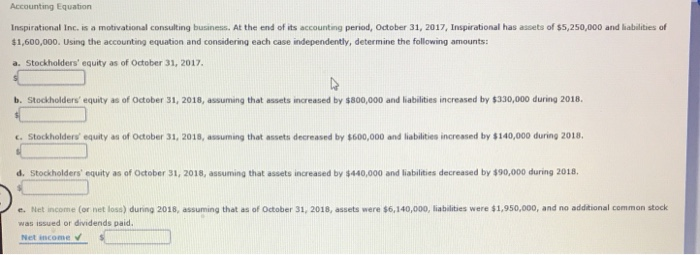

Accounting Equation Inspirational Inc. is a motivational consulting business.

Accounting Equation Inspirational Inc. is a motivational consulting business. At the end of its accounting period, October 31, 2017, Inspirational has assets of $5,250,000 and habilities of $1,600,000. Using the accounting equation and considering each case independently, determine the following amounts:

a. Stockholders' equity as of October 31, 2017.

b. Stockholders' equity as of October 31, 2018, assuming that assets creased by $800,000 and liabilities increased by $330,000 during 2018.

c. Stockholders equity as of October 31, 2018, assuming that assets decreased by $600,000 and liabilities increased by $140,000 during 2018.

d. Stockholders' equity as of October 31, 2018, assuming that assets increased by $440,000 and liabilities decreased by $90,000 during 2018

e. Net income (or net loss) during 2018, assuming that as of October 31, 2018, assets were $6,140,000, liabilities were $1,950,000, and no additional common stock was issued or dividends paid.

In: Accounting

On January 1, 2018, the Mason Manufacturing Company began construction of a building to be used...

On January 1, 2018, the Mason Manufacturing Company began

construction of a building to be used as its office headquarters.

The building was completed on September 30, 2019.

Expenditures on the project were as follows:

| January 1, 2018 | $ | 2,020,000 | |

| March 1, 2018 | 1,740,000 | ||

| June 30, 2018 | 1,940,000 | ||

| October 1, 2018 | 1,740,000 | ||

| January 31, 2019 | 441,000 | ||

| April 30, 2019 | 774,000 | ||

| August 31, 2019 | 1,071,000 | ||

On January 1, 2018, the company obtained a $4,900,000 construction

loan with a 12% interest rate. The loan was outstanding all of 2018

and 2019. The company’s other interest-bearing debt included two

long-term notes of $2,000,000 and $8,000,000 with interest rates of

8% and 10%, respectively. Both notes were outstanding during all of

2018 and 2019. Interest is paid annually on all debt. The company’s

fiscal year-end is December 31.

In: Accounting

Causwell Company began 2018 with 22,000 units of inventory on hand. The cost of each unit...

Causwell Company began 2018 with 22,000 units of inventory on

hand. The cost of each unit was $6.00. During 2018 an additional

42,000 units were purchased at a single unit cost, and 32,000 units

remained on hand at the end of 2018 (32,000 units therefore were

sold during 2018). Causwell uses a periodic inventory system. Cost

of goods sold for 2018, applying the average cost method, is

$225,600. The company is interested in determining what cost of

goods sold would have been if the FIFO or LIFO methods were

used.

Required:

1. Determine the cost of goods sold for 2018 using

the FIFO method. [Hint: Determine the cost per unit of

2018 purchases.]

2. Determine the cost of goods sold for 2018 using

the LIFO method. (Do not round intermediate

calculations.)

|

In: Accounting

Grayson is in the 24 percent tax rate bracket and has sold the following stocks in...

Grayson is in the 24 percent tax rate bracket and has sold the

following stocks in 2018: (Loss amounts should be indicated

by a minus sign.)

| Description | Date Purchased | Basis | Date Sold | Amount Realized | ||

| Stock A | 1/23/1994 | $ | 8,000 | 7/22/2018 | $ | 5,100 |

| Stock B | 4/10/2018 | 15,500 | 9/13/2018 | 19,330 | ||

| Stock C | 8/23/2016 | 12,625 | 10/12/2018 | 17,850 | ||

| Stock D | 5/19/2008 | 5,830 | 10/12/2018 | 13,525 | ||

| Stock E | 8/20/2018 | 7,825 | 11/14/2018 | 3,875 | ||

a. What is Grayson’s net short-term capital gain

or loss from these transactions?

b. What is Grayson’s net long-term gain or loss

from these transactions?

c. What is Grayson’s overall net gain or loss from

these transactions?

In: Accounting

This information is available for Pharoah Company for 2017, 2018, and 2019. 2017 2018 2019 Beginning...

|

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||

|

In: Accounting

Item 13 Item 13 Neely BBQ leased equipment from Smoke Industries on January 1, 2018. Smoke...

Item 13 Item 13 Neely BBQ leased equipment from Smoke Industries on January 1, 2018. Smoke Industries had manufactured the equipment at a cost of $810,000. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Other information: Lease term 4 years Annual payments $360,000 beginning Jan. 1, 2018, and at Dec. 31, 2018, 2019, and 2020 Life of asset 4 years Rate the lessor charges 8% Required: 1. Prepare the appropriate entries for Neely BBQ (Lessee) on January 1, 2018, and December 31, 2018. 2. Prepare the appropriate entries for Smoke Industries (Lessor) on January 1, 2018, and December 31, 2018. Assume that control is transferred to the lessee. 3. Prepare the appropriate entries for Smoke Industries (Lessor) on January 1, 2018, and December 31, 2018. Assume that control is not transferred to the lessee.

In: Accounting